- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Sees 27% Price Surge Following CEO Appointment

Reviewed by Simply Wall St

Intel (NasdaqGS:INTC) recently saw a 26.55% increase in its share price over the last quarter, which can be attributed to several key events and market trends. The appointment of Lip-Bu Tan as CEO on March 18, 2025, brought confidence to investors given his extensive experience in the semiconductor sector. The launch of the Intel Xeon 6 processors in February showcased the company's commitment to innovation, potentially boosting investor expectations. Additionally, market conditions played a role, as stocks experienced mixed performance with broader indexes like the S&P 500 and Nasdaq showing signs of volatility. Despite ongoing challenges reflected in recent earnings and acquisition rumors involving Altera Corp., Intel's solid advances in AI and networking solutions appear to resonate positively with market participants. Furthermore, while the overall tech sector faced varied performances, Intel's strategic moves have helped it secure its robust position in a landscape marked by uncertainties in monetary policy and economic growth projections.

Buy, Hold or Sell Intel? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

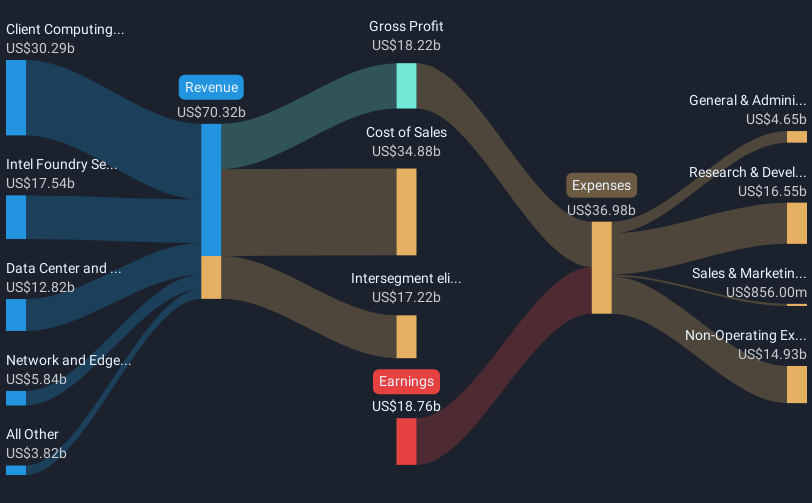

While Intel experienced a robust increase in its share price recently, over the longer period of the last year, it faced challenges, with a total shareholder return of 42.25% decline. This stark contrast to the 12.2% return in the US Semiconductor industry and 8.1% return in the broader market highlighted Intel's underperformance. Several factors contributed to this downturn. For one, the revenue decline in Q4 2024 to US$14.26 billion from the previous year's US$15.41 billion, along with a net loss, played a significant role. The anticipation of continued financial struggles was also reflected in the reduced earnings guidance for early 2025.

Another influential element was the decision in late 2024 to suspend dividends to prioritize liquidity, which may have influenced investor sentiment negatively. Additionally, the ongoing legal challenges, such as the patent infringement lawsuit from May 2024, added uncertainties to Intel's operational climate. Despite these difficulties, Intel's value proposition remains strong, as it is trading significantly below estimated fair value, demonstrating investor interest even amid short-term hurdles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives