- United States

- /

- Semiconductors

- /

- NasdaqCM:INDI

indie Semiconductor (INDI) Is Up 29.7% After Launching Ultra-Stable Gallium Nitride DFB Lasers for Quantum and Automotive

Reviewed by Sasha Jovanovic

- On October 14, 2025, indie Semiconductor announced the release of a new Visible DFB gallium nitride-based laser diode, designed for quantum, automotive LiDAR and sensing, and industrial Raman applications with ultra-stable, sub-MHz linewidths across near-UV to green wavelengths.

- A unique feature of indie’s new DFB lasers is mode-hop free performance and precise on-wafer spectral control, enabling scalable, high-volume photonics manufacturing without traditional color binning.

- We'll review how indie’s photonics innovation for quantum and automotive applications could reshape the company's investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

indie Semiconductor Investment Narrative Recap

To invest in indie Semiconductor, one must buy into the company’s long-term vision of pioneering automotive technologies and photonics, even as it remains unprofitable and highly reliant on automotive cycles. The recent Visible DFB laser diode launch adds credibility to indie’s photonics ambitions but is unlikely to change the most important short-term catalyst: ramping automotive design wins. However, persistent operating losses and cash burn remain a significant risk that could affect the company's ability to invest in growth if margins do not improve.

Out of the various company updates, the July 2025 announcement highlighting momentum in ultra-low noise photonics lasers for ADAS and quantum markets is most relevant, as it directly links to the recent DFB product release and underpins potential for future adjacent market expansion. Both updates support indie’s catalyst of differentiated engineering delivering incremental revenue, but do not diminish the near-term pressure to convert innovation into sustained commercial gains.

By contrast, investors should be aware of the underlying risk if indie’s unprofitable operations and cash flow...

Read the full narrative on indie Semiconductor (it's free!)

indie Semiconductor's narrative projects $421.4 million revenue and $59.5 million earnings by 2028. This requires 24.6% yearly revenue growth and a $215.3 million increase in earnings from -$155.8 million today.

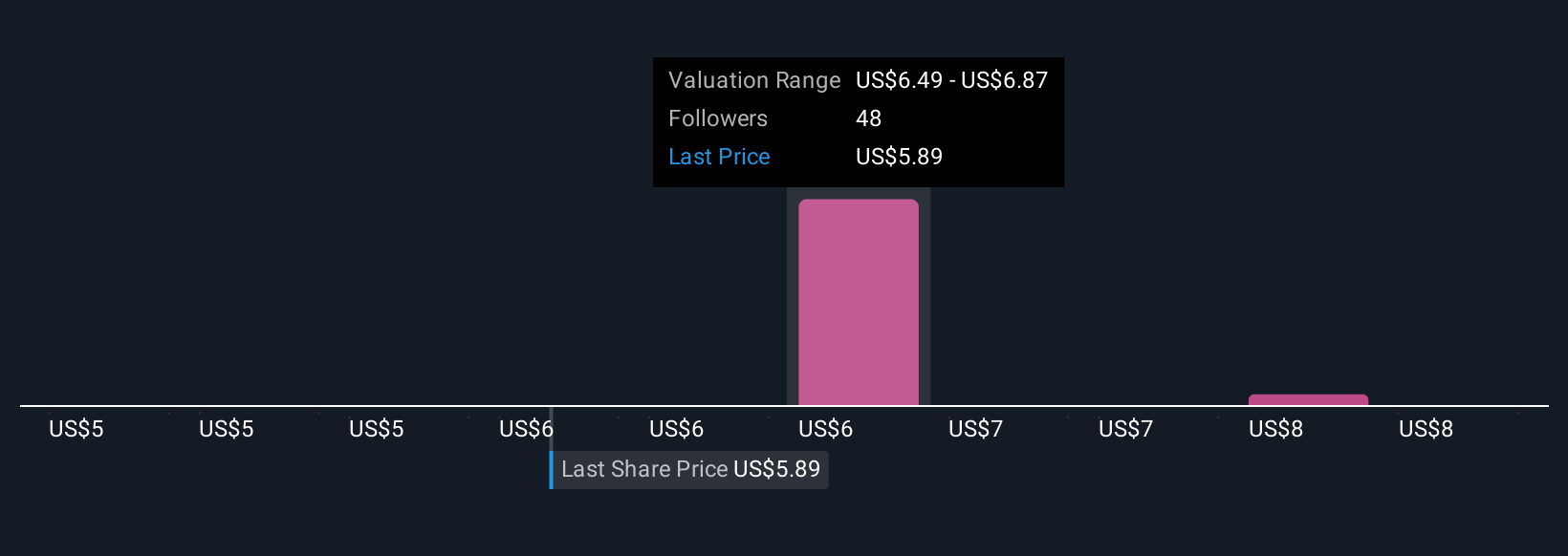

Uncover how indie Semiconductor's forecasts yield a $6.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Six individual fair value estimates from the Simply Wall St Community span a wide range between US$4.55 and US$8.42. This diversity in opinion highlights how ongoing operating losses and cash burn could weigh on broader confidence in indie’s future, so review several viewpoints before reaching your own conclusion.

Explore 6 other fair value estimates on indie Semiconductor - why the stock might be worth as much as 43% more than the current price!

Build Your Own indie Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your indie Semiconductor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free indie Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate indie Semiconductor's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if indie Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:INDI

indie Semiconductor

Provides automotive semiconductors and software solutions for advanced driver assistance systems, driver automation, in-cabin, connected car, and electrification applications.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives