- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

3 Stocks Estimated To Be Priced Below Intrinsic Value In April 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 8.4%, contributing to a 5.9% increase over the past year, with earnings expected to grow by 13% per annum in the coming years. In this environment of positive momentum and anticipated growth, identifying stocks that are priced below their intrinsic value can offer potential opportunities for investors seeking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $39.57 | $78.07 | 49.3% |

| First National (NasdaqCM:FXNC) | $18.60 | $36.89 | 49.6% |

| Truist Financial (NYSE:TFC) | $36.49 | $72.23 | 49.5% |

| CI&T (NYSE:CINT) | $5.15 | $10.21 | 49.5% |

| First Bancorp (NasdaqGS:FBNC) | $36.77 | $72.67 | 49.4% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.30 | $18.55 | 49.9% |

| BeiGene (NasdaqGS:ONC) | $238.84 | $476.31 | 49.9% |

| Rocket Lab USA (NasdaqCM:RKLB) | $21.07 | $41.76 | 49.5% |

| Sotera Health (NasdaqGS:SHC) | $10.50 | $20.99 | 50% |

| BioLife Solutions (NasdaqCM:BLFS) | $22.43 | $44.33 | 49.4% |

Let's review some notable picks from our screened stocks.

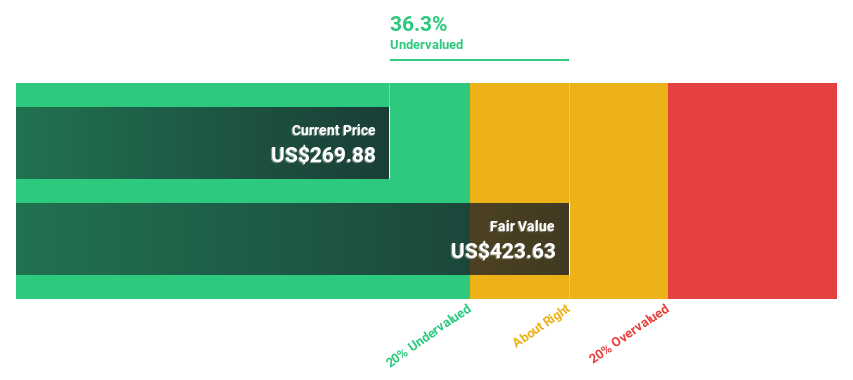

Advanced Micro Devices (NasdaqGS:AMD)

Overview: Advanced Micro Devices, Inc. is a global semiconductor company with a market capitalization of approximately $152.74 billion.

Operations: The company's revenue segments include Client at $7.05 billion, Gaming at $2.60 billion, Embedded at $3.56 billion, and Data Center at $12.58 billion.

Estimated Discount To Fair Value: 40.9%

Advanced Micro Devices appears undervalued based on cash flow analysis, trading at US$95.29, below its estimated fair value of US$161.18. Recent product innovations, like the 5th Gen EPYC processors and collaborations with Oracle Cloud Infrastructure, highlight AMD's strategic advancements in AI and cloud computing. Despite a low forecasted return on equity of 18.2% in three years, AMD's earnings are expected to grow significantly at 31.3% annually over the next three years.

- Our comprehensive growth report raises the possibility that Advanced Micro Devices is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Advanced Micro Devices.

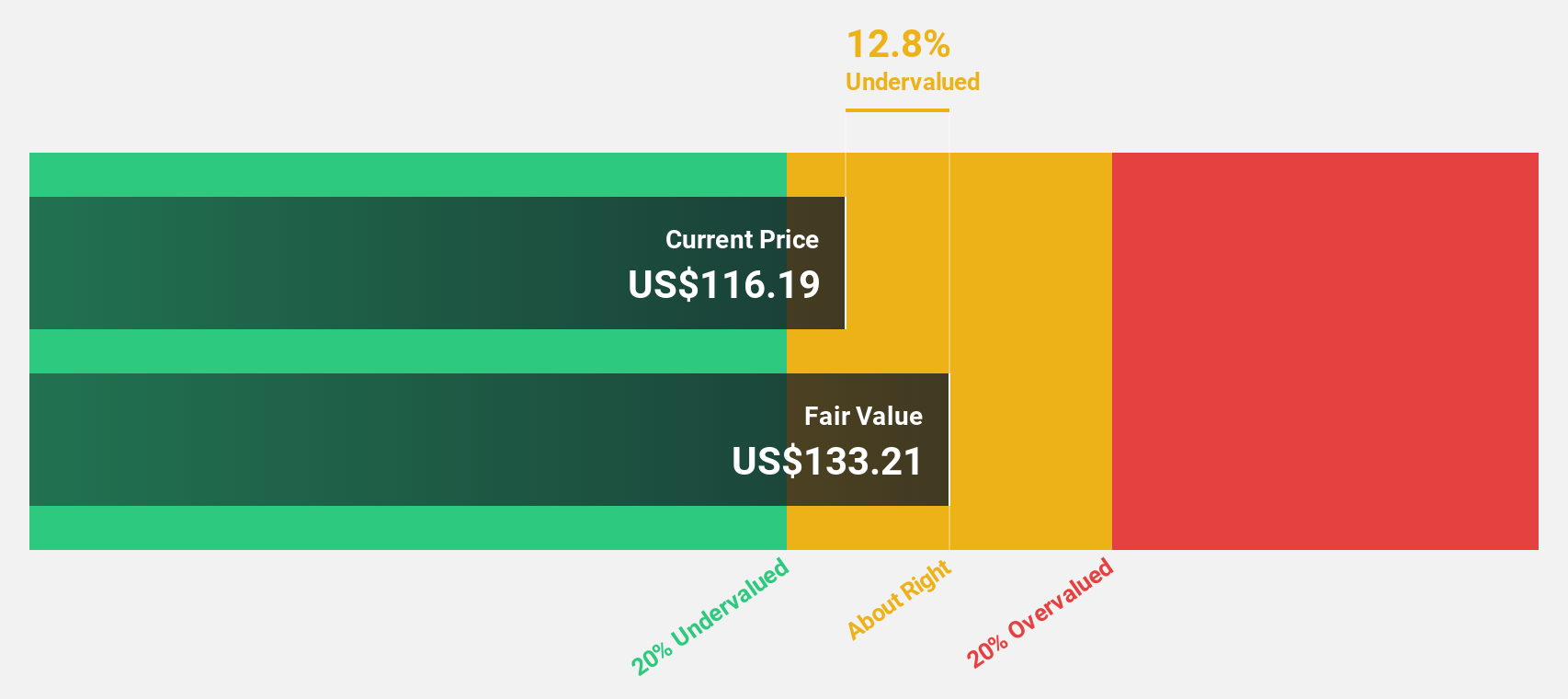

Marvell Technology (NasdaqGS:MRVL)

Overview: Marvell Technology, Inc. and its subsidiaries offer semiconductor solutions for data infrastructure, covering the spectrum from data center core to network edge, with a market cap of approximately $45.26 billion.

Operations: The company's revenue is primarily derived from the design, development, and sale of integrated circuits, amounting to $5.77 billion.

Estimated Discount To Fair Value: 28.4%

Marvell Technology is trading at US$53.32, significantly below its estimated fair value of US$74.51, highlighting potential undervaluation based on cash flows. The company recently showcased groundbreaking 400G/lane technology and a 1.6T light engine for AI and cloud infrastructure at OFC 2025, underscoring its innovative edge in high-speed connectivity solutions. Despite recent executive changes, Marvell's revenue is projected to grow robustly at 18.4% annually, with profitability expected within three years.

- Our earnings growth report unveils the potential for significant increases in Marvell Technology's future results.

- Delve into the full analysis health report here for a deeper understanding of Marvell Technology.

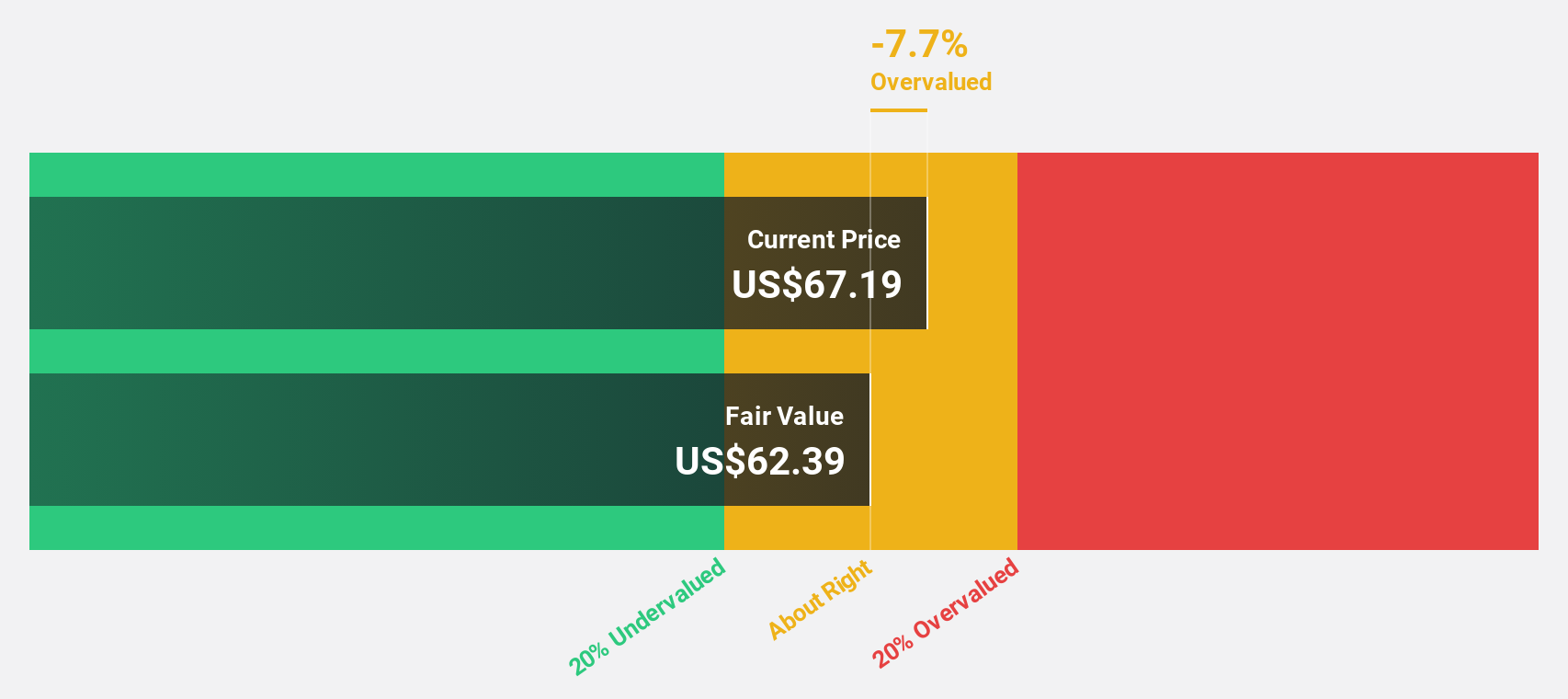

Workday (NasdaqGS:WDAY)

Overview: Workday, Inc. offers enterprise cloud applications globally, with a market capitalization of $61.88 billion.

Operations: The company generates revenue primarily from its cloud applications segment, which amounts to $8.45 billion.

Estimated Discount To Fair Value: 38%

Workday is trading at US$233.32, significantly below its estimated fair value of US$376.4, suggesting undervaluation based on cash flows. Recent innovations, including AI-powered contract intelligence and expanded data accessibility through partnerships like Incorta, enhance operational efficiency and decision-making capabilities. Despite a decline in profit margins from 19% to 6.2%, earnings are forecast to grow substantially at 27.5% annually, with revenue also expected to outpace the broader market growth rate.

- Our expertly prepared growth report on Workday implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Workday here with our thorough financial health report.

Make It Happen

- Access the full spectrum of 178 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives