- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Should Lam Research's (LRCX) VECTOR TEOS 3D Debut at Semicon West Influence Investor Decisions?

Reviewed by Sasha Jovanovic

- Lam Research showcased its latest semiconductor manufacturing innovations at Semicon West 2025 in Phoenix this past week, including the launch of the VECTOR TEOS 3D deposition tool for advanced chip packaging in AI and high-performance computing markets.

- The event further highlighted Lam Research's leadership in enabling next-generation semiconductor manufacturing, drawing attention from industry analysts and investors amid a wave of AI-focused partnerships across the sector.

- We'll examine how the launch of the VECTOR TEOS 3D tool shapes Lam Research's investment narrative and future growth outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Lam Research Investment Narrative Recap

To be a Lam Research shareholder today is to believe that AI-driven demand, next-generation chip architectures, and robust fab investment will continue to drive both growth and margin expansion, even as risks from China and customer concentration persist. The recent showcase at Semicon West 2025 keeps attention centered on Lam’s VECTOR TEOS 3D tool as the most immediate catalyst, but this innovation does not meaningfully shift the near-term dependence on memory and advanced foundry orders, or resolve regulatory uncertainty in China.

Alongside its product unveiling, Lam's just-announced collaboration with JSR Corporation on next-generation materials is also worth a close look. While VECTOR TEOS 3D spotlights Lam’s technical capabilities and growth thesis, this new partnership supports the same need for technology leadership, reinforcing both Lam’s market strategy and the challenges of sustaining that edge when barriers to entry are high, but change quickly. Contrary to the headline-making innovations, investors should be aware of ongoing geopolitical and export control risks that could impact Lam’s access to...

Read the full narrative on Lam Research (it's free!)

Lam Research's narrative projects $23.6 billion in revenue and $6.7 billion in earnings by 2028. This requires 8.5% yearly revenue growth and a $1.3 billion earnings increase from the current earnings of $5.4 billion.

Uncover how Lam Research's forecasts yield a $120.82 fair value, a 14% downside to its current price.

Exploring Other Perspectives

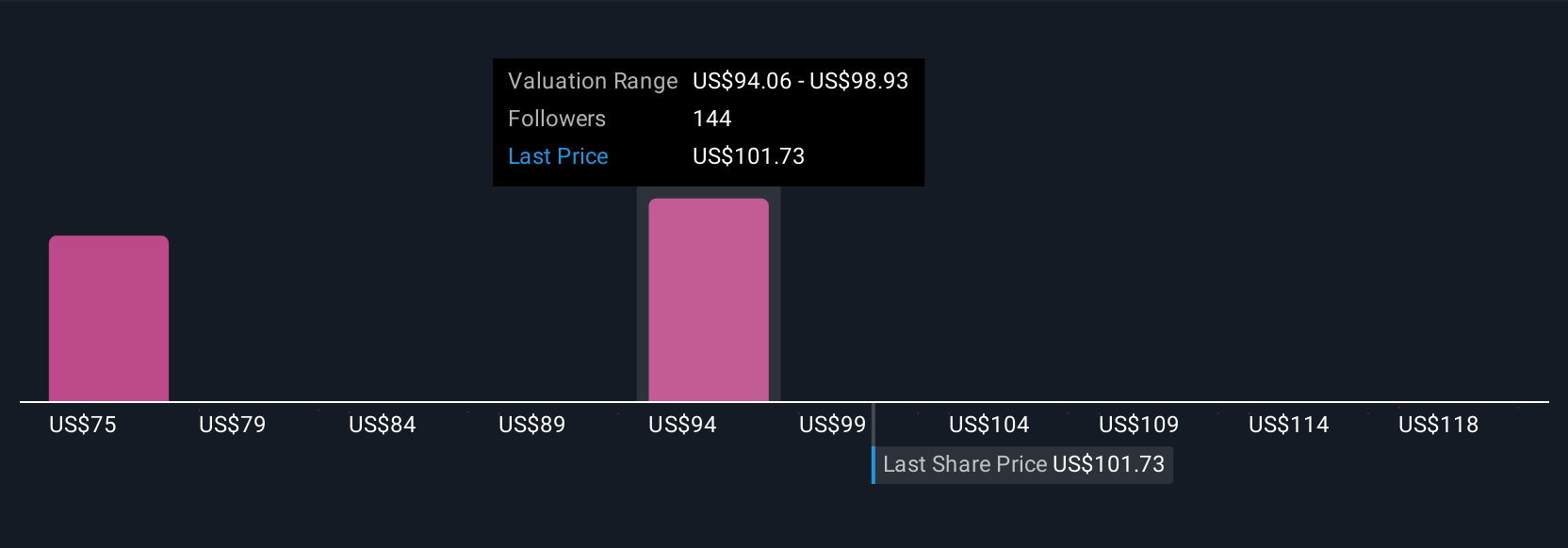

Simply Wall St Community members have set Lam Research fair values between US$58 and US$135, with 19 individual opinions captured. While many focus on Lam’s AI-related growth drivers, your view may hinge on the scale of China-related policy risks influencing future revenue streams.

Explore 19 other fair value estimates on Lam Research - why the stock might be worth less than half the current price!

Build Your Own Lam Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lam Research research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Lam Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lam Research's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives