- United States

- /

- Semiconductors

- /

- NasdaqGS:GFS

Assessing GlobalFoundries (NasdaqGS:GFS) Valuation as Strategic Partnerships Boost Investor Interest

Reviewed by Kshitija Bhandaru

GlobalFoundries (NasdaqGS:GFS) has attracted renewed investor attention following its recent partnerships targeting AI-driven photonics and smart sensing technologies. Momentum around the stock is growing as industry support for domestic chipmaking and next-generation applications gains traction.

See our latest analysis for GlobalFoundries.

Recent news of high-profile partnerships and mounting industry support has brought GlobalFoundries into sharper focus, but the share price tells a mixed story. Despite flashes of optimism spurred by announcements around AI-driven photonics and expanded manufacturing, the 1-year total shareholder return stands at -9.7%, reflecting persistent headwinds and a cautious market view. There is growing interest around the company’s role in next-generation tech; however, momentum in the stock remains tentative compared to the sector’s recent high-flyers.

If this surge in semiconductor collaborations has you watching the sector, now’s the perfect moment to discover See the full list for free.

With shares rebounding in recent weeks but longer-term returns still lagging, the key question is whether GlobalFoundries is trading at a discount to its future potential or if recent optimism is already reflected in the price.

Most Popular Narrative: 9.2% Undervalued

At $35.81, GlobalFoundries currently trades below the fair value of $39.43 implied by the widely followed narrative. This suggests attractive upside potential if key assumptions hold.

GlobalFoundries' diversified manufacturing footprint in the U.S., Europe, and China aligns with customer needs for regionalized, resilient supply chains amid geopolitical uncertainty and tariff risks. This positions the company to capture increased volumes and benefit from government incentives, supporting long-term growth in revenue and free cash flow.

Want to know why analysts see so much room for profit expansion? The answer lies in a future profit margin leap and robust revenue trajectories. Dive in to discover which bold projections are powering this valuation. Some expectations might surprise even seasoned investors.

Result: Fair Value of $39.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure in mobile chips and limited access to cutting-edge process nodes could dampen the company’s long-term profit and growth prospects.

Find out about the key risks to this GlobalFoundries narrative.

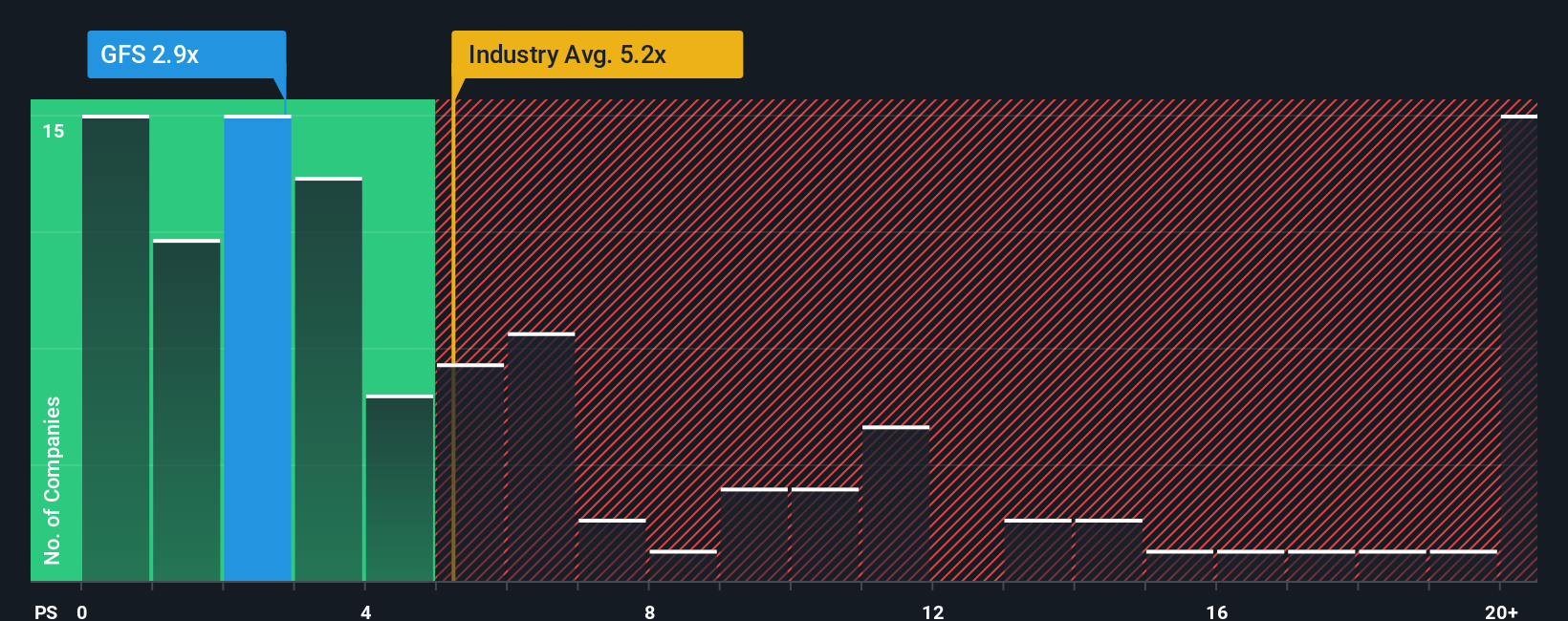

Another View: Multiples Suggest a Cautious Stance

Taking a step back from analyst forecasts, the company’s price-to-sales ratio sits at 2.9x. While this looks attractive compared to the broader industry average of 4.9x, it is slightly more expensive than the estimated fair ratio of 2.6x. This could mean that some optimism is already priced in, raising the question of whether there is still real value on the table for new investors.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GlobalFoundries Narrative

If you see the story differently or want to dig deeper into the numbers, you can easily shape your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding GlobalFoundries.

Looking for More Investment Ideas?

Opportunity doesn’t wait. If you want to stay ahead of the curve, check out high-potential stocks using the Simply Wall Street Screener before the crowd catches on.

- Capitalize on game-changing breakthroughs in artificial intelligence by starting your search with these 24 AI penny stocks.

- Catch underappreciated gems with strong cash flows by scanning these 896 undervalued stocks based on cash flows and gain an edge on value-driven opportunities.

- Begin building a portfolio of technology leaders who are driving the next wave of innovation in computing by browsing these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GFS

GlobalFoundries

A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives