- United States

- /

- Semiconductors

- /

- NasdaqGS:GFS

GlobalFoundries (GFS): Assessing Valuation Following Corning Partnership in AI Datacenter Connectivity

Reviewed by Kshitija Bhandaru

GlobalFoundries (GFS) recently announced a partnership with Corning to develop advanced fiber connector solutions for its silicon photonics platform. This initiative aims to address the rising bandwidth and efficiency needs of AI data centers. The collaboration was showcased at multiple industry events, highlighting investor interest in datacenter connectivity innovation.

See our latest analysis for GlobalFoundries.

Even with GlobalFoundries’ high-profile Corning partnership in the spotlight and recent appearances at key industry events, the stock’s momentum has faded this year. The share price return stands at -22.4% year-to-date, with a 1-year total shareholder return of -20.3%. Investors seem to be weighing the growth opportunities in datacenter connectivity against broader sector headwinds and shifting risk perceptions in chip manufacturing.

If you’re interested in more companies making strides in technology and AI infrastructure, consider checking out See the full list for free..

With GlobalFoundries trading nearly 20% below analyst price targets and growth in key segments, is this a compelling value play for patient investors, or has the market already factored in future improvement?

Most Popular Narrative: 16% Undervalued

Compared to GlobalFoundries' recent close of $32.96, the narrative's fair value estimate sits noticeably higher. This signals the potential for upside and contrasts with this year's subdued share performance. This creates an opportunity to explore what analysts believe could unlock significant value for patient investors.

GlobalFoundries' diversified manufacturing footprint in the U.S., Europe, and China aligns with customer needs for regionalized, resilient supply chains amid geopolitical uncertainty and tariff risks. This positions the company to capture increased volumes and benefit from government incentives, supporting long-term growth in revenue and free cash flow.

Want to know the reason behind this bullish valuation? The answer lies in bold upward shifts expected for both margins and profits, with a future income multiple that reflects ambitions typically seen among chip giants. Looking for the key numbers and assumptions that support this optimism? Unlock the rest and see what’s really driving this price target.

Result: Fair Value of $39.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, GlobalFoundries' limited exposure to advanced technologies and ongoing pricing pressures could limit the long-term growth outlook for the stock.

Find out about the key risks to this GlobalFoundries narrative.

Another View: What Does SWS’s DCF Model Reveal?

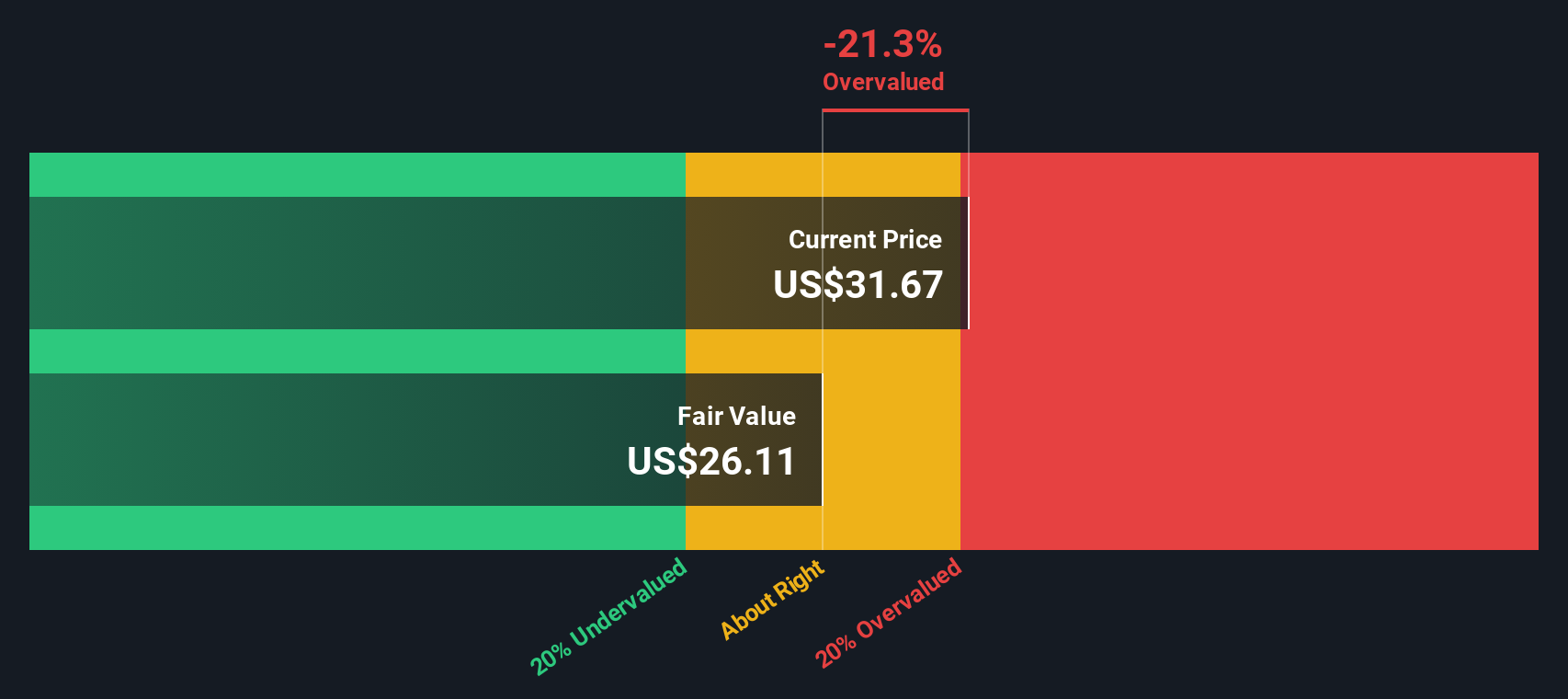

While analyst consensus sees GlobalFoundries as undervalued, our discounted cash flow (DCF) model offers a different perspective. According to the SWS DCF model, the stock is trading above its intrinsic value. This approach suggests investors may be overestimating future cash flows. Which outlook do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GlobalFoundries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GlobalFoundries Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, it's quick and easy to put together your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding GlobalFoundries.

Looking for more investment ideas?

Don’t let opportunities pass you by. Expand your portfolio with stocks spotted by our powerful screeners and catch the trends everyone will soon be talking about.

- Pinpoint fast-growing trends by checking out these 25 AI penny stocks making waves in the artificial intelligence space.

- Tap into consistent income streams by browsing these 19 dividend stocks with yields > 3% that offer robust yields above 3%.

- Capitalize on tomorrow’s breakthroughs with these 26 quantum computing stocks at the forefront of quantum computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GFS

GlobalFoundries

A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives