- United States

- /

- Semiconductors

- /

- NasdaqGS:MTSI

MACOM Technology Solutions (MTSI): Assessing Valuation After a Strong Multi‑Year Share Price Run

Reviewed by Simply Wall St

MACOM Technology Solutions Holdings (MTSI) has quietly delivered a strong run this year, with the stock up roughly 36% year to date and about 33% over the past 3 months.

See our latest analysis for MACOM Technology Solutions Holdings.

That climb to a share price of $175.69 has come with a 30 day share price return of just over 8% and a powerful 3 year total shareholder return above 170%, which points to momentum still building as investors lean into MACOM’s growth story and reassess its risk profile.

If MACOM’s run has you thinking about what else could surprise to the upside in chips and hardware, it might be worth exploring other high growth tech and AI stocks that are starting to show similar momentum.

With shares hovering just below Wall Street’s price targets after a triple digit three year run, the key question now is simple: is MACOM still trading below its true potential or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 4.9% Undervalued

With the narrative fair value sitting just above the latest $175.69 close, the storyline leans toward more upside ahead rather than exhaustion.

Full operational control of the RTP fab enables increased capacity (up to 30% boost within 12-15 months), improved yields, and cost efficiencies; this is expected to shift the fab from a short-term gross margin headwind to a meaningful margin tailwind by late 2026, leading to expansion of company-wide gross and operating margins.

Curious what kind of revenue lift, margin expansion, and future earnings multiple are baked into that seemingly small discount to fair value? The underlying projections are far bolder than they first appear, and the path to that target hinges on a very specific profitability and growth profile that most casual holders have not dug into yet.

Result: Fair Value of $184.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case depends heavily on flawless RTP fab execution and resilient data center demand. Any stumble could quickly undermine those margin and growth assumptions.

Find out about the key risks to this MACOM Technology Solutions Holdings narrative.

Another Angle On Valuation

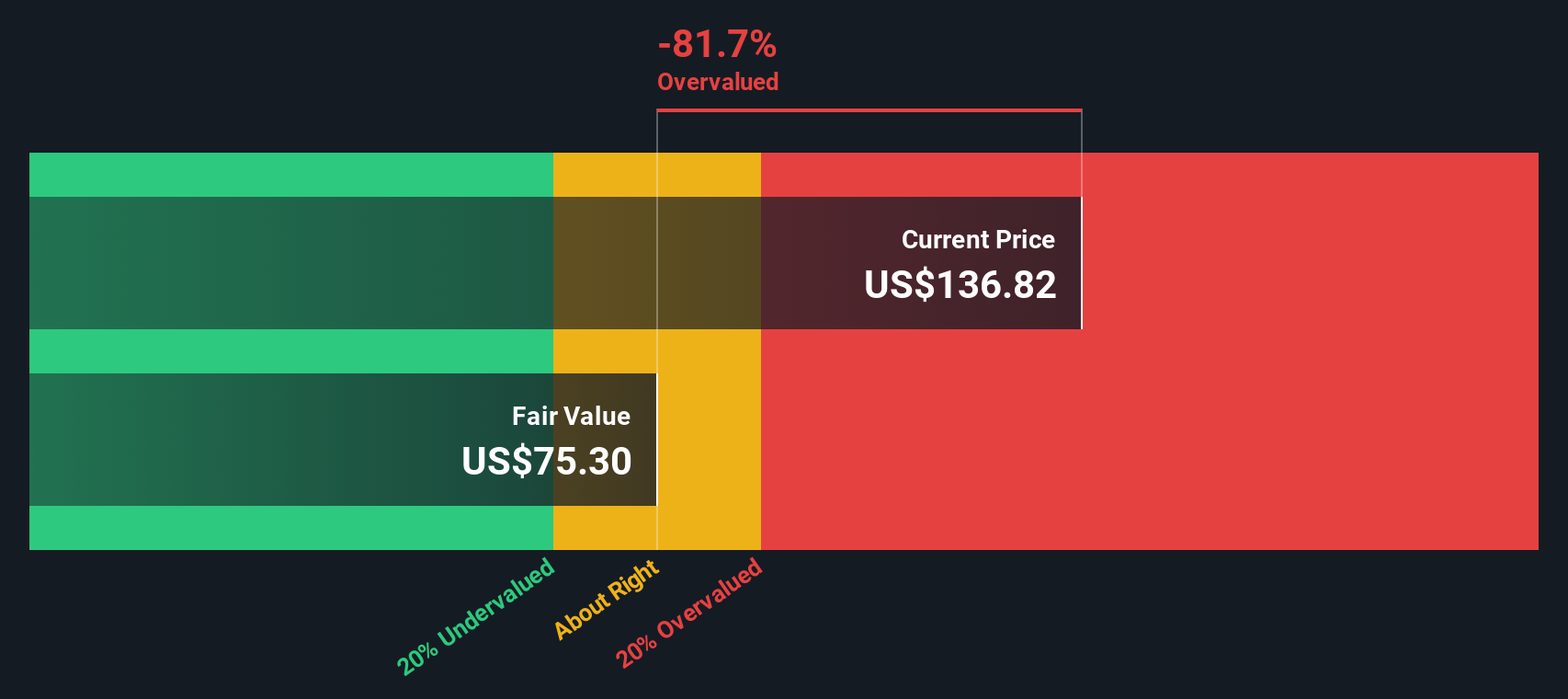

Our DCF model paints a cooler picture, suggesting MACOM’s shares are trading above an estimated fair value of $113.84, not below it. If cash flows point to overvaluation while narratives imply upside, which set of assumptions do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MACOM Technology Solutions Holdings Narrative

If you see the story differently or would rather test your own assumptions against the numbers, you can build a full narrative in just a few minutes: Do it your way.

A great starting point for your MACOM Technology Solutions Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next move?

Before you close this tab, lock in your advantage by using the Simply Wall St Screener to uncover fresh, data backed opportunities other investors are still missing.

- Capture potential bargains early by scanning these 911 undervalued stocks based on cash flows that the market may be overlooking based on their cash flow strength.

- Ride powerful secular trends by targeting these 25 AI penny stocks positioned at the heart of accelerating artificial intelligence adoption.

- Boost your income strategy by focusing on these 13 dividend stocks with yields > 3% that combine solid yields with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MTSI

MACOM Technology Solutions Holdings

Provides analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)