- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Microchip Technology (NasdaqGS:MCHP) Expands Product Line With New Digital Signal Controllers

Reviewed by Simply Wall St

Microchip Technology (NasdaqGS:MCHP) has experienced a 24% increase in share price over the last quarter, likely driven by significant product-related announcements, including the expansion of its dsPIC33A Digital Signal Controller line. These advancements cater to high-demand sectors like AI and energy efficiency, capturing investor interest. Despite broader geopolitical and market volatility, such as concerns over the Israel-Iran conflict and stability in oil prices, Microchip's focused innovations in cutting-edge technology likely provided a strong counterbalance. The declaration of dividends and revised earnings guidance might have further bolstered investor confidence, aligning with overall market strength and tech sector resilience.

The recent share price increase for Microchip Technology may provide a favorable backdrop for its ongoing transformation efforts. Over a five-year period ending today, the company has delivered a total return of 42.48%, reflecting its resilience and investor confidence in the midst of market challenges. In the past year, however, Microchip's shares have underperformed the broader US market, which saw a return of 9.8%, highlighting potential short-term pressures faced by the company.

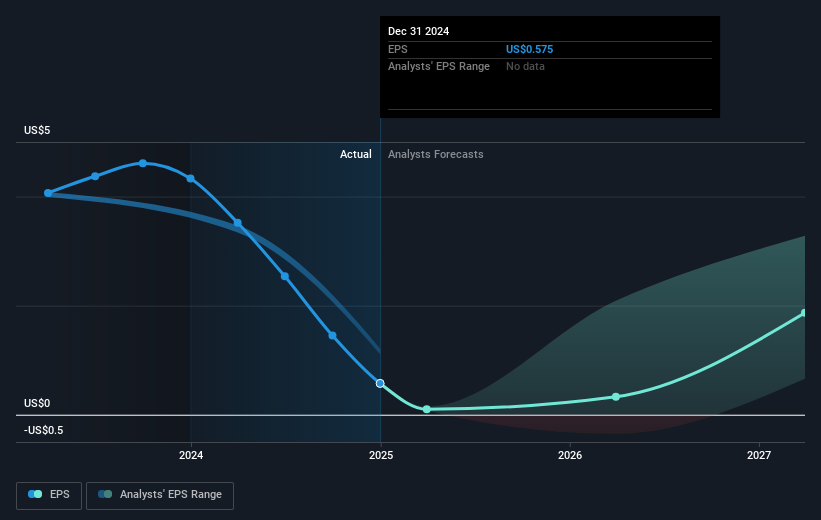

The recent product announcements and strategic moves, like the expansion of the dsPIC33A Digital Signal Controller line, are aimed at high-demand markets such as AI and energy efficiency, possibly supporting positive movements in revenue and earnings forecasts. Analysts anticipate that these efforts will bolster Microchip’s revenues, projected to grow at 10.7% annually over the next few years. However, the company’s current restructuring and efficiency improvement plans could present short-term challenges, affecting operational costs and efficiency.

In the context of the share price movement, Microchip is currently trading below the consensus price target of US$66.14. While the latest forecasts suggest potential earnings growth, the need for continuous execution in strategic initiatives plays a significant role in bridging this gap. Investors will be closely monitoring the company's progress in its restructuring and innovation pipeline against the backdrop of their long-term price expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)