- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Even If Stagnant, Intel's (NASDAQ:INTC) Free Cash Flows may be Undervalued by Investors

Intel Corporation (NASDAQ:INTC) is a US$218b market cap company which had a volatile last three years. The stock had many ups and downs, and ultimately has made 15.9% return over that period. The volatility has selected out a certain type of investor, and we will be examining if the stock is appropriate for long-term holders.

Value in stocks can be derived in multiple ways, the two most frequent approaches are the growth stock, when a company is in a high-growth phase, and the other being the value phase, when a stock's cash flows are mispriced and have the potential to increase due to efficiencies, value maximization policies or other catalysts.

See our latest analysis for Intel

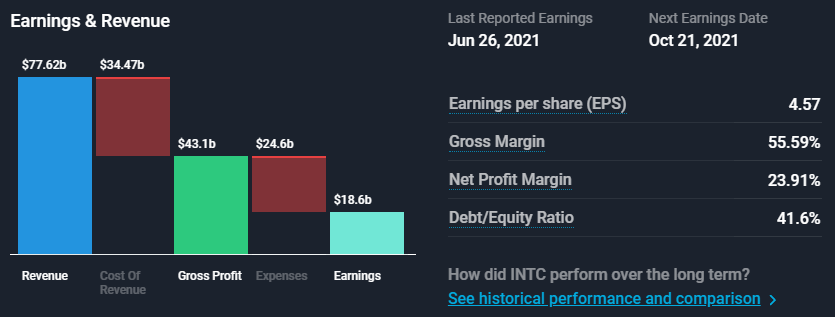

Before estimating the value of Intel's cash flows, we will preview a snapshot of the performance of the company:

Intel is making US$77.6 in revenues and has a relatively high profit margin of 23.9%. The earnings are estimated to slowly decrease and keep a stable level around US$17b. This may caution some investors, and that is why we will see jut how much of the net income will translate to free cash flows for investors.

Today we will run through one way of estimating the intrinsic value of Intel by using the Discounted Cash Flow (DCF) model.

We would caution that there are many ways of valuing a company and, like the DCF, each technique has advantages and disadvantages in certain scenarios. For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you.

Crunching the numbers

Generally we assume that a dollar today is more valuable than a dollar in the future, so we need to discount the sum of these future cash flows to arrive at a present value estimate:

10-year free cash flow (FCF) forecast

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Levered FCF ($, Millions) | US$11.3b | US$12.0b | US$12.3b | US$14.5b | US$15.4b | US$16.2b | US$16.8b | US$17.4b | US$17.9b | US$18.4b |

| Growth Rate Estimate Source | Analyst x13 | Analyst x4 | Analyst x2 | Analyst x2 | Est @ 6.16% | Est @ 4.9% | Est @ 4.02% | Est @ 3.4% | Est @ 2.97% | Est @ 2.67% |

| Present Value ($, Millions) Discounted @ 7.3% | US$10.5k | US$10.4k | US$10.0k | US$11.0k | US$10.8k | US$10.6k | US$10.3k | US$9.9k | US$9.5k | US$9.1k |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$102b

After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond the first stage.

For a number of reasons, a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (2.0%) to estimate future growth.

In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 7.3%.

Terminal Value (TV)= FCF2031 × (1 + g) ÷ (r * g) = US$18b× (1 + 2.0%) ÷ (7.3%* 2.0%) = US$353b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$353b÷ ( 1 + 7.3%)10= US$175b

The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is US$277b.

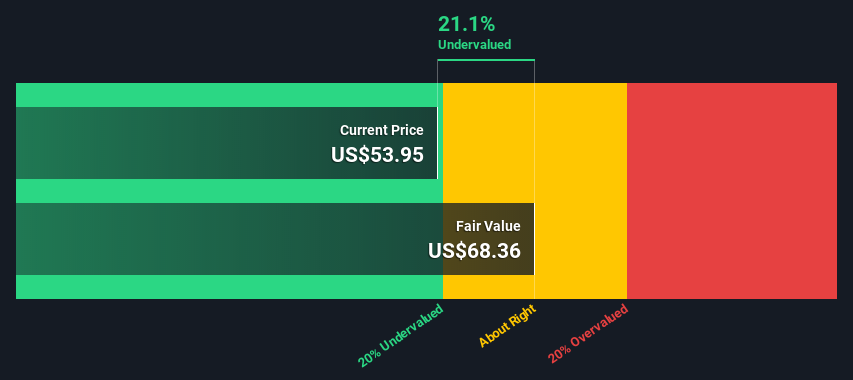

Relative to the current share price of US$54.0, the company appears a touch undervalued at a 21% discount to where the stock price trades currently.

The assumptions in any calculation have a big impact on the valuation, so it is better to view this as a rough estimate, not precise down to the last cent.

We can see that although Intel may not be a company that is growing, the vast cash flows in the company might be undervalued even at current levels.

Our model suggests that in a period of stability or the appearance of a catalyst, the stock has some upwards potential. Keep in mind that this might not necessarily happen, as macro trends and competitors may draw investors away from Intel.

Key Takeaways

Intel has the potential to converge to value even at current levels. The stock's cash flows seem to be mispriced and this might leave an opportunity for investors.

The company has a volatile stock price and reduced growth. This could have possibly led some investors to pull away from the company as it transitions to a value stock. The company itself can still innovate and increase efficacy, which is an additional reason why the current stock price might not be capturing the full potential of the technology.

When considering Intel, there are three more fundamental items you should explore:

- Risks: Take risks, for example - Intel has 1 warning sign we think you should be aware of.

- Future Earnings: How does INTC's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other Solid Businesses: Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered!

PS. Simply Wall St updates its DCF calculation for every American stock every day, so if you want to find the intrinsic value of any other stock just search here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives