- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

First Solar (FSLR): Evaluating Valuation as U.S. Clean Energy Incentives and Analyst Optimism Drive Growth Prospects

Reviewed by Kshitija Bhandaru

First Solar (FSLR) remains in the investor spotlight as fresh U.S. clean energy incentives and key solar tax credits are kept intact. This reinforces the company’s outlook amid a robust bookings backlog and expanding domestic operations.

See our latest analysis for First Solar.

First Solar’s shares have been on a tear lately, recently hitting a fresh 52-week high and climbing over 39% in the last 90 days as clean energy incentives strengthen its outlook and analyst sentiment becomes more bullish. Even with some short-term pullbacks, its one-year total shareholder return of nearly 7% and 168% over five years show that momentum is firmly with the company as investors bet on ongoing industry tailwinds and First Solar’s growing U.S. presence.

If the renewed momentum in solar has you looking for new opportunities, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But after such a rapid rally, is Wall Street now getting ahead of itself? Do recent valuation metrics point to a real buying opportunity for investors looking at First Solar's future growth prospects?

Most Popular Narrative: Fairly Valued

First Solar’s most watched narrative places fair value just a touch below the current market price, signaling that shares are now trading roughly in line with future expectations. The narrative’s assumptions paint a picture of a business directly shaped by major policy reforms and technological advances.

Recent U.S. policy changes, specifically, strengthened incentives and tighter restrictions against foreign entities of concern (such as China) under the new reconciliation legislation, are boosting First Solar's competitive moat, supporting robust demand for domestically produced modules, and enabling the company to capture higher long-term contracted pricing. This directly improves forward revenue visibility and gross margins.

Want to see what revenue leaps, margin boosts, and bold assumptions are fueling First Solar’s latest valuation narrative? You’ll be surprised which quantitative factors analysts think could make or break this fair value calculation. Don’t miss the full details behind this compelling market story.

Result: Fair Value of $224.13 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting global trade policy or a slowdown in large-scale solar demand could quickly challenge these optimistic growth and valuation assumptions.

Find out about the key risks to this First Solar narrative.

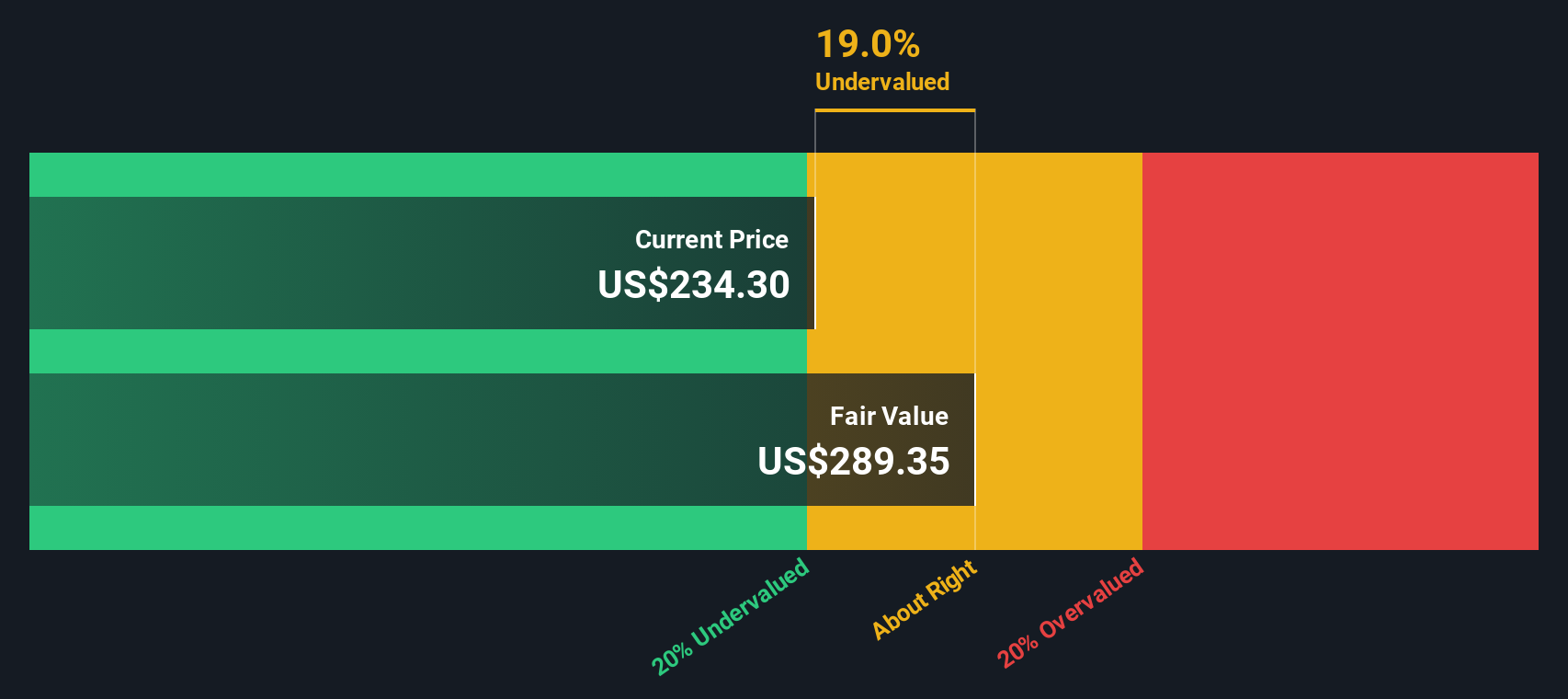

Another View: Discounted Cash Flow Challenges the Fair Value

While many observers consider First Solar fairly valued using analyst targets and current price ratios, our SWS DCF model paints a different picture. This method, which estimates future cash flows and discounts them to today's value, suggests the shares are still undervalued and trading below what long-term fundamentals might imply. Can the numbers behind this model reveal hidden upside that analysts have missed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Solar Narrative

If you see things differently or want to dig into the numbers your own way, you can shape your own First Solar narrative in just a few minutes with Do it your way.

A great starting point for your First Solar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let the next wave of winning stocks pass you by. Put yourself ahead of other investors by searching for opportunities where the data gives you an edge.

- Uncover companies shaking up financial markets with breakthrough blockchain and digital assets by checking out these 79 cryptocurrency and blockchain stocks.

- Spot high-yield opportunities with reliable payouts and stable growth through these 19 dividend stocks with yields > 3% offering dividend yields above 3%.

- Tap into tomorrow’s tech leaders by finding innovative firms at the forefront of artificial intelligence using these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives