- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Insider Selling Should Not Spook NVIDIA's (Nasdaq:NVDA) Shareholders

As we are closing on the end of the year, it is evident that NVIDIA Corporation ( NasdaqGS: NVDA ) will be one of the biggest winners in 2021.

Although parabolic moves are seldom sustainable, the stock is up over 8% pre-market, owing to a positive earnings surprise and Omniverse optimism. Yet, the insider trading volume in the last months shows only selling.

See our latest analysis for NVIDIA

Q3 Earnings Results

- Non-GAAP EPS: US$1.17 (beat by US$0.09)

- GAAP EPS: US$0.97 (beat by US$0.11)

- Revenue: US$7.1b (beat by US$290m)

- Revenue Growth Y/Y: +50.1%

Highlights:

- Gaming revenue at a record US$3.22b, 42% increase Y/Y

- Data Center revenue at a record US$2.94b, 55% increase Y/Y

- Q4 Revenue Guideline at US$7.40b

Meanwhile, the U.K has launched a second investigation into NVIDIA's acquisition of ARM Ltd – a U.K based semiconductor and software design company. Nadine Dorries, the Secretary of State, ordered the second probe on the grounds of public interest. This is prolonging the closing of the US$40b worth deal that Nvidia made with SoftBank.

While U.K. regulators pose a threat, Wedbush's analyst Matthew Bryson believes that the more significant danger lies within the ongoing Chinese regulatory crackdown . Bryson holds a neutral rating with a price target of US$300.

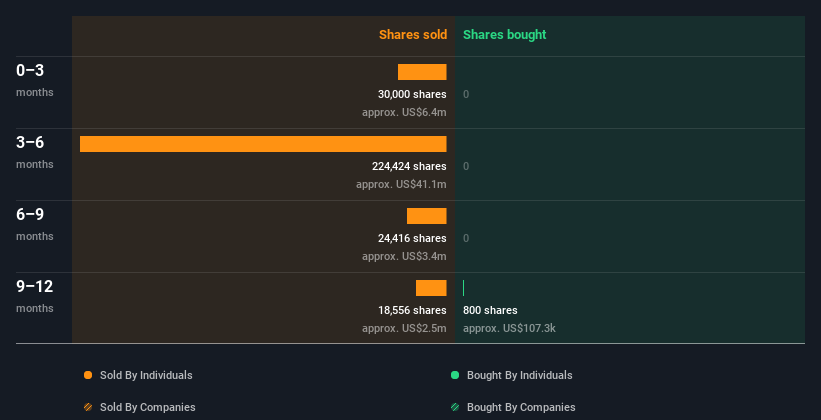

The Last 12 Months Of Insider Transactions At NVIDIA

The Independent Director, Tench Coxe, made the most significant insider sale in the last 12 months. That single transaction was for US$36m worth of shares at US$179 each.That means that an insider was selling shares at slightly below the current price (US$293).We generally consider it a negative if insiders have been selling, especially if they did so below the current price because it implies that they considered a lower price to be reasonable.

However, please note that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price.This single sale was just 4.4% of Tench Coxe's stake.

All up, insiders sold more shares in NVIDIA than they bought over the last year.The chart below shows insider transactions (by companies and individuals) over the previous year.

By clicking on the graph below, you can see the precise details of each insider transaction.

If you like to buy stocks that insiders are buying rather than selling, you might love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders.Usually, the higher the insider ownership, the more likely it is that insiders will be incentivized to build the company for the long term.

NVIDIA insiders own about US$29b worth of shares (which is 4.0% of the company).This kind of significant ownership by insiders generally increases the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At NVIDIA Tell Us?

Insiders sold stock recently, but they haven't been buying. However, NVIDIA is making good profits, mostly owning to the strong tailwinds in 2 of the most important sectors- gaming and data.

While these transactions might not make fresh investors very comfortable, they should not be of significant concern for those who already own NVIDIA. After all, the stock rallied over 140% in this year alone. It is not uncommon to see an insider take some money off the table in such a scenario.

Although insider transactions can help us build a thesis about the stock, it's also worthwhile knowing the risks facing this company. For example - NVIDIA has 3 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives