- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

Monolithic Power Systems (MPWR): Valuation Spotlight After Analyst Upgrades and AI Chip Growth Momentum

Reviewed by Kshitija Bhandaru

Monolithic Power Systems (MPWR) has drawn attention following a series of analyst upgrades, which highlight the company’s growing presence in AI chip power management. These developments come at a time when a fresh patent lawsuit from Reed Semiconductor has emerged.

See our latest analysis for Monolithic Power Systems.

Even with the recent legal dispute making headlines, Monolithic Power Systems’ share price momentum has been unmistakable. The stock set a new 52-week high last week on the back of strong demand for AI power-management chips and renewed investor confidence. For context, the stock’s 52% year-to-date share price return stands out in the sector. However, over the past year, total shareholder return is slightly negative, showing just how quickly sentiment can shift even for top performers.

If the surge in AI hardware demand has your attention, it might be the perfect time to discover See the full list for free.

With shares trading just below their latest analyst targets and investor enthusiasm at a high, the key question is whether Monolithic Power Systems offers genuine value at current levels, or if future growth is already priced in.

Most Popular Narrative: 4.3% Overvalued

Monolithic Power Systems’ latest consensus narrative assigns it a fair value of $867, slightly below its last close of $904.44. The narrative describes robust growth drivers, but the gap suggests that high performance may be fully factored into today’s price.

Expectations for long-term automotive segment growth, driven by secular shifts toward EVs, zonal and 48V/800V in-car architectures, and increased semiconductor content per vehicle, are supporting high valuation multiples. However, these trends may already be fully priced in, leading to risk of eventual slower revenue growth as the rollout curve flattens.

Want to see what numbers justify this tight valuation? The narrative leans on ambitious revenue expansion and hefty future profit multiples. Find out what financial hurdles must be cleared for the stock to live up to these bold projections. Dive into the narrative and discover which forecasts the analysts are betting the farm on.

Result: Fair Value of $867 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, broad-based revenue growth across end markets or major wins in the data center AI segment could challenge the current overvaluation thesis in the future.

Find out about the key risks to this Monolithic Power Systems narrative.

Another View: Multiples Tell a Different Story

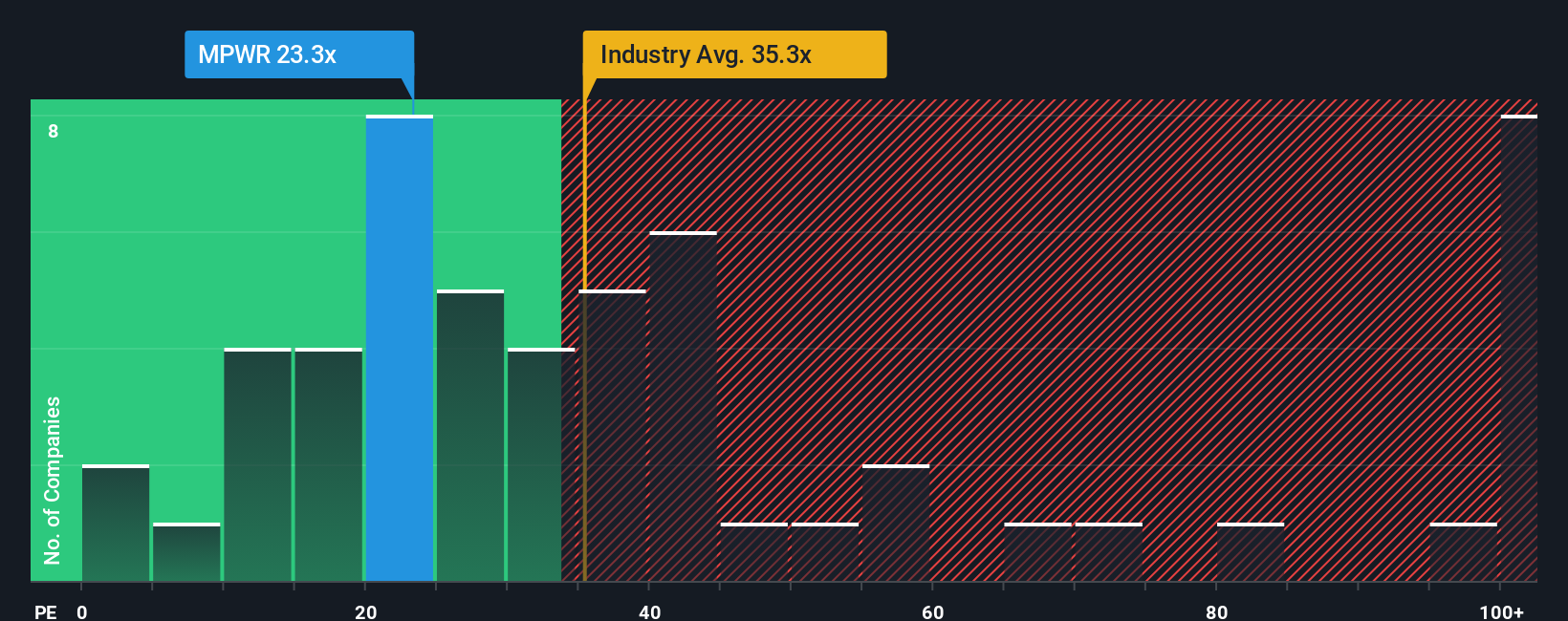

Looking at valuation through the lens of the company’s price-to-earnings ratio offers a surprising contrast. Monolithic Power Systems trades at 23.3 times earnings, which is far below both the peer group average of 68.9 and the US semiconductor industry’s 35.3. Compared to the fair ratio of 22.5, it appears only slightly expensive. Is market skepticism here a sign of overlooked opportunity or a caution flag?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Monolithic Power Systems Narrative

If you see things differently or want to dive into the numbers your own way, you can piece together your own detailed narrative in just a few minutes. Do it your way

A great starting point for your Monolithic Power Systems research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Keep your portfolio one step ahead by checking out fresh opportunities across different themes. Don’t miss out on what savvy investors are already tracking.

- Uncover growing income potential with these 19 dividend stocks with yields > 3%, where rising yields can offer solid returns for patient shareholders.

- Spot tech leaders early by exploring these 24 AI penny stocks, which are powering breakthrough AI innovation and redefining tomorrow’s industries.

- Tap into gains others might overlook by scanning these 898 undervalued stocks based on cash flows for stocks trading below their true worth based on strong cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives