- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

Should US-China Trade Tensions and Tariff Threats Change the Outlook for Himax Technologies (HIMX) Investors?

Reviewed by Sasha Jovanovic

- In the past week, Himax Technologies was affected by renewed US-China trade tensions following President Trump's threat of new tariffs on Chinese goods after China's move to restrict rare earth exports, which rattled the global semiconductor sector.

- This development spotlights the vulnerability of semiconductor supply chains to geopolitical risks, prompting investors to weigh different valuation models for Himax Technologies amid wider sector uncertainty.

- We'll examine how fresh tariff threats and elevated trade concerns could influence Himax Technologies' growth outlook and risk profile.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Himax Technologies Investment Narrative Recap

To be a shareholder in Himax Technologies today, you need to believe in the long-term upside from the company's leadership in automotive display ICs and its expansion into AI-enabled sensing solutions, despite ongoing macro and trade-related headwinds. The recent escalation of US-China trade tensions may further cloud near-term demand and supply visibility, intensifying the biggest risk facing Himax: sector-wide revenue volatility stemming from geopolitical shocks and customer caution. However, unless tariffs directly target Himax's core products, the immediate catalyst, commercial wins in automotive and AI, remains intact.

The recent announcement of Himax’s WiseEye™ AI sensing solution powering Acer's Swift Edge 14 AI notebooks is especially relevant, emphasizing the company's focus on new applications in ultralow power vision processors. This aligns with one of Himax’s most promising catalysts: growing adoption of its WiseEye technology across notebooks and consumer devices, which could help offset weakness in more cyclical end-markets such as automotive and displays. But while WiseEye expands addressable market opportunities, investors should keep a close watch on...

Read the full narrative on Himax Technologies (it's free!)

Himax Technologies' outlook projects $1.1 billion in revenue and $139.3 million in earnings by 2028. This requires 7.4% annual revenue growth and a $65.1 million increase in earnings from the current $74.2 million.

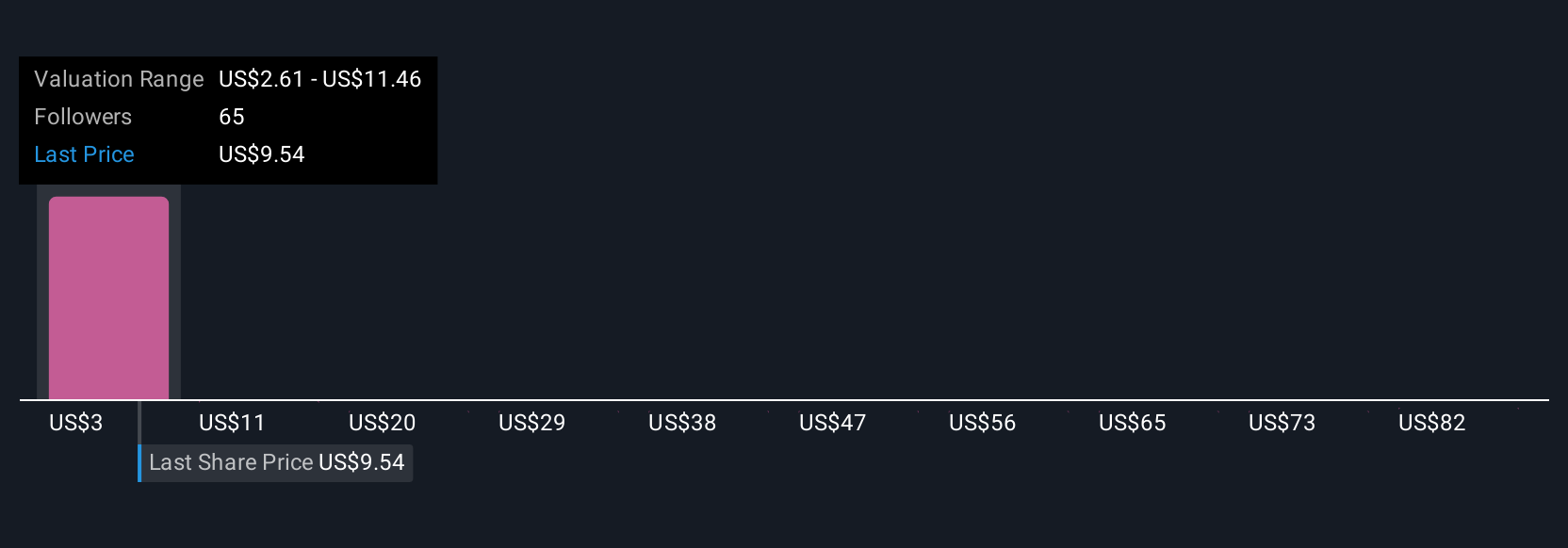

Uncover how Himax Technologies' forecasts yield a $9.31 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Eight separate fair value estimates from the Simply Wall St Community span from US$1.52 to US$91.18, highlighting extraordinary gaps in market opinion. With trade frictions threatening revenue stability, you can find sharply different viewpoints on what drives Himax’s future performance, explore these perspectives for a more complete picture.

Explore 8 other fair value estimates on Himax Technologies - why the stock might be worth over 10x more than the current price!

Build Your Own Himax Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Himax Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Himax Technologies' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives