- United States

- /

- Semiconductors

- /

- NasdaqGS:GFS

3 US Stocks That Might Be Undervalued According To Estimates

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance with the Dow Jones Industrial Average reaching record highs while the S&P 500 and Nasdaq Composite face slight declines, investors are closely monitoring inflation data and Federal Reserve rate cuts. In this environment, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies. Given these conditions, it is important to consider stocks that may be trading below their intrinsic value due to temporary market factors or broader economic trends. Here are three U.S. stocks that might be undervalued according to estimates.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Western Alliance Bancorporation (NYSE:WAL) | $85.58 | $167.74 | 49% |

| M-tron Industries (NYSEAM:MPTI) | $41.02 | $79.57 | 48.4% |

| KBR (NYSE:KBR) | $64.18 | $126.97 | 49.5% |

| TAL Education Group (NYSE:TAL) | $10.80 | $21.08 | 48.8% |

| Tenable Holdings (NasdaqGS:TENB) | $39.92 | $78.94 | 49.4% |

| Enphase Energy (NasdaqGM:ENPH) | $115.00 | $224.88 | 48.9% |

| EVERTEC (NYSE:EVTC) | $33.90 | $66.21 | 48.8% |

| Cytek Biosciences (NasdaqGS:CTKB) | $5.39 | $10.61 | 49.2% |

| Vasta Platform (NasdaqGS:VSTA) | $2.60 | $5.10 | 49.1% |

| SunOpta (NasdaqGS:STKL) | $6.52 | $12.65 | 48.4% |

Here's a peek at a few of the choices from the screener.

DoorDash (NasdaqGS:DASH)

Overview: DoorDash, Inc. operates a commerce platform connecting merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of approximately $58.53 billion.

Operations: Revenue segments include Internet Information Providers, generating $9.61 billion.

Estimated Discount To Fair Value: 36.9%

DoorDash, trading at US$142.23, is significantly undervalued based on its estimated fair value of US$225.55. Despite recent insider selling and a net loss reduction from US$331 million to US$180 million for the first half of 2024, DoorDash's revenue growth outpaces the market and is forecasted to grow annually by 13.3%. The company’s strategic partnerships with brands like Mattress Firm and Save A Lot enhance its logistics network and customer base, supporting future profitability within three years.

- Our earnings growth report unveils the potential for significant increases in DoorDash's future results.

- Unlock comprehensive insights into our analysis of DoorDash stock in this financial health report.

GlobalFoundries (NasdaqGS:GFS)

Overview: GlobalFoundries Inc., a semiconductor foundry with a market cap of $22.60 billion, provides a range of mainstream wafer fabrication services and technologies worldwide.

Operations: GlobalFoundries generates $6.89 billion from its semiconductor segment, offering a variety of mainstream wafer fabrication services and technologies globally.

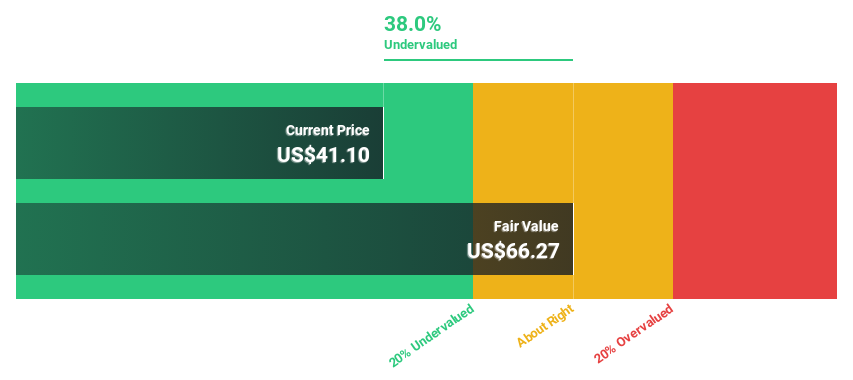

Estimated Discount To Fair Value: 38.2%

GlobalFoundries, trading at US$40.95, is significantly undervalued with an estimated fair value of US$66.31. Despite a decline in profit margins from 19.1% to 11.8%, earnings are forecasted to grow annually by 23%, outpacing the US market's growth rate of 15.2%. Recent strategic partnerships with Finwave Semiconductor and Efficient bolster its technological capabilities and market reach, potentially enhancing future cash flows and profitability despite current revenue challenges.

- Our growth report here indicates GlobalFoundries may be poised for an improving outlook.

- Take a closer look at GlobalFoundries' balance sheet health here in our report.

