- United States

- /

- Semiconductors

- /

- NasdaqCM:INDI

indie Semiconductor, Inc. (NASDAQ:INDI) Might Not Be As Mispriced As It Looks After Plunging 28%

Unfortunately for some shareholders, the indie Semiconductor, Inc. (NASDAQ:INDI) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

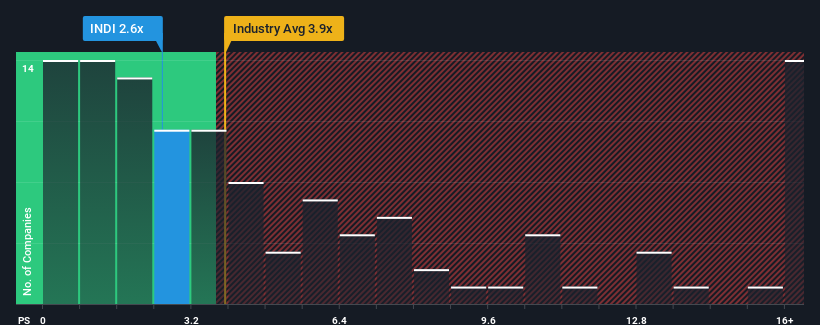

Following the heavy fall in price, indie Semiconductor may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.6x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios greater than 3.6x and even P/S higher than 9x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for indie Semiconductor

How Has indie Semiconductor Performed Recently?

While the industry has experienced revenue growth lately, indie Semiconductor's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on indie Semiconductor.What Are Revenue Growth Metrics Telling Us About The Low P/S?

indie Semiconductor's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 2.9% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 40% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 23% each year, which is noticeably less attractive.

With this information, we find it odd that indie Semiconductor is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

indie Semiconductor's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems indie Semiconductor currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for indie Semiconductor that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if indie Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:INDI

indie Semiconductor

Provides automotive semiconductors and software solutions for advanced driver assistance systems, driver automation, in-cabin, connected car, and electrification applications.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success