- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Market Might be Too Impatient With Micron Technology, Inc. (NASDAQ:MU)

As the fears of the memory chip price declines start to materialize, the latest slump of Micron Technology (NASDAQ: MU) completely erased the yearly gains.

While short-term headwinds shouldn't be a reason to "panic-sell, "prospective buyers should carefully evaluate upsides vs. downsides in their investment time frame.

View our latest analysis for Micron Technology

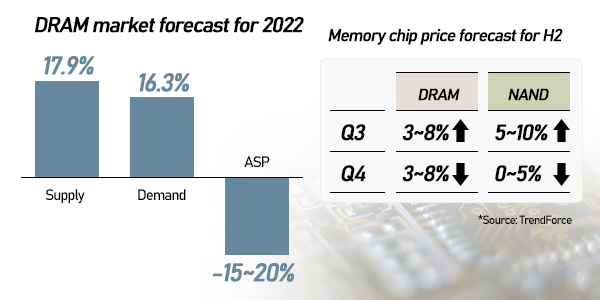

After the last month's predictions about the memory chip oversupply, the latest investigation by TrendForce predicts a notable discrepancy between supply and demand in 2022.

Naturally, this draws caution from the analysts, as evident from the Bank of America's view, as it issued a Neutral rating on the stock. While the average price target is above US$100, BofA issued a target of US$76.

Their analyst Vivek Arya praised the management and improving free cash flows but warned about the impact of the supply shortages in non-memory components creating imbalances on the market and pressuring the margins.

Yet, CEO Sanjay Mehrotra remains optimistic, as he sees the market recovery in the second half of 2022, forecasting "the record revenue with solid profitability in fiscal 2022. "For a company, this would mean overshooting the US$30.39b revenue from 2018. While optimistic, it is important to note that Mr. Mehrotra aims for record revenue, not profitability.

How Profitable is Micron Technology?

ROE or return on equity is a valuable tool to assess how effectively a company can generate returns on the investment it receives from its shareholders. In other words, it is a profitability ratio that measures the rate of return on the capital provided by the company's shareholders.

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Micron Technology is:

13% = US$5.9b ÷ US$44b (Based on the trailing twelve months to September 2021).

The 'return' is the amount earned after tax over the last twelve months. That means that for every $1 worth of shareholders' equity, the company generated $0.13 in profit.

The Relationship Between ROE And Earnings Growth

Based on how much of its profits the company chooses to reinvest or "retain," we can evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the company's growth rate compared to companies that don't necessarily bear these characteristics.

Micron Technology's Earnings Growth And 13% ROE

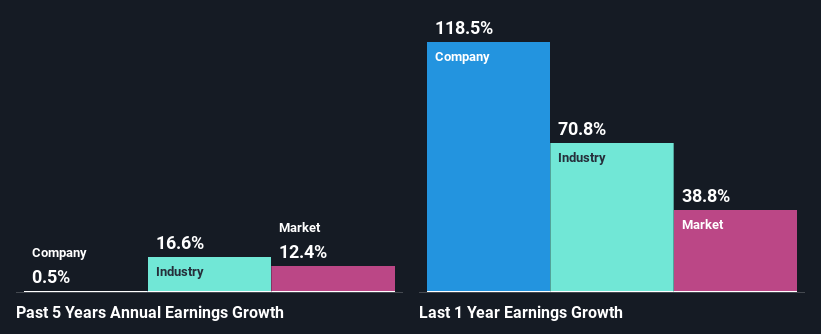

Micron Technology's ROE looks acceptable, as the average industry ROE is similar at 15%. Given the circumstances, we can't help but wonder why Micron Technology saw little to no growth in the past five years. We reckon that there could be some other factors at play here that's limiting the company's growth. These include low earnings retention or poor allocation of capital.

As you compare Micron Technology's net income growth with the industry, you can see that the company's growth figure is lower than the average industry growth rate of 17% in the same period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. Investors need to determine next if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await.

Has the market priced in the future outlook for MU? You can find out in our latest intrinsic value infographic research report.

Is Micron Technology Efficiently Reinvesting Its Profits?

Micron Technology's low three-year median payout ratio of 1.9% (meaning the company retains 98% of profits) should mean that it is retaining most of its earnings and, consequently, should see higher growth than it has reported.

Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 3.3% over the next three years. However, Micron Technology's future ROE is expected to rise to 19% despite the anticipated increase in the company's payout ratio. We infer that other factors could be driving the anticipated growth in the company's ROE.

Summary

Despite facing supply & demand imbalances, it seems that the market is overreacting in the short term. The current price-to-earnings ratio is around 13x, price to earnings growth ratio is at 0.7, while the price-to-book ratio is at 1.7x, well below the 4.4x industry average.

Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return and is reinvesting a considerable portion of its profits. By the looks of it, there could be some other factors, not necessarily in control of the business, that are preventing growth. But, on a positive note, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate.

To know more about the company's future earnings growth forecasts, take a look at this free report on analyst forecasts to find out more.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives