- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Reports US$821 Million Q1 Net Loss

Reviewed by Simply Wall St

Intel (NasdaqGS:INTC) recently announced the launch of the NetApp AIPod Mini, a step underscoring its commitment to AI innovation. With the market rising 4% in the past week and 12% over the year, Intel's share price climbed 14% this month despite reporting a Q1 net loss of $821 million. The collaboration with Tejas Networks to deliver educational content in India and the introduction of quantum-safe architecture with Arqit Quantum likely added weight to the broader market trends. Meanwhile, executive transitions and a potential sale of its Altera unit highlight Intel's ongoing realignment efforts.

Buy, Hold or Sell Intel? View our complete analysis and fair value estimate and you decide.

Intel's recent announcements, including the introduction of the NetApp AIPod Mini and collaborations with companies like Tejas Networks and Arqit Quantum, highlight Intel's ongoing efforts to realign its operations amid increasing competition in the AI space. These initiatives could be perceived as steps toward overcoming organizational inefficiencies and embracing new technology sectors. However, such structural transformations may not instantly translate into immediate financial gains, potentially impacting short-term revenue and earnings forecasts.

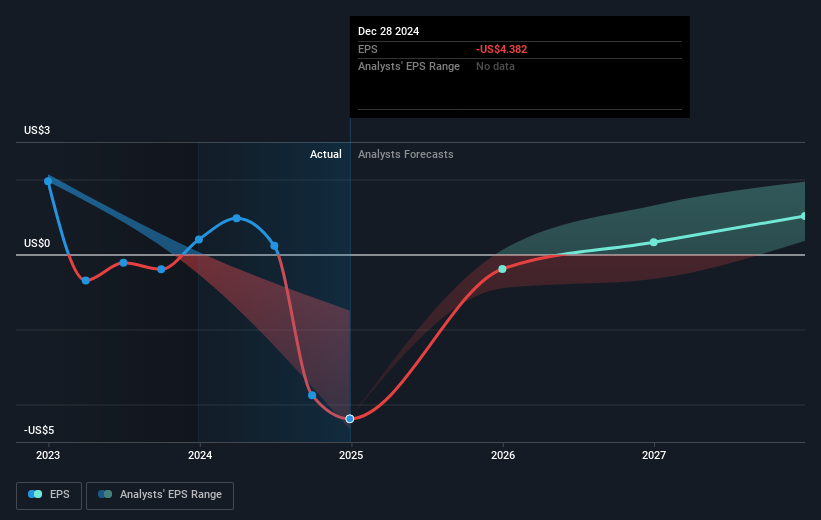

Over the past year, Intel's total shareholder return, combining share price and dividends, was a decline of 26.88%. This underperformance contrasts with the US Semiconductor industry and the broader US market, which saw positive returns of 18.5% and 11.6% respectively during the same period. This suggests that while Intel's recent strategic moves have generated short-term excitement, as seen in April's 14% share price increase, the longer-term outlook remains challenging.

Intel's current share price stands at US$19.94, below the consensus analyst price target of US$21.34, suggesting that some investors might perceive the stock as undervalued. Nevertheless, the news of potential product innovations and collaborations could positively influence future revenue and earnings expectations, contingent on successful execution and market adoption. Overall, while the market appears to discount Intel's current valuation compared to its peers, the company's strategic initiatives in AI and the potential restructuring benefits could shape the trajectory of its competitiveness and financial performance.

Gain insights into Intel's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives