- United States

- /

- Semiconductors

- /

- NasdaqCM:INDI

Investors ignore increasing losses at indie Semiconductor (NASDAQ:INDI) as stock jumps 7.1% this past week

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the indie Semiconductor, Inc. (NASDAQ:INDI) share price is 22% higher than it was a year ago, much better than the market decline of around 0.7% (not including dividends) in the same period. So that should have shareholders smiling. Unfortunately the longer term returns are not so good, with the stock falling 3.9% in the last three years.

Since the stock has added US$89m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for indie Semiconductor

Given that indie Semiconductor didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year indie Semiconductor saw its revenue grow by 107%. That's stonking growth even when compared to other loss-making stocks. The solid 22% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. So quite frankly it could be a good time to investigate indie Semiconductor in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

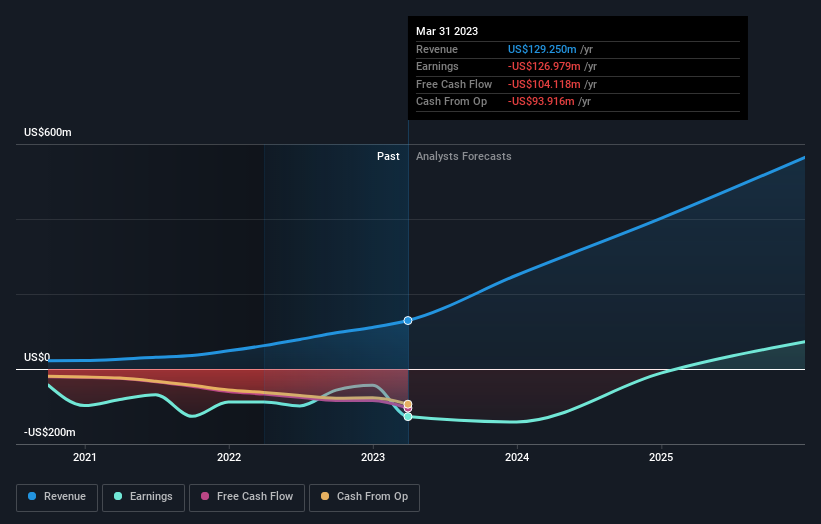

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think indie Semiconductor will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that indie Semiconductor rewarded shareholders with a total shareholder return of 22% over the last year. That certainly beats the loss of about 1.3% per year over three years. It could well be that the business has turned around -- or else regained the confidence of investors. It's always interesting to track share price performance over the longer term. But to understand indie Semiconductor better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for indie Semiconductor you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if indie Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:INDI

indie Semiconductor

Provides automotive semiconductors and software solutions for advanced driver assistance systems, driver automation, in-cabin, connected car, and electrification applications.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives