- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Go big or go home: Intel's (NASDAQ: INTC) comeback plan to compete in the global chip race

Summary:

- Intel has big plans to innovate as it wrestles with tough competition.

- Significant investments will weigh on cash generation in the coming years.

- Capital allocation decisions may need to be reassessed if roadblocks come in the way of milestones.

Intel Corporation ( NASDAQ: INTC ) has been through a rough patch lately. The stock recently hit a new 52-week low of $35.54. While the decline could be dismissed as just another setback spurred by a global pandemic followed by a supply chain crunch, Intel’s woes began much before the markets began to get skittish .

According to reports, the company has been losing the CPU market share to rival Advanced Micro Devices ( NASDAQ: AMD ) since 2016. Recently, the company lost the top spot to Samsung ( KOSE: A005930 ) as a leading semiconductor chip manufacturer, a Gartner report reveals.

In late 2020, Activist hedge fund investor Daniel Loeb advocated for significant reforms at the company, citing that the company’s dominance in the semiconductor space was diminishing. Meanwhile, customers such as Amazon ( NASDAQ: AMZN ) were beginning to manufacture their own chips.

Under pressure, the company appointed Pat Gelsinger, who had previously held the same position at VMware ( NYSE: VMW ), as its new CEO.

See our detailed analysis for Intel Corp

The Goal

One of Gelsinger’s primary strategies to restore Intel to its former glory is to reorganise the company’s business and double down on its semiconductor manufacturing business. The company plans to invest in new factories both in the US and abroad while spending $20-$30 billion annually for the next couple of years.

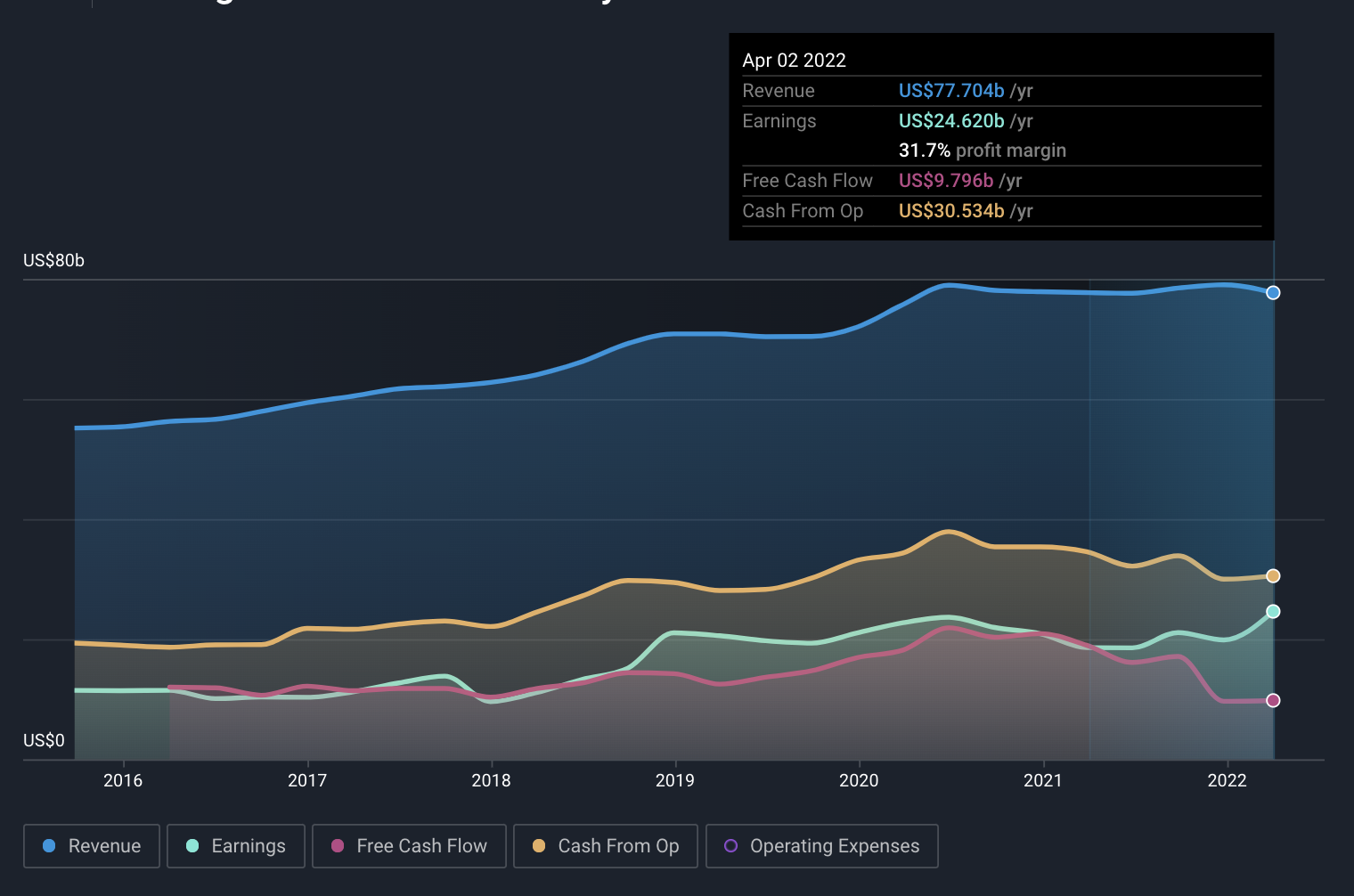

To provide some context, Intel has spent roughly 40%-50% of its operating cash flows on capital expenditures historically. In 2021, that figure rose to about 70%. As a result, free cash flows (cash remaining after covering operating and capital expenses) saw a sharp drop in 2021.

Working capital requirements also contributed to the decline in free cash flows. Inventories rose to almost $11b after averaging around $8b from 2017-2020. Upon being questioned by an analyst during the Q4 2021 earnings call, Gelsinger acknowledged that inventory levels had been historically low and the main goal behind the increase was to match demand. Accounts receivable also increased from an average of about $7 billion between 2017 and 2020 to $9.5 billion in 2021. Typically, an increase in inventories and accounts receivable represents cash outflows and reduces cash from operating income.

Pulling all the stops

Intel seems committed to bolstering its operations to take its rivals head-on. While the company’s ambitious expansion strategy is anticipated to serve as the means toward that end, Intel has also been making some concrete moves, including significant capital allocation decisions, to support that objective. We have reviewed a few of them below.

MobilEye spinoff - In December last year, the company announced its plans to take its automotive business, valued at $50b , public. Revenue from the MobilEye business grew 43% year-over-year in 2021. Gelsinger had indicated that a portion of the funds raised from the IPO would be used to fund its expansion. However, the company has already hit a snag as the IPO has stalled over fears about market volatility .

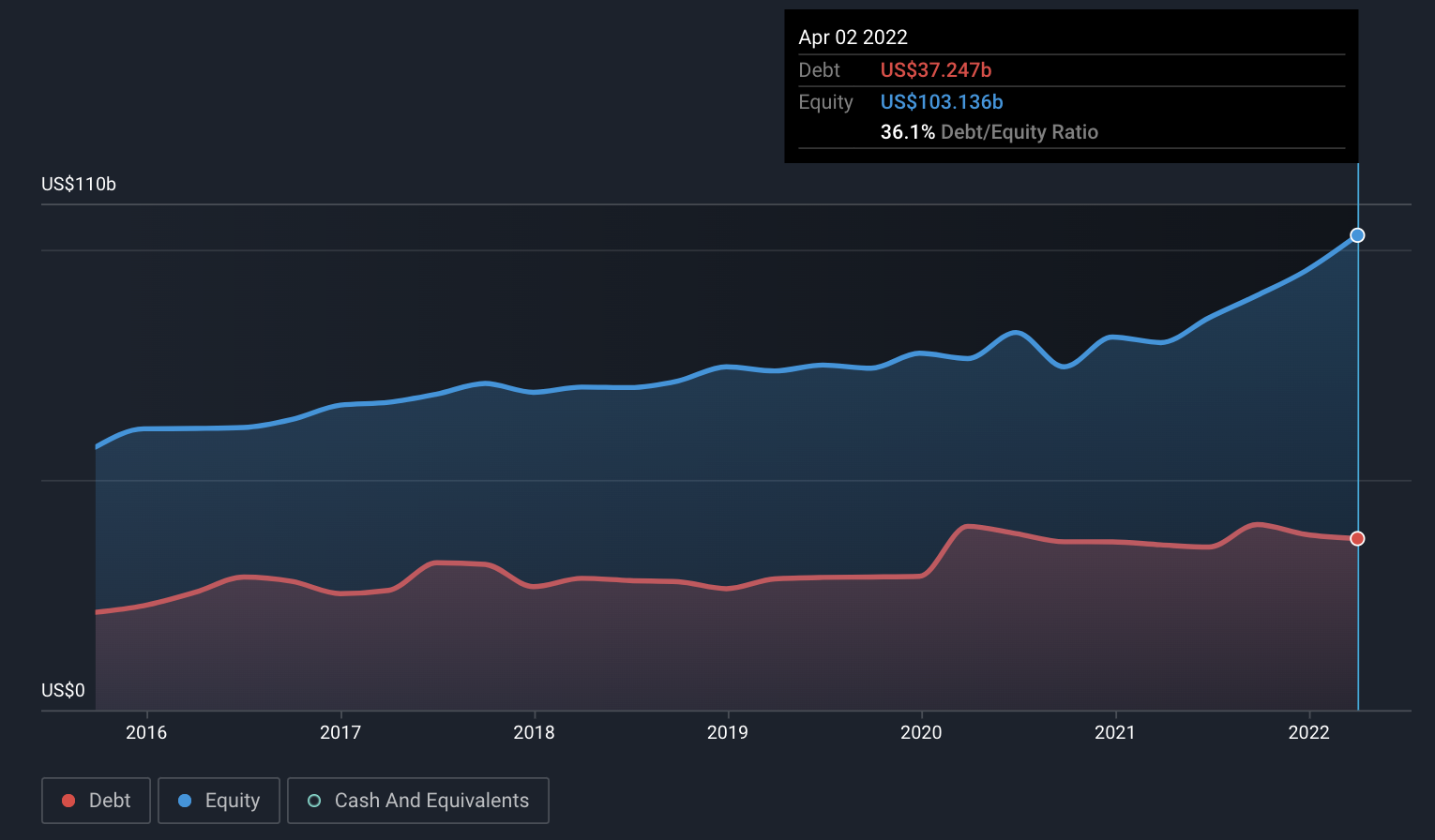

Strategic acquisitions - Intel recently acquired Tower Semiconductor, a leading analog semiconductor solutions company. The acquisition is expected to expand the scope and capability of its current semiconductor business. Currently sitting atop $38.7b cash (including short-term investments), the company is in a good position to engage in such transactions to enhance its operations and compete globally.

Easing share repurchases- Intel is also planning to scale back on its stock repurchase, likely to redirect the funds towards its planned expansion. While it is yet to make similar announcements on its dividend- in fact, the company recently raised its dividends - there is a chance that the company may have to revisit its dividend policy in the future. Over the past five years, dividends have made up roughly 19% of Intel's operational cash flows, while share repurchases have made up about 20%.

Debt is always an option - Share buybacks and dividend payments haven’t come without some cost to the company’s balance sheet. Despite its sizeable cash position, the company has a negative net debt of $3.2 billion, meaning its debt exceeds its cash. However, the low debt-to-equity ratio suggests the company is in good overall financial shape. Accessing capital markets to fund growth could always be a possibility.

Although, borrowing in the current interest rate environment may not be the best move for the company. Higher borrowing costs due to higher interest rates could put further strain on its cash flows.

Finally, unrelated to the actions taken by the company, a vital component that will carry Intel’s ambitious plans to fruition is the CHIPS (Creating Helpful Incentives to Produce Semiconductor) act, a government initiative that will grant Intel tax credits for R&D and chip manufacturing related expenses and help boost its cash flows. The final legislation for the bill, however, is still pending.

Conclusion

Intel intends to ride the wave of semiconductor industry growth through its aggressive expansion strategy. The company is aiming to reclaim market share with year-over-year revenue growth of 10%-12%, gross margins of 54%-58%, and significant free cash flows in 2025 and 2026.

In the near term, however, working capital requirements and significant capital expenses would continue to put pressure on Intel's cash flows. Potential roadblocks in the form of delay in the Chips subsidies bill as well as the postponing of the MobilEye IPO could also put a strain on its finances.

If the company does find itself in troubled waters, it may need to reconsider its capital allocation decisions. For instance, it might have to decide whether to cut or suspend its dividends to preserve capital or issue new debt-both of which might negatively impact shareholders.

Investors who are in for the long haul will be keeping their eyes peeled as the company races to meet its milestones. Keeping track of company updates will be easier if you have the stock on your watchlist or portfolio . You can also check out this in-depth analysis to learn more about Intel's finances and future growth projections.

If you're looking to trade Intel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Kshitija Bhandaru and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives