- United States

- /

- Semiconductors

- /

- NasdaqGS:MTSI

MACOM (MTSI): Valuation Check After TD Cowen Buy Rating and Data Center Chipset Launch

Reviewed by Kshitija Bhandaru

MACOM Technology Solutions Holdings (MTSI) caught investors’ attention after receiving a new Buy rating from TD Cowen and announcing a new chipset aimed at reducing costs and improving connectivity for data centers.

See our latest analysis for MACOM Technology Solutions Holdings.

Following these developments, MACOM’s 1-year total shareholder return has climbed 4.75 percent, even as the share price has recently dipped, down 7.35 percent over the past month and off 5.6 percent for the year to date. The longer-term story is much brighter though, as investors who held for three or five years have enjoyed triple-digit gains. This suggests momentum has cooled lately after a very strong run.

If breakthrough chip innovations are what you’re tracking, why not check out other leading tech and AI stocks? You might discover your next opportunity with our See the full list for free.

The question now is whether recent weakness leaves MACOM undervalued compared to its growth outlook, or if the market has already factored in its potential upside and left little room for a bargain.

Most Popular Narrative: 18.2% Undervalued

With a fair value of $149.29 compared to the last close at $122.18, the most widely followed narrative sees room for significant upside based on future earnings potential and margin expansion.

Full operational control of the RTP fab enables increased capacity (up to 30% boost within 12-15 months), improved yields, and cost efficiencies. This is expected to shift the fab from a short-term gross margin headwind to a meaningful margin tailwind by late 2026, leading to expansion of company-wide gross and operating margins.

Want the inside story on this valuation call? The narrative banks on ambitious margin improvement and a future earnings profile that could change the game for MACOM. Find out which blockbuster assumptions underpin this price target; there is more to the calculations than meets the eye.

Result: Fair Value of $149.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin headwinds and volatility in data center revenues could challenge MACOM’s growth trajectory and put earnings momentum at risk.

Find out about the key risks to this MACOM Technology Solutions Holdings narrative.

Another View: What Does Our DCF Model Say?

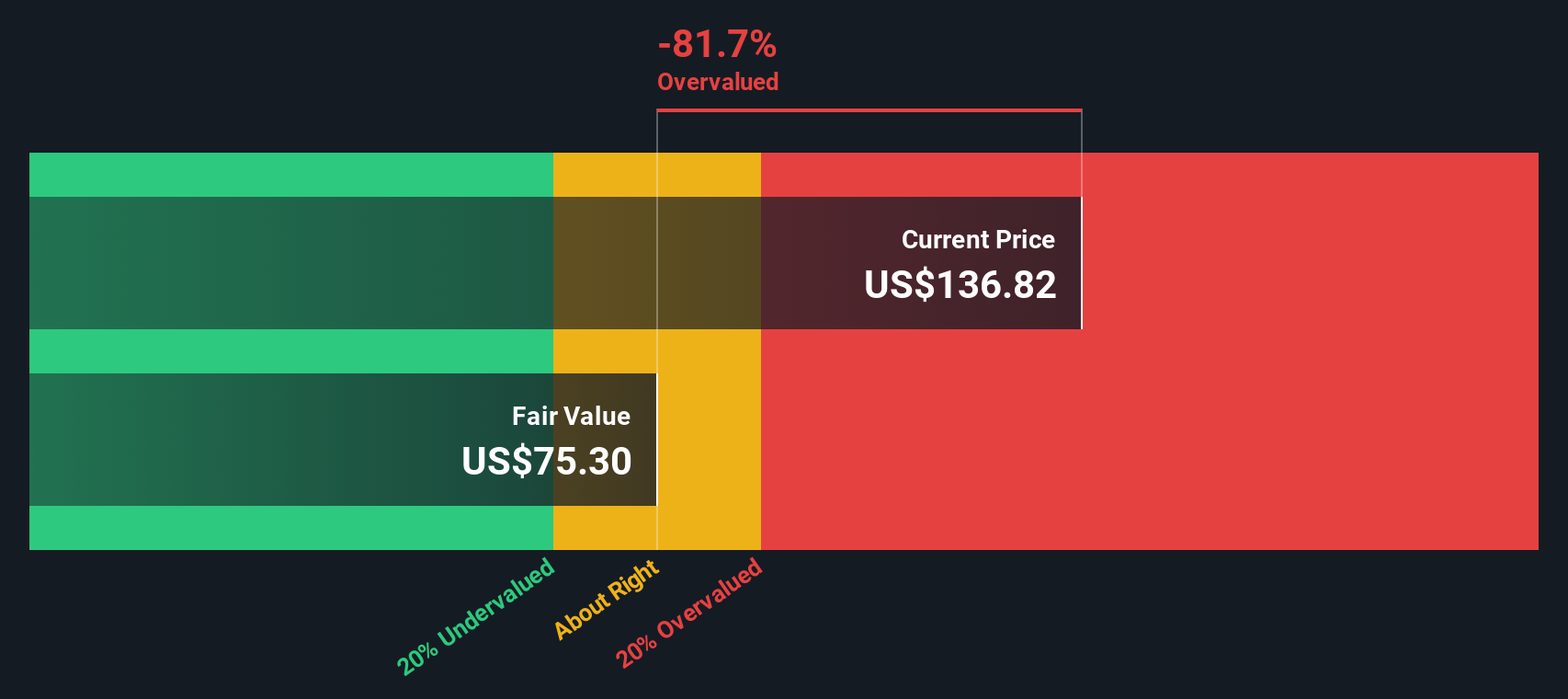

Looking through the lens of the SWS DCF model, MACOM appears overvalued. The current share price of $122.18 is trading well above the fair value estimate of $74.45. This gap suggests the present price reflects high expectations for future results, raising the bar for what MACOM must deliver.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MACOM Technology Solutions Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MACOM Technology Solutions Holdings Narrative

If you prefer a hands-on approach or want to challenge the prevailing view, you can use the tools to build your own narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding MACOM Technology Solutions Holdings.

Looking for more investment ideas?

Swipe away any regrets by tapping into fresh investment options right now. The market is always moving, and you could be missing tomorrow’s winners.

- Catch the wave of next-generation healthcare by checking out these 33 healthcare AI stocks, making strides in medical diagnostics and personalized medicine.

- Power up your portfolio with steady income; see these 19 dividend stocks with yields > 3%, offering yields over 3%, ideal for building robust, cash-generating holdings.

- Ride early-stage growth stories by uncovering these 3580 penny stocks with strong financials, with strong financials and the potential to deliver standout returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MTSI

MACOM Technology Solutions Holdings

Provides analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives