- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (NasdaqGS:MRVL) Expands AI Packaging with Innovative Multi-Die Solution

Reviewed by Simply Wall St

Marvell Technology (NasdaqGS:MRVL) recently launched a multi-die packaging solution aimed at enhancing AI infrastructure, which has been well-received and demonstrated the company's commitment to innovation. Over the past month, the company's stock price increased by 10.03%, potentially influenced by this development. Additionally, Marvell's partnership with NVIDIA on NVLink Fusion Technology could have supported this upward move. While the broader tech sector also saw gains partly due to strong performance from Nvidia, Marvell’s advancements in AI and strategic collaborations seem to have significantly bolstered investor confidence during this period.

We've spotted 1 risk for Marvell Technology you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

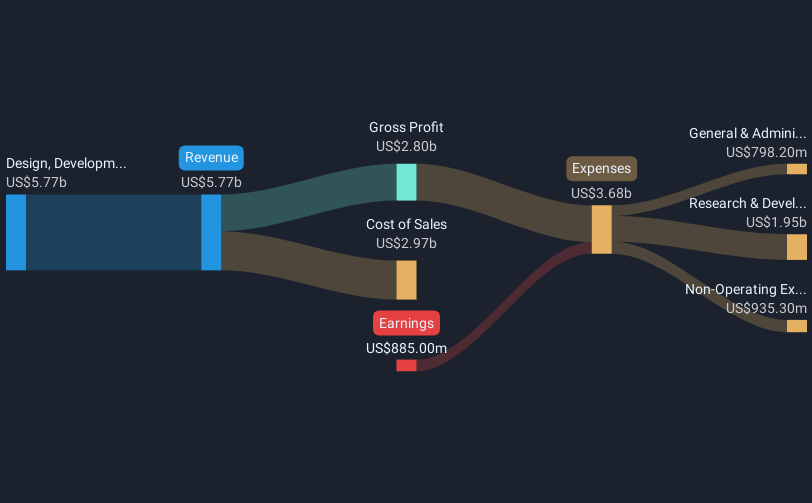

Marvell Technology's recent initiatives, particularly its multi-die packaging solution and strategic collaboration with NVIDIA, align with the company's ambitions to boost its AI infrastructure capabilities. These developments could enhance revenue as strong AI demand drives growth, potentially surpassing its AI revenue target of $2.5 billion in fiscal 2026. Analysts project Marvell's earnings may reach US$2.6 billion by 2028, significantly impacting longer-term valuation estimates. These initiatives may bolster Marvell's earnings forecasts as the company anticipates efficiency improvements through technological advancements, like cutting power consumption in optical modules by 20%.

Over the past five years, Marvell's total return, including share price and dividends, was 83.64%, a substantial gain over this period despite market volatility. This performance provides context to the recent 10.03% share price increase, highlighting strong investor sentiment in light of current developments. However, over the past year, Marvell's performance lagged behind the US Semiconductor industry, which experienced a 9.1% return, indicating room for improvement.

The current share price of $61.22 remains significantly below the consensus price target of $95.43, suggesting potential upside if future growth prospects materialize as forecasted. Despite some analysts' disagreement, the consensus target reflects anticipated growth in revenue and earnings, assuming a future PE ratio of 44.7x. As Marvell continues to address challenges, such as heavy reliance on data center revenue and customer dependency, the effectiveness of these technological innovations can play a pivotal role in navigating future market dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives