- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Micron (MU) Valuation Check as AI-Fueled Growth Outlook and Japan Plant Approval Lift Expectations

Reviewed by Simply Wall St

Micron Technology (MU) is back in the spotlight after two big catalysts: upbeat guidance for its upcoming fiscal 2026 first quarter and Japan’s greenlight for a heavily subsidized next generation memory plant in Hiroshima.

See our latest analysis for Micron Technology.

Those catalysts are landing on top of already powerful momentum, with the share price at about $239.49 after a 90 day share price return of roughly 93% and a 1 year total shareholder return of about 133%. AI driven demand, tighter memory supply, and upbeat earnings expectations are resetting how investors are valuing Micron’s long term growth story.

If Micron’s AI memory upside has caught your attention, it is worth exploring other potential beneficiaries across high growth tech and AI stocks to see where the next wave of demand might be building.

With Micron now trading above some analyst targets, investors have to ask whether AI optimism and Japan backed expansion still leave room for upside, or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 17.4% Overvalued

According to BlackGoat, Micron’s latest close of $239.49 sits well above a narrative fair value a little over $200, framing today’s rally as stretched.

The core investment thesis is a bet that the structural, long-term demand for high-performance memory, particularly HBM, will be strong enough to fundamentally change the company's profitability and mitigate the historical boom-and-bust cycles. While the current environment of rising prices and immense AI demand is highly favorable, investors must weigh this against the significant challenges, including fierce competition from rivals like Samsung and SK Hynix, and the unpredictable nature of geopolitical tensions.

Curious how this narrative justifies a premium price tag? Its model leans on sharp revenue acceleration, fatter margins, and a future earnings multiple usually reserved for elite compounders. Want to see exactly how those moving parts add up to that fair value line in the sand?

Result: Fair Value of $203.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering industry cyclicality and intensifying HBM competition from Samsung and SK Hynix could quickly compress margins and undermine Micron’s premium narrative.

Find out about the key risks to this Micron Technology narrative.

Another View on Value

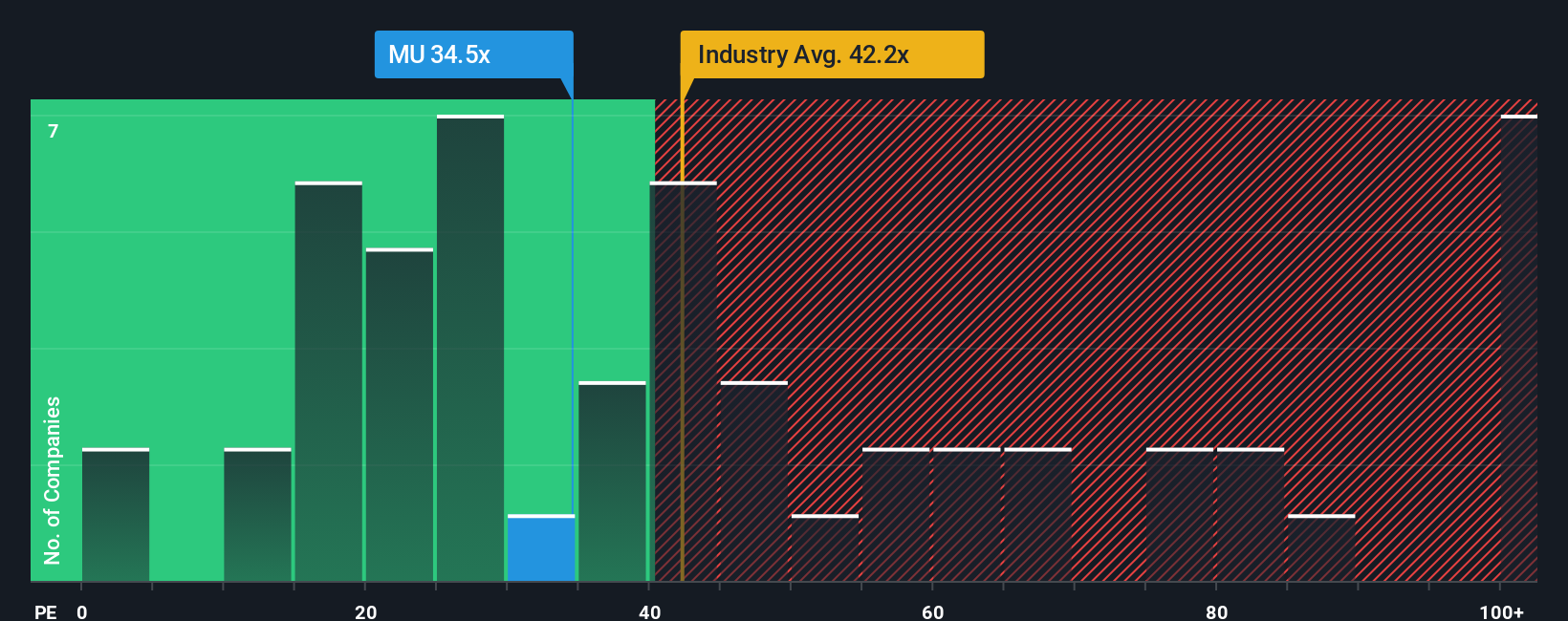

The narrative calls Micron roughly 17% overvalued, but earnings based multiples paint a softer picture. At 31.5 times earnings versus a 36.2 times semiconductor average and an 87.8 times peer average, plus a fair ratio of 45.5 times, the market may be leaving upside on the table.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Micron Technology Narrative

If this perspective does not fully align with your own or you prefer digging into the numbers yourself, you can craft a personalized Micron thesis in just a few minutes, Do it your way.

A great starting point for your Micron Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in your advantage by using the Simply Wall Street Screener to uncover fresh, data driven opportunities that others are still overlooking.

- Explore misunderstood value by targeting these 933 undervalued stocks based on cash flows that may offer upside potential before the crowd catches on.

- Position yourself at the heart of the next technology wave by scanning these 24 AI penny stocks built around real revenue opportunities, not just hype.

- Strengthen your income strategy with these 14 dividend stocks with yields > 3% that can support long term returns through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026