- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NASDAQ:INTC) Looks Attractive for Investors that can Wait-Out the Growth Campaign

Summary:

- Intel is embarking on a longer growth campaign, aimed to onshore chip production in the U.S.

- The earnings and cash flows are expected to be lower in the next few years.

- Even with the future forecasts, Intel seems to be underpriced and may present an opportunity for investors that are bullish on the growth in semiconductors, digitalization and computing power.

When discovering potential investments, investors can turn to large and stable corporations which have recently fallen out of the spotlight - and ask themselves if they can get them at a cheaper price. This is what we will evaluate for the Intel Corporation (NASDAQ:INTC) today. Namely, is the stock a good bargain with the assumption that the company will catch up with technology in the future?

In this analysis, we want to explore whether the stock is poised to regain its market if it manages to develop valuable technologies in the future. For long-term or value investors, this is precisely the time when research on a company should be done, since waiting too long for a novelty to be broadcasted may put investors behind on the stock price action.

First, let's get a good picture as to what we can expect to see from Intel going forward, and for that we will use the forecasts of analysts that are covering the company.

Intel's Future Estimates

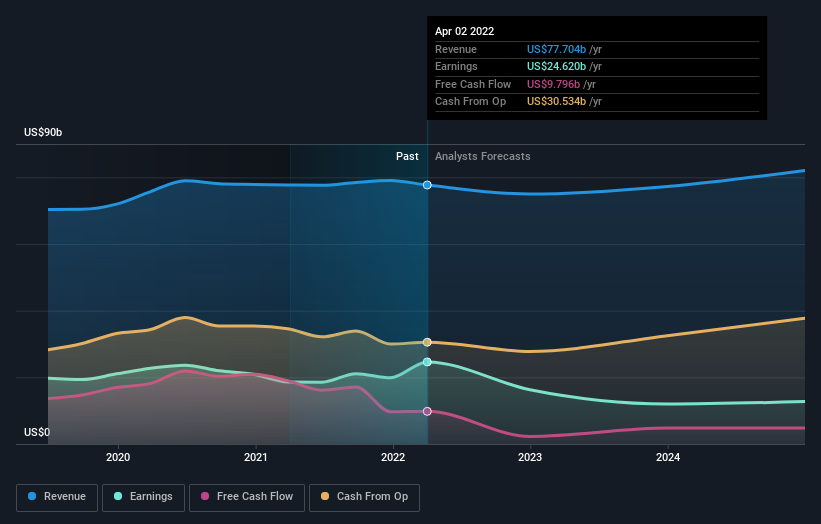

When we look at Intel's financials, we find a relatively large discrepancy between earnings and free cash flows. Ideally, we would like these to match, however when they differ, we may want to err on the side of trusting the cash flows, since they are the basis for providing investors with returns such as dividends, buybacks, or investing in growth CapEx.

To that end, we see that the current 12-month earnings are $24.6b while the cash flows lag behind at $9.8b. Investors need to know if these can sufficiently cover dividend expenses, else the alluring $1.32 dividend per share may be at risk. We can see that Intel has a cash payout ratio of 61% for dividends, which amounts to about $5.4b needed to compensate shareholders with the current dividend per share levels.

As we can see from the chart below, while earnings are projected to slightly decline, it is the free cash flows that are in more "trouble". Analysts are predicting free cash flows of $2.27b for 2023, and if that happens, then the company will need to look for alternative financing sources to fund the dividend. This should not be a problem in the short-term, however, if profitability doesn't recover, then the company will have trouble maintaining its dividends - which is also partly why investors are staying away from the stock even if the dividend yield is a high 3.9%.

The chart below shows how analysts are estimating the income of the company to change up to 2025:

See our latest analysis for Intel

Intel has been investing in their new production plant in Ohio in a bid to increase chip independence in the U.S. as well as boosting production capacity in an industry that is currently experiencing semiconductor shortages.

New Growth Campaign

The company recently underwent a change in management, and Intel's reinstated CEO Patrick Gelsinger envisions 5 years of growth investments. Intel already booked $20b in CapEx in the last 12 months, and has a $28b investment budget for 2023.

For shareholders, growth investing may be a much better option than finessing and optimizing the cash flows. It seems that management believes that there is still high potential in chip technology development, and even the software-side may be leveraged to drive back margins. They aim to shift to growth in the next 5 to 10 years, with a focus on becoming a top provider for foundry services, high-performance computing, and moving into autonomous vehicles processing.

In essence, this is the short and long term forecast for the company: diminishing cash flows in order to concentrate on reinvestment. If successful, Intel will be a central, U.S. based foundry with both client and server products for international markets. This may garner some political protection, as the U.S. is having difficulties maintaining good relations in Asia.

Pricing Analysis

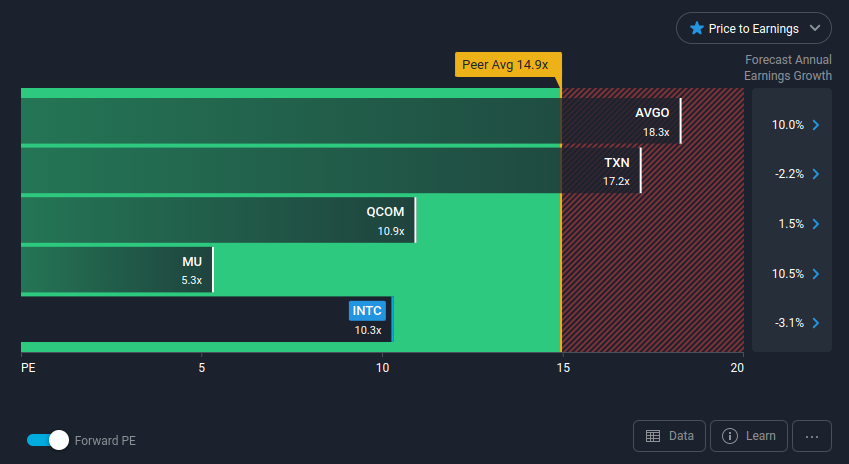

Intel has a trailing Price to Earnings (PE) ratio of 6.2x, however, if we account for the projected decline in earnings, we can see the forward PE ratio rising to 10.3x earnings. This is still good, as it places Intel some 45% below the average peer PE ratio.

In the chart below, we can see the pricing relationship between peers with forward earnings:

Even if future earnings are expected to decline 3.1%, Intel is still relatively underpriced vs peers. This interpretation also assumes relatively stable earnings, while Intel is currently embarking on a 5-year growth campaign.

Conclusion

Investors that believe in Intel's new growth vision and do not mind waiting for the development period before seeing higher returns, may be inclined to see the opportunity in the company. The relative analysis also indicates, that investors are fearful of the earnings in the next few years, and are pricing the stock lower than peers. This may be a legitimate approach if they have annual investment goals that need to be reached.

After the new infrastructure investment phase, Intel will be one of the rare chip foundries that have onshored semiconductor manufacturing back to the U.S., which can turn out to be more important in the future.

Our dividend analysis revealed that the dividends per share may not be stable and are likely not compatible with the new growth strategy, so investors may want to be cautious when buying the stock for cash income. Alternatively, we see that Intel is in good financial health and may choose to sustain dividend payments even on a tighter budget.

Finally, investors may want to look at the insider trading activity, as it shows significant buying from multiple insiders that may indicate that management is optimistic when it comes to the future of Intel.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion