- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

First Solar (NasdaqGS:FSLR) Sees 16% Price Move Despite Growth In Annual Earnings

Reviewed by Simply Wall St

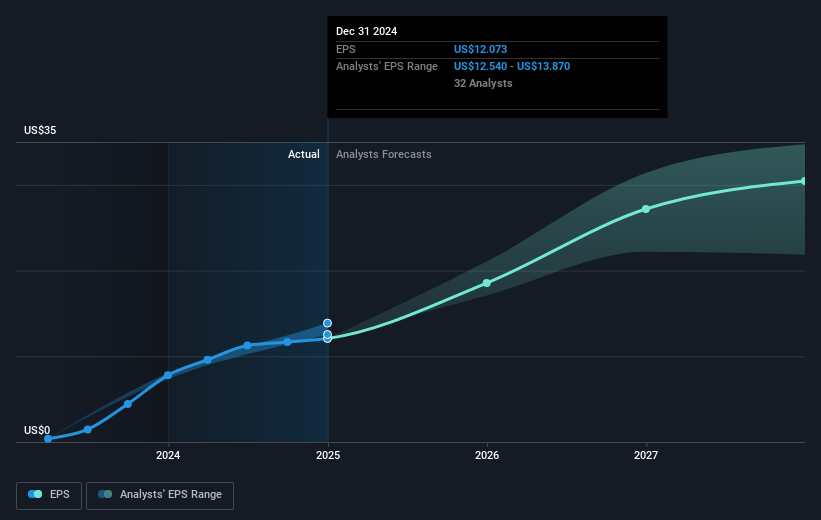

First Solar (NasdaqGS:FSLR) recently announced significant growth in its annual and quarterly earnings, with a positive outlook for 2025 and expectations of increased net sales and operating income. However, despite this robust performance, the company's stock experienced a 16.54% downturn over the past week. This decline coincided with broader market sell-offs prompted by tariff uncertainties, which led to a notable 1.9% drop in the market as a whole. As tech stocks led the sell-off and concerns about inflation and economic growth mounted, even solid earnings and optimistic guidance did not shield First Solar from the prevailing market pressures. The tech-heavy Nasdaq Composite itself fell as investors reacted to tariff announcements and anticipation of the February jobs report affected sentiment further. This confluence of factors illustrates the broader market's heavy influence over individual stock movements, including those with strong financial outlooks like First Solar.

See the full analysis report here for a deeper understanding of First Solar.

Over the past five years, First Solar has achieved a total return of 251.60%. The company's trajectory has been closely tied to its impressive growth in profitability. With earnings growth averaging 42.5% annually, the company transitioned to profitability during this period. In the past year alone, earnings surged by 55.5%, outpacing its five-year average. This substantial earnings growth has been instrumental in driving shareholder returns.

During this time, First Solar's attractiveness among investors was bolstered by its relative valuation. The company trades at a significant discount to its estimated fair value and exhibits a Price-To-Earnings Ratio of 10.8x, considerably lower than the peer average of 47.7x. Furthermore, recent challenges in executive leadership did not inhibit the company's forward momentum, underscored by the opening of a new R&D innovation center in Ohio in July 2024, positioning it for continued growth and innovation.

- Learn how First Solar's intrinsic value compares to its market price with our detailed valuation report.

- Discover the key vulnerabilities in First Solar's business with our detailed risk assessment.

- Invested in First Solar? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade First Solar, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Very undervalued with flawless balance sheet.