- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

Monolithic Power Systems (MPWR) Declares US$1.56 Dividend Per Share Payable October 2025

Reviewed by Simply Wall St

Monolithic Power Systems (MPWR) recently affirmed a third-quarter dividend of $1.56 per share, underscoring its ongoing commitment to shareholder value. Over the past quarter, the company's stock saw an impressive 25% rise, influenced by robust Q2 2025 earnings, which showcased significant increases in sales and net income. This financial strength helped buoy its market position amidst broader market gains, where tech stocks, particularly in the Nasdaq, reached new records. The company's strategic partnerships and completed stock buyback program also likely bolstered investor confidence, adding momentum to its stock's upward trajectory.

Monolithic Power Systems' decision to affirm its third-quarter dividend reflects its solid financial footing and commitment to enhancing shareholder value. This decision, coupled with the recent rise in share price by 25% and a completed stock buyback program, aligns with the company's narrative of prioritized shareholder returns amid market optimism for AI and automotive sectors. Over the past five years, the company's total return, including share price and dividends, stands at 245.56%, highlighting its robust performance and long-term growth for investors. However, the company underperformed the US market and the Semiconductor industry over a shorter one-year timeframe, emphasizing the need to consider both short-term fluctuations and longer-term growth when evaluating investment potential.

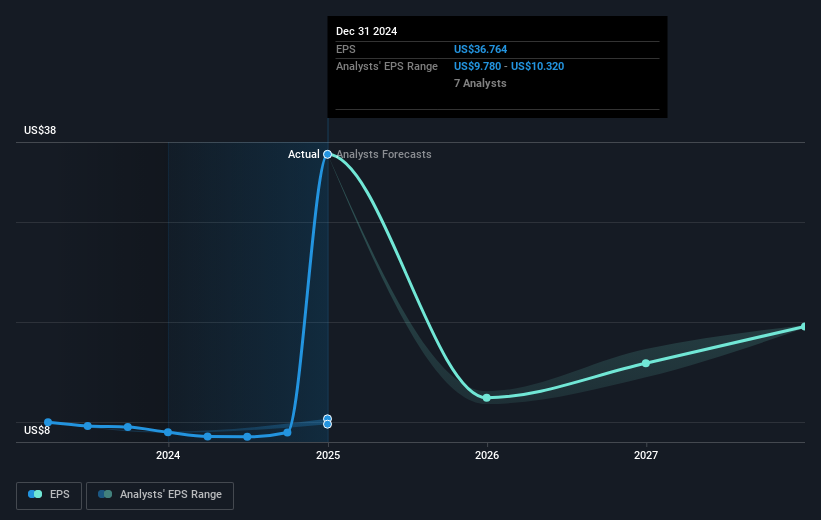

The recent news may support revenue forecasts as the company's expansion into AI and automotive markets persists. Yet, analysts expect a decline in profit margins, projecting earnings to decrease from $1.9 billion to $1 billion by 2028, accompanied by a PE ratio increase from 22.1x to 49.2x. The current share price of $840.38, nearly matching the consensus price target of $843.23, suggests minimal upside potential based on analyst expectations. Investors should therefore critically assess these metrics alongside broader market dynamics to gauge future company performance.

Evaluate Monolithic Power Systems' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in