- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

What Monolithic Power Systems (MPWR)'s Patent Lawsuit Means for Shareholders Amid Sector Uncertainty

Reviewed by Sasha Jovanovic

- In October 2025, Reed Semiconductor Corp. filed a patent infringement lawsuit against Monolithic Power Systems in the United States District Court for the Western District of Texas, alleging infringement of a patent covering power semiconductor devices and asserting claims of bad-faith interference with business relationships.

- This legal action arose amid heightened demand for Monolithic Power Systems' power management products, particularly in the growing artificial intelligence and server markets, with sector-wide volatility also influenced by escalating US-China trade tensions impacting semiconductor supply chains.

- We'll explore how rising geopolitical uncertainty and sector-wide pressures may influence Monolithic Power Systems’ investment narrative following the lawsuit filing.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Monolithic Power Systems Investment Narrative Recap

To invest in Monolithic Power Systems, one must believe in the long-term expansion of AI, automotive electrification, and data center demand that underpin the company’s positioning as a diversified power semiconductor supplier. The recent Reed Semiconductor lawsuit introduces headline risk but, for now, does not appear material to core catalysts like strong customer momentum in AI and datacenter applications; the main threat remains potential disruption from sector volatility and geopolitics rather than litigation. Among recent announcements, the upcoming Q3 earnings release scheduled for October 30, 2025, stands out, as it will be the first opportunity to gauge if legal or trade headwinds are impacting operational or financial performance in the near term. While robust Q2 results and an optimistic Q3 revenue outlook have reinforced confidence in MPS’s short-term momentum, this earnings update will offer crucial insight for anyone weighing the durability of growth drivers amid external turmoil. Yet, in contrast to this optimism, investors should be aware that unresolved legal actions could introduce operational uncertainty and financial exposure beyond what’s currently reflected in consensus...

Read the full narrative on Monolithic Power Systems (it's free!)

Monolithic Power Systems' narrative projects $3.9 billion revenue and $1.0 billion earnings by 2028. This requires a structurally larger total addressable market and consistently robust top-line growth, translating to an earnings increase of $X from current earnings (current earnings value not given in excerpt).

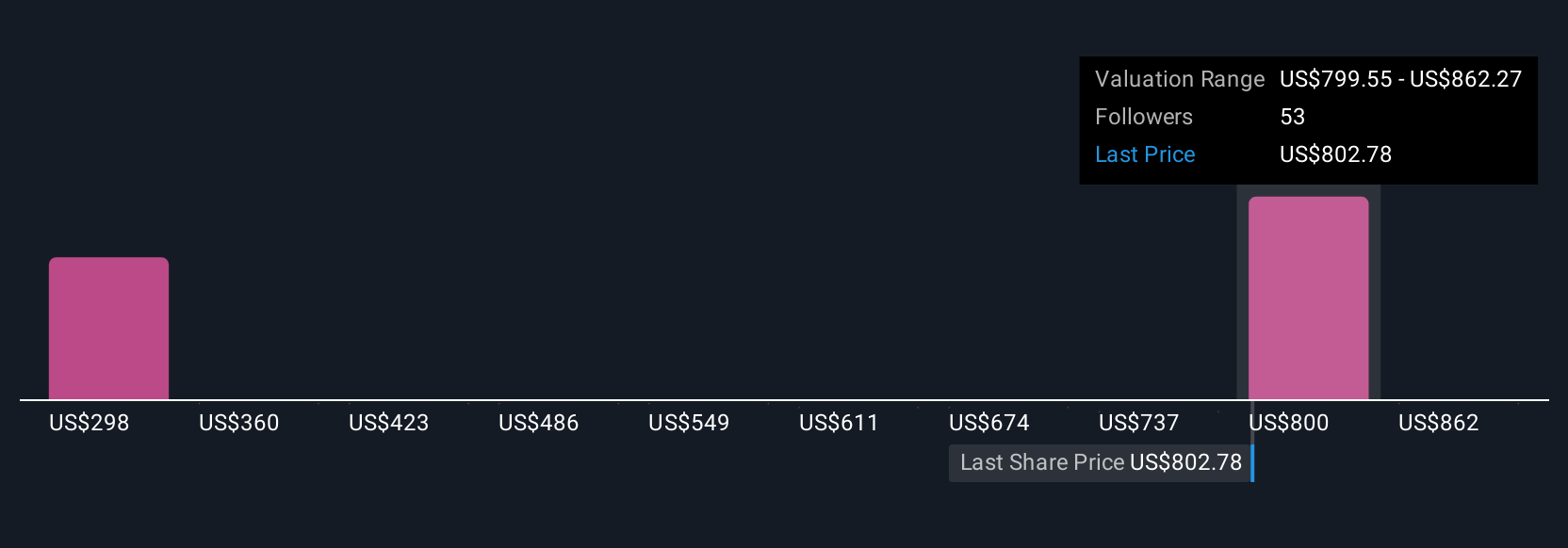

Uncover how Monolithic Power Systems' forecasts yield a $867.46 fair value, a 12% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for Monolithic Power Systems span US$370.98 to US$925 across 14 views, highlighting major differences in outlook. Against this backdrop, ongoing legal risks could shift opinions on revenue resilience, so it’s worth weighing all sides.

Explore 14 other fair value estimates on Monolithic Power Systems - why the stock might be worth less than half the current price!

Build Your Own Monolithic Power Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monolithic Power Systems research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Monolithic Power Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monolithic Power Systems' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives