- United States

- /

- Semiconductors

- /

- NasdaqGS:LSCC

Does Lattice Semiconductor’s (LSCC) Job Cuts and Insider Trades Reframe Its AI Investment Story?

Reviewed by Sasha Jovanovic

- Lattice Semiconductor recently announced a 14% workforce reduction and disclosed fresh insider trading activity, including CEO share purchases and executive stock sales, drawing attention to how these moves could affect operations and innovation capacity.

- At the same time, an SVP of R&D completed a pre-planned US$399,147 share sale under a 10b5-1 plan, while analysts maintained a positive stance on Lattice’s growth outlook after third-quarter results aligned with expectations.

- We’ll now explore how the workforce reduction, alongside active insider trading, could reshape Lattice Semiconductor’s existing AI-focused investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Lattice Semiconductor Investment Narrative Recap

To own Lattice Semiconductor, you need to believe its focus on low power FPGAs can keep winning design slots in AI, industrial and communications systems. The 14% workforce reduction and insider trading activity do not appear to materially change the near term catalyst around AI driven demand, but they may sharpen attention on execution risk after a year of compressed margins and lower earnings.

The recent completion of the latest share repurchase tranche, totaling US$85.85 million since late 2024, sits in contrast to the cost cutting program and insider share sales. While buybacks can support per share metrics in the short run, investors may focus more on whether the leaner cost base still supports Lattice’s product roadmap in AI centric markets.

Yet against this backdrop, rising competition in low and mid range FPGAs remains a risk investors should be aware of, especially as...

Read the full narrative on Lattice Semiconductor (it's free!)

Lattice Semiconductor's narrative projects $764.9 million revenue and $187.0 million earnings by 2028. This requires 16.1% yearly revenue growth and a roughly $155 million earnings increase from $31.6 million today.

Uncover how Lattice Semiconductor's forecasts yield a $80.31 fair value, a 12% upside to its current price.

Exploring Other Perspectives

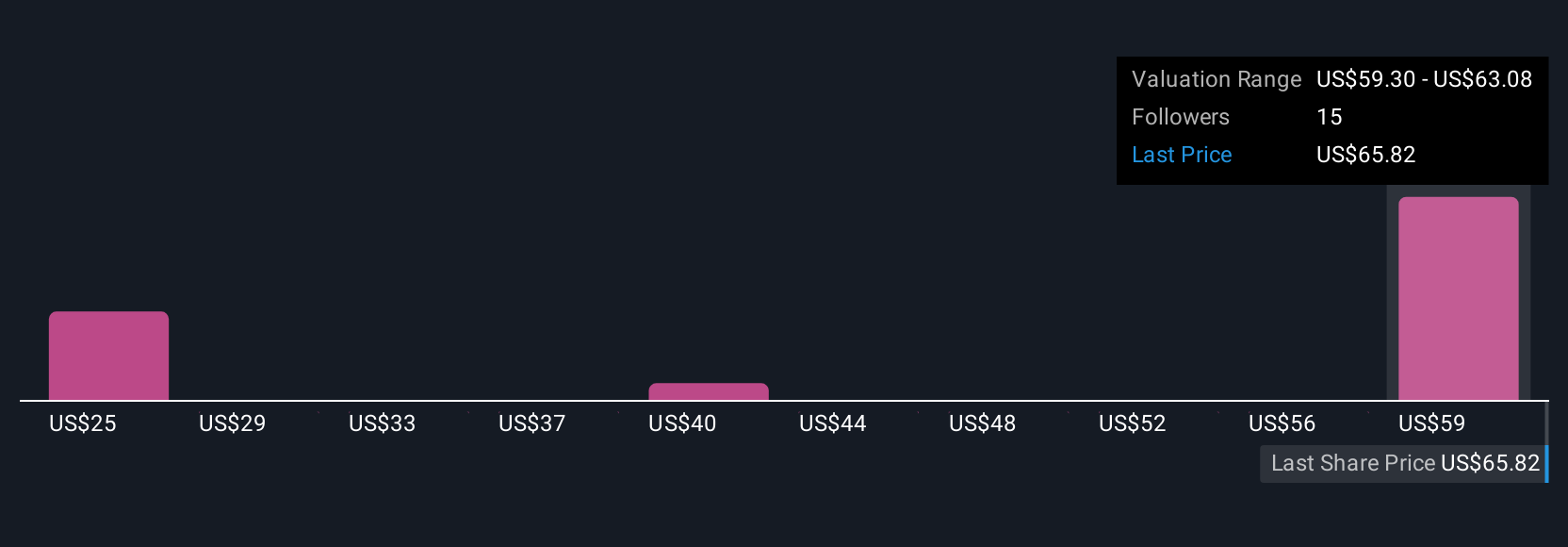

Four members of the Simply Wall St Community currently estimate Lattice’s fair value between about US$31 and US$80, reflecting a wide spread of views. When you set these against the AI and edge computing demand story that underpins the investment case, it is worth comparing how different investors weigh growth potential against competitive and margin pressures.

Explore 4 other fair value estimates on Lattice Semiconductor - why the stock might be worth as much as 12% more than the current price!

Build Your Own Lattice Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lattice Semiconductor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lattice Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lattice Semiconductor's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSCC

Lattice Semiconductor

Develops and sells semiconductor, silicon-based and silicon-enabling, evaluation boards, and development hardware products in Asia, Europe, and the Americas.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026