- United States

- /

- Semiconductors

- /

- NasdaqGS:LSCC

How Investors Are Reacting To Lattice Semiconductor (LSCC) Amid Rising AI Chip Partnership Momentum

Reviewed by Sasha Jovanovic

- Lattice Semiconductor participated in FPGA Horizons 2025 in the United Kingdom, with Senior FAE Matt Holdsworth presenting, while sector-wide optimism increased following the announcement that AMD and OpenAI would collaborate to power AI infrastructure with AMD’s GPUs.

- The heightened attention on AI infrastructure partnerships has magnified investor focus on chipmakers positioned to benefit from accelerating AI demand, such as those providing companion or enabling technologies.

- We'll now explore how renewed enthusiasm for AI supply chain partners may influence Lattice Semiconductor’s investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Lattice Semiconductor Investment Narrative Recap

To be a shareholder in Lattice Semiconductor right now, you need to believe in a future where accelerating AI and edge computing demand supports a larger attach rate for Lattice’s low-power FPGAs as companion chips for AI accelerators and servers. The recent surge in sector-wide optimism tied to the AMD and OpenAI partnership reinforces this major catalyst but does not change the short-term risk that Lattice remains highly dependent on growth in these specific product segments; any slowdown or shift toward alternative AI architectures would still threaten near-term revenue stability.

Among recent announcements, the expansion of Lattice's FPGA portfolio with the new CertusPro-NX and MachXO5-NX released in May 2025 is most relevant. These products include features aimed at higher connectivity, enhanced power efficiency, and robust security, positioning Lattice to capitalize if AI demand accelerates across industrial and data center markets, consistent with the current catalyst of broadening end-market exposure.

However, it’s equally important for investors to consider that, despite AI-driven optimism, Lattice’s narrow focus on specific FPGA categories exposes the company to…

Read the full narrative on Lattice Semiconductor (it's free!)

Lattice Semiconductor's narrative projects $764.9 million in revenue and $187.0 million in earnings by 2028. This requires 16.1% yearly revenue growth and a $155.4 million earnings increase from the current earnings of $31.6 million.

Uncover how Lattice Semiconductor's forecasts yield a $65.00 fair value, a 10% downside to its current price.

Exploring Other Perspectives

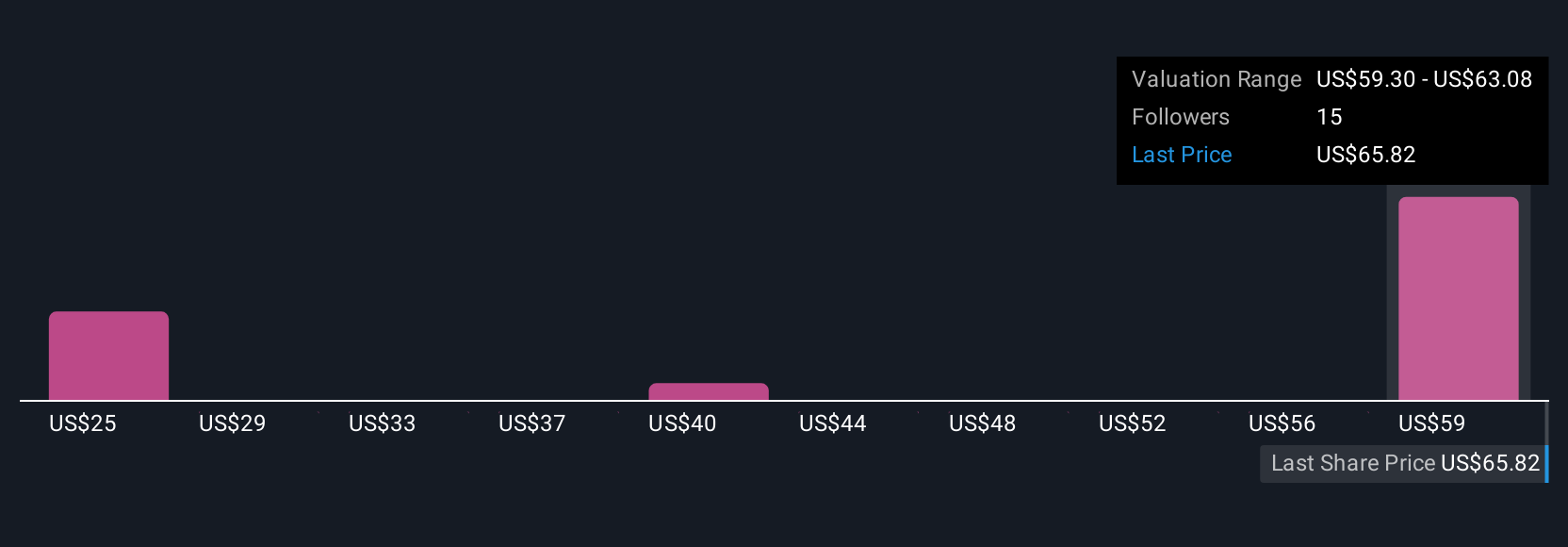

Four fair value estimates from the Simply Wall St Community range from US$25.37 to US$65 per share. Opinions are split, especially as Lattice’s ongoing reliance on growth in companion AI chips could amplify both opportunity and risk if customer priorities change.

Explore 4 other fair value estimates on Lattice Semiconductor - why the stock might be worth as much as $65.00!

Build Your Own Lattice Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lattice Semiconductor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lattice Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lattice Semiconductor's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSCC

Lattice Semiconductor

Develops and sells semiconductor, silicon-based and silicon-enabling, evaluation boards, and development hardware products in Asia, Europe, and the Americas.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives