- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

A Fresh Look at Intel (INTC) Valuation After Recent Share Price Action

Reviewed by Simply Wall St

Most Popular Narrative: 14.2% Undervalued

According to julio, the latest narrative pegs Intel as undervalued, with a suggested fair value above the current share price. This perspective emphasizes the company’s renewed focus and long-term market strengths.

"Intel is making some smart moves in its turnaround plans, such as shedding some noncore businesses, spinning off shares of its attractive automotive business (Mobileye), and seeking innovative co-investment partnerships with financial firms. The AI semiconductor market is booming, and Intel is one of the few merchant firms with a diverse enough portfolio to serve a larger portion of the market."

What is quietly powering this bullish narrative? There is a radical shift behind the numbers, hinging on transformation strategies and a future profit profile that might surprise you. Want to know what assumptions drive such a dramatic fair value? The real story is tucked inside the projected turnaround.

Result: Fair Value of $28.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, manufacturing delays or rising competition from AMD and Nvidia could disrupt Intel’s turnaround and challenge the bullish fair value narrative.

Find out about the key risks to this Intel narrative.Another View: What Our DCF Model Says

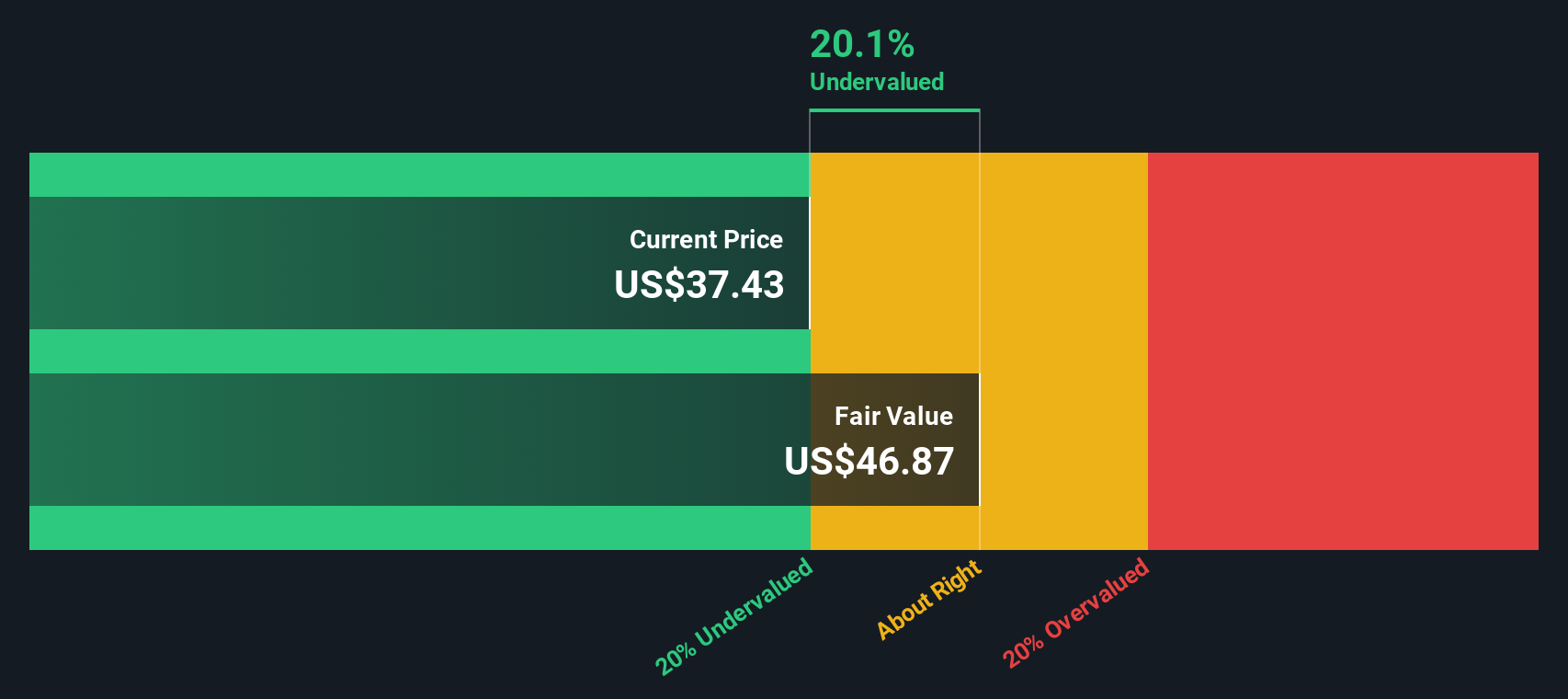

While some see an attractive entry point for Intel, our DCF model also finds the stock trading below fair value. This second method highlights lingering market caution and prompts the question: is skepticism still justified?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Intel Narrative

If you see things differently or want to dig deeper, you can build your own Intel narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Intel.

Looking for more investment ideas?

Do not just watch from the sidelines when smart opportunities are within reach. Use the power of the Simply Wall Street Screener to spot your next big move. Plenty of savvy investors are uncovering possibilities right now.

- Unlock the growth potential of tomorrow’s innovators as you tap into AI penny stocks shaping advances in artificial intelligence.

- Capture stable income streams and strengthen your portfolio with dividend stocks with yields > 3% offering reliable yields and resilient business models.

- Zero in on hidden gems trading at compelling valuations through undervalued stocks based on cash flows before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026