- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

A Look at Himax Technologies (NasdaqGS:HIMX) Valuation Following Breakthrough Automotive Display Announcements

Reviewed by Simply Wall St

Himax Technologies (NasdaqGS:HIMX) has just put its marker down in the automotive tech race, unveiling new breakthroughs for in-car displays that go beyond the basics. The company’s latest announcements center around its ground-breaking integrated timing controller with local dewarping for head-up display (HUD) applications, plus a host of other chip innovations showcased at industry events. For investors sizing up what comes next, these launches address real-world needs, from sharper, safer vehicle displays to systems that adapt to futuristic smart cabins.

These fresh product rollouts come at a time when Himax Technologies is already seeing momentum shift. Over the past year, shares have jumped 61%, outpacing many semiconductor peers, although the ride hasn’t been completely smooth. There has been a pullback in the past three months. Still, investors have seen long-term rewards, and the company has demonstrated consistent growth, with annual revenue and net income ticking higher. Recent industry showcases and major customer evaluations only add to the narrative that Himax is staying visible and competitive as a global automotive display leader.

But after such a sharp run and headline-grabbing news, is the bulk of growth now priced in, or is there still an opening for value-driven buyers to get ahead of the curve?

Most Popular Narrative: 9.5% Undervalued

The prevailing narrative suggests that Himax Technologies could be trading at a notable discount to its fair value based on growth opportunities and industry positioning.

"Himax's leading position and rapid expansion in automotive display ICs, including TDDI, traditional DDIC, Tcon, and a growing pipeline of OLED projects, position it at the heart of automotive digital cockpit upgrades and EV/autonomous vehicle adoption. These trends are expected to drive higher ASPs and gross margins in the coming years and accelerate revenue growth from 2027 onwards as mass production ramps up."

Curious how a mix of accelerating revenue, margin expansion, and tech leadership across hot automotive and AR markets could anchor a higher valuation? This narrative makes some bold assumptions about the company's ability to deliver. The real intrigue is how aggressive growth projections and future multiples stack up against today's price. Find out the numbers that drive this consensus fair value.

Result: Fair Value of $9.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macro uncertainty or escalating trade tensions could quickly challenge Himax’s growth trajectory and valuation outlook in the near term.

Find out about the key risks to this Himax Technologies narrative.Another View: Discounted Cash Flow Model Tells a Different Story

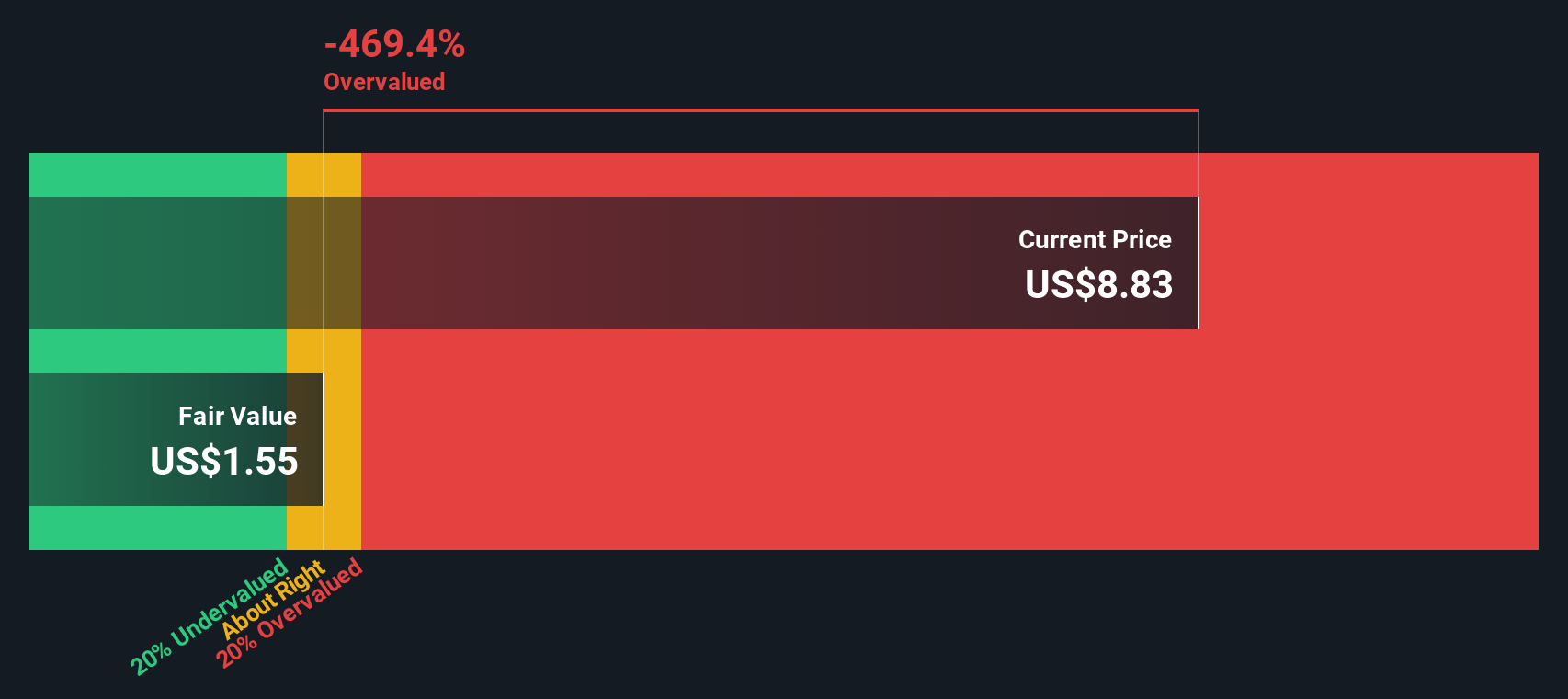

Taking a step back from analyst price targets, the SWS DCF model actually suggests a far less optimistic assessment. This casts doubt on the current share price. Could the market be overestimating Himax’s underlying value?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Himax Technologies Narrative

If you see it differently or want to dig into the numbers yourself, it’s fast and simple to craft your own narrative and draw your own conclusions. Do it your way.

A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

Smart investors know real opportunities don't just appear; they’re found with the right tools. Put Simply Wall Street’s screeners to work and spot tomorrow’s leaders before the crowd catches on.

- Capture growth potential in emerging tech by scanning the latest opportunities in quantum computing using quantum computing stocks.

- Maximize your income by seeing which companies are currently offering yields over 3% with dividend stocks with yields > 3% to power up your portfolio’s cash flow.

- Uncover hidden gems undervalued on cash flow fundamentals and make value-driven moves confidently using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)