- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

FormFactor (FORM): Valuation Check Following Earnings Miss and Sector Uncertainty

Reviewed by Simply Wall St

If you have been watching FormFactor (FORM), this week’s stock move likely stands out. After delivering Q2 revenues that topped expectations, the company’s shares actually slid 17% as profit margins missed the mark. Management’s comments on underperforming margins, paired with Wells Fargo’s reinforcing a cautious stance, seem to have sharpened investor focus on the company’s ability to convert market leadership into stronger bottom-line results.

This sharp drop marks a continuation of a downward trend for FormFactor over the past year, with momentum cooling despite some operational growth and a 7.8% revenue increase. More broadly, the sector is facing incoming headwinds as new US government rules restricting chip equipment exports to China fuel uncertainty and pressure stocks across the semiconductor landscape. Short-term volatility contrasts with longer-term returns. FormFactor remains up nearly 27% over five years but has struggled recently, down 29% over the past twelve months and 34% year-to-date.

With the stock’s recent slide and sector clouds, investors are considering whether this presents a potential bargain or if the market is simply adjusting for further risks ahead.

Most Popular Narrative: 11.4% Undervalued

The prevailing narrative sees FormFactor as trading below its calculated fair value, pointing to untapped upside driven by structural growth themes and strategic moves in next-generation semiconductor markets.

Accelerating adoption of generative AI, high-performance computing, and HBM DRAM in data centers is driving substantial increases in test complexity and intensity. FormFactor's differentiated probe cards and early leadership in HBM4 chiplet testing position the company to benefit from higher ASPs and revenue growth as these markets scale. (Impacts: Revenue, potential margin improvement)

What is the secret behind FormFactor’s bold undervaluation narrative? The foundation of this story weaves together rising earnings, expanding margins, and aggressive growth assumptions. Which specific numbers push that analyst price target higher and challenge market skepticism? Find out which future financial leaps power this valuation call.

Result: Fair Value of $33.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure or continued customer concentration could quickly change the outlook and challenge the case for significant upside in FormFactor shares.

Find out about the key risks to this FormFactor narrative.Another View: Higher Price Tag on Standard Metrics

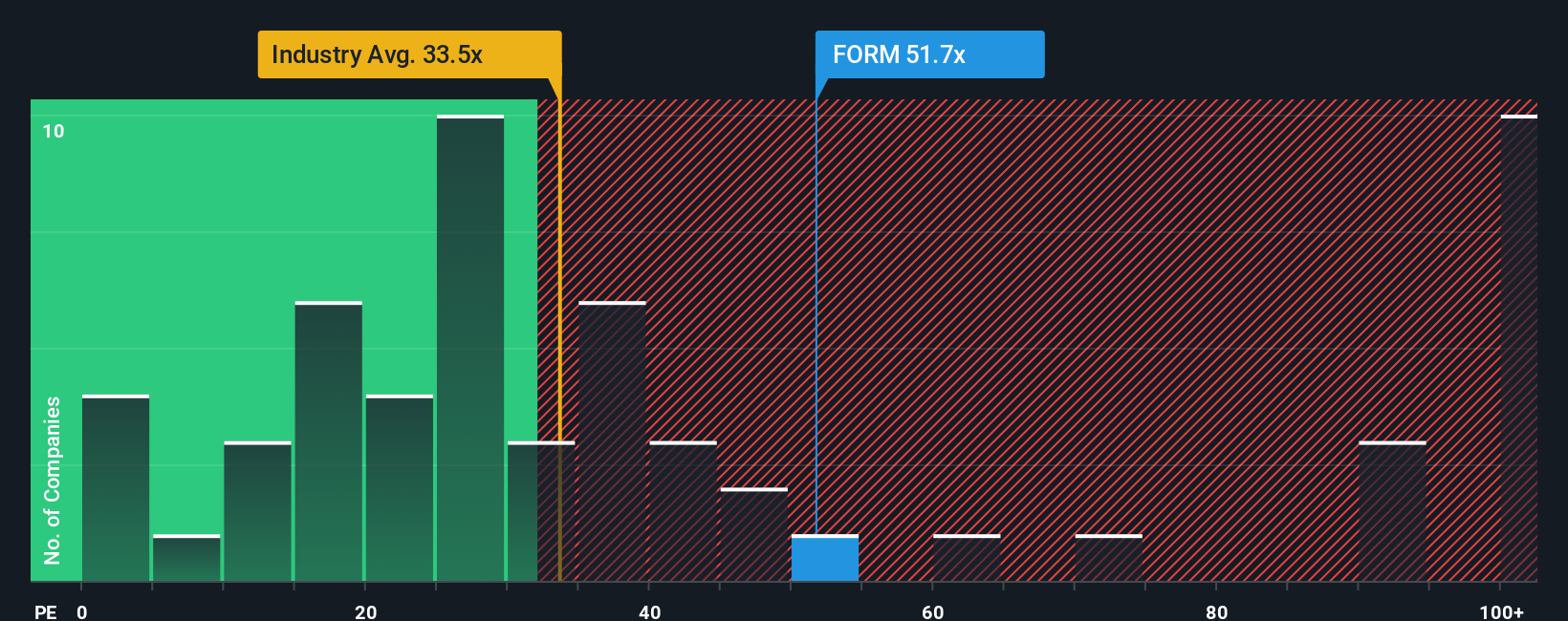

While the fair value narrative points to untapped opportunity, traditional valuation methods paint a less optimistic picture. Based on current earnings multiples compared to the sector, FormFactor actually screens as expensive. Could recent optimism be overdone?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FormFactor Narrative

If you see FormFactor’s story differently or want to test your own investment thesis, the tools are here to build and share your own view in under three minutes. Do it your way

A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to just one story. Uncover some of the most promising opportunities the market has to offer with these trailblazing stock screens. Skip the crowd and be ahead of tomorrow’s winners:

- Uncover overlooked gems delivering robust balance sheets and real staying power with penny stocks with strong financials.

- Boost your strategy with income potential from companies offering generous yields by starting with dividend stocks with yields > 3%.

- Stay at the forefront by targeting companies shaping the future of medicine and patient care through healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)