TAL Education Group (NYSE:TAL)

Overview: TAL Education Group offers K-12 after-school tutoring services in the People’s Republic of China and has a market cap of $6.54 billion.

Operations: The company generates $1.63 billion from its K-12 after-school tutoring services in the People’s Republic of China.

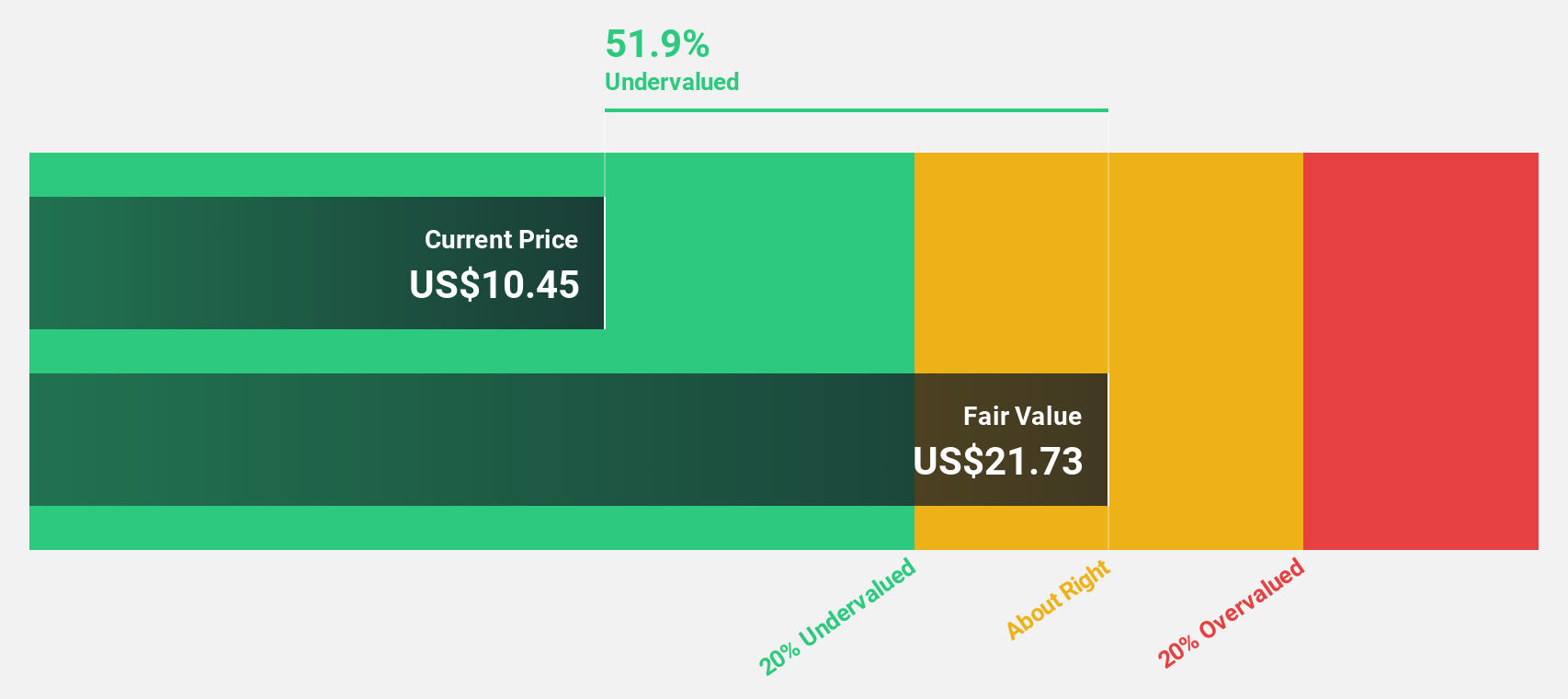

Estimated Discount To Fair Value: 48.8%

TAL Education Group, currently trading at US$10.8, is significantly undervalued with an estimated fair value of US$21.08. The company reported a net income of US$11.4 million for Q1 2024, marking a turnaround from a net loss the previous year. Earnings are expected to grow annually by 32.9%, outpacing the US market's growth rate of 15.2%. However, its share price has been highly volatile recently and large one-off items have impacted financial results.

- Our expertly prepared growth report on TAL Education Group implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of TAL Education Group with our detailed financial health report.

Seize The Opportunity

- Dive into all 194 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GFS

GlobalFoundries

A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

Excellent balance sheet and good value.