- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Is Lam Research (LRCX) Still Undervalued? A Fresh Look at Its Valuation After the Recent Rally

Reviewed by Simply Wall St

Most Popular Narrative: 5.4% Undervalued

According to the most widely followed narrative, Lam Research appears to be trading below its estimated fair value. The narrative points to growth catalysts and margin expansion that could justify a higher valuation.

Rapidly rising AI workloads and the associated need for higher storage, bandwidth, and processing power are accelerating the adoption of advanced chip architectures (such as gate-all-around, 3D NAND, and advanced packaging). This increases demand for Lam's etch and deposition tools, supporting sustained revenue growth and robust order visibility.

Curious how Lam’s fair value is calculated? The secret lies in ambitious projections for earnings, revenue trajectories, and profit margins. This narrative uses bold assumptions about Lam’s future financial engine that might surprise even seasoned investors. Want to discover which metrics shape this tantalizing price target? Keep reading to reveal the forecast that has everyone talking.

Result: Fair Value of $108.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are key risks to consider, including geopolitical tensions and customer concentration, which could quickly shift the outlook for Lam Research.

Find out about the key risks to this Lam Research narrative.Another View: What Does the SWS DCF Model Say?

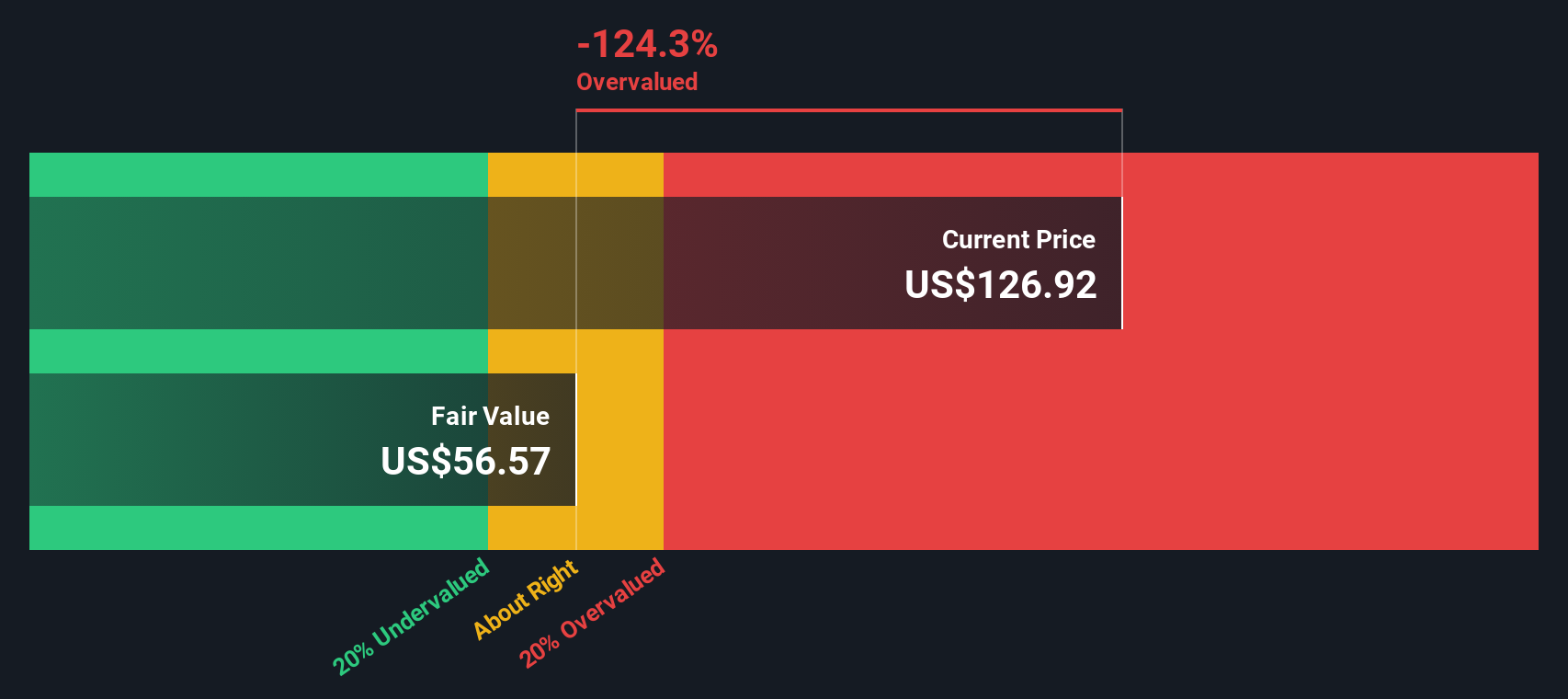

While many see Lam Research as undervalued based on analyst forecasts and future growth potential, our DCF model suggests the stock could be overvalued from a purely cash flow perspective. Which approach truly reflects today’s market reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lam Research Narrative

If you have a different perspective or want to dig into the numbers yourself, it takes just a few minutes to craft your own take on Lam Research. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Lam Research.

Looking for more investment ideas?

There is no shortage of creative opportunities waiting for those who take action. Don’t just watch from the sidelines; your next smart move could be one click away.

- Uncover high-growth potential by searching for up-and-coming companies with solid balance sheets using our handpicked selection of penny stocks with strong financials.

- Tap into the booming artificial intelligence trend and find pioneers advancing this transformative space through our exclusive AI penny stocks list.

- Target great value opportunities and pinpoint stocks with strong fundamentals that may be underappreciated using our tailored undervalued stocks based on cash flows insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion