- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

Himax Technologies (NasdaqGS:HIMX) Showcases AIoT And Smart Wearable Innovations At Embedded World 2025

Reviewed by Simply Wall St

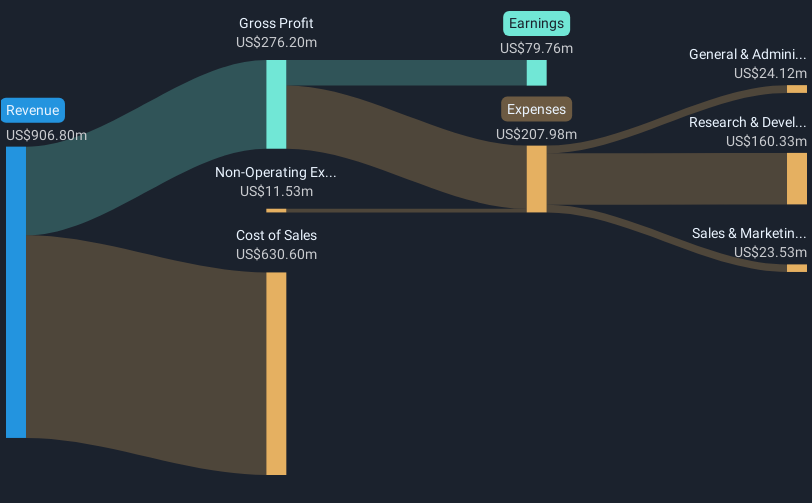

Himax Technologies (NasdaqGS:HIMX) recently announced its participation in Embedded World 2025, where it plans to showcase its innovative AI technologies, such as WiseEye™ AI solutions, and advanced optical applications. This event came on the heels of the company's Q4 2024 earnings report, which showed an increase in sales to $237.22 million and net income growth, despite a projected Q1 revenue decline. These developments coincided with the company's 70.96% share price increase over the last quarter. Notably, Himax has been active in launching innovative products such as the WiseEye2 processor and collaborating with partners to enhance its technologies, selling amidst a backdrop of a 2.5% market decline in recent days and broader economic challenges, including newly imposed U.S. tariffs. The recent introduction of tax measures has put pressure on the broader market, causing significant declines for major tech companies, while Himax's stock defied the trend with its robust quarter and engaging product announcements.

Click here to discover the nuances of Himax Technologies with our detailed analytical report.

Over the past five years, Himax Technologies has provided shareholders with a significant total return of 234.21%. During this period, the company's profitability improved steadily, with earnings growing annually by 2.2%, now achieving high-quality earnings per the latest reports. One key factor has been its ability to unveil innovative technologies and strategic alliances, such as the partnership with Ganzin Technology for advanced AR solutions unveiled in December 2024. This commitment to innovation alongside effective collaborations has likely contributed to sustained investor confidence.

Recently, Himax has outpaced the US Semiconductor industry and the broader market with its share price performance over the past year. Despite broader economic pressures, the company traded at a good value, with its Price-To-Earnings Ratio (20.4x) sitting below industry averages. Additionally, the announcement of a share buyback program up to US$20 million in December 2024 may have further bolstered market sentiment, underscoring the company’s robust capital management approach.

- Learn how Himax Technologies' intrinsic value compares to its market price with our detailed valuation report.

- Gain insight into the risks facing Himax Technologies and how they might influence its performance—click here to read more.

- Is Himax Technologies part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives