- United States

- /

- Semiconductors

- /

- NasdaqGS:MXL

MaxLinear, Inc.'s (NASDAQ:MXL) 40% Share Price Surge Not Quite Adding Up

The MaxLinear, Inc. (NASDAQ:MXL) share price has done very well over the last month, posting an excellent gain of 40%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.6% in the last twelve months.

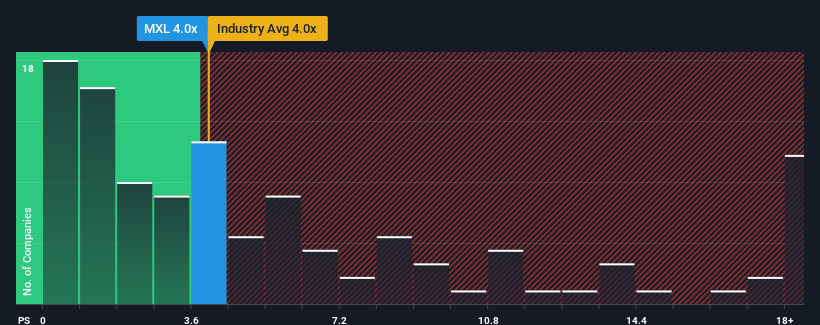

In spite of the firm bounce in price, there still wouldn't be many who think MaxLinear's price-to-sales (or "P/S") ratio of 4x is worth a mention when it essentially matches the median P/S in the United States' Semiconductor industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for MaxLinear

What Does MaxLinear's P/S Mean For Shareholders?

MaxLinear could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think MaxLinear's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For MaxLinear?

There's an inherent assumption that a company should be matching the industry for P/S ratios like MaxLinear's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 54%. This means it has also seen a slide in revenue over the longer-term as revenue is down 53% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 15% per year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 26% per year, which is noticeably more attractive.

With this information, we find it interesting that MaxLinear is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does MaxLinear's P/S Mean For Investors?

MaxLinear appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that MaxLinear's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 1 warning sign for MaxLinear that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MXL

MaxLinear

Provides communications systems-on-chip solutions in the United States, Asia, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026