- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

Did Mixed Q2 Results and Margin Pressure Just Shift FormFactor's (FORM) Investment Narrative?

Reviewed by Simply Wall St

- FormFactor announced that its second-quarter revenue exceeded expectations, driven by growth in its probe-card business, though earnings per share fell short of analyst forecasts.

- The company's CEO acknowledged that recent gross margins have not matched FormFactor's market leadership, as sector-wide uncertainty around US-China trade restrictions continues to affect semiconductor firms.

- With profit margin concerns cited by analysts and the impact of global regulatory shifts, we'll examine how these developments influence FormFactor's investment outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

FormFactor Investment Narrative Recap

To invest in FormFactor today, you need to believe that the company’s highly specialized probe-card solutions are positioned to capitalize on complex chip testing trends in AI and high-performance computing, and that recent margin pressures are fleeting rather than a persistent challenge. Short-term, the main catalyst is continued strength and differentiation in probe cards for next-gen memory and AI chips; however, sustained margin weakness and regulatory headwinds from US-China trade restrictions remain the company’s biggest risks. Recent margin compression and near-term earnings volatility reflected in this quarter’s EPS miss are unlikely to immediately affect FormFactor’s long-term opportunity in advanced test markets, but could amplify swings in valuation and sentiment. Among recent announcements, FormFactor’s $150 million credit line with Wells Fargo stands out as most relevant against this backdrop. This additional financial flexibility could help manage cost and supply chain volatility amid industry uncertainty, directly addressing some immediate concerns around gross margin pressure and operational investments as the company ramps its new Texas facility. In contrast, investors should be aware that ongoing US-China trade restrictions could continue to quietly undermine...

Read the full narrative on FormFactor (it's free!)

FormFactor's narrative projects $984.3 million in revenue and $97.0 million in earnings by 2028. This requires 8.8% yearly revenue growth and a $53.1 million earnings increase from $43.9 million today.

Uncover how FormFactor's forecasts yield a $33.12 fair value, a 13% upside to its current price.

Exploring Other Perspectives

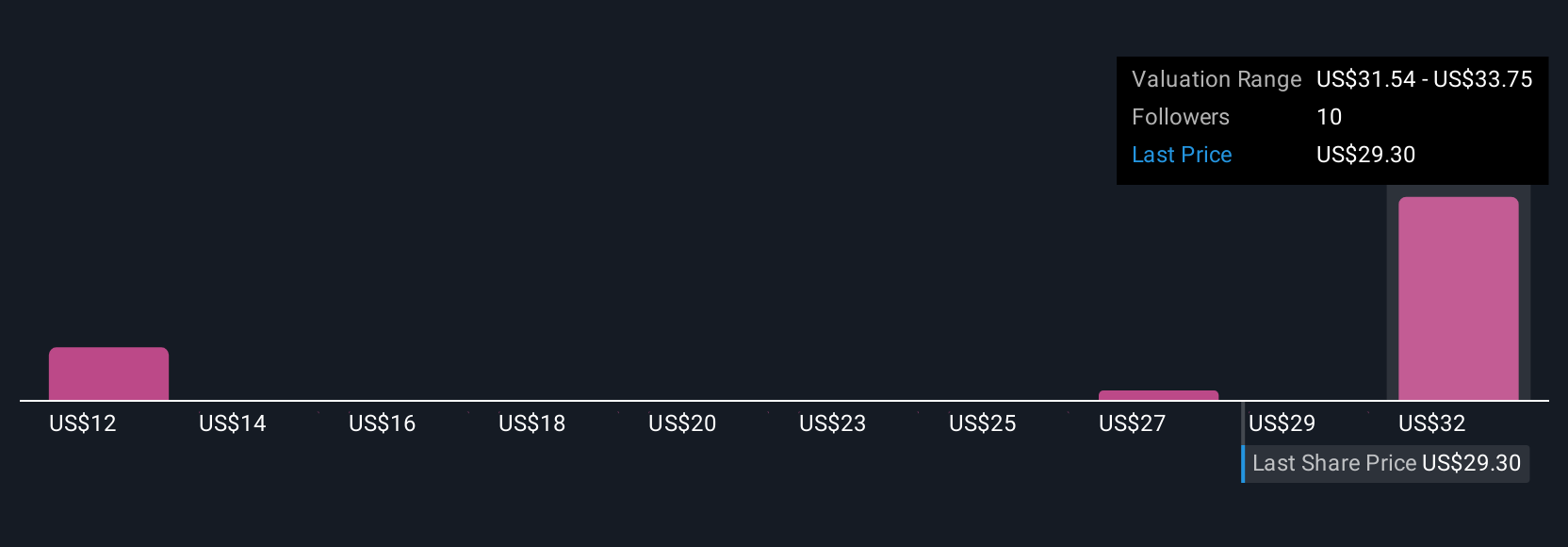

Four community members from Simply Wall St estimate FormFactor’s fair value between US$10.98 and US$44.63 per share. Persistent margin pressure amid regulatory volatility challenges confidence in realizing the upper range, so consider how varied peer views may affect your analysis.

Explore 4 other fair value estimates on FormFactor - why the stock might be worth as much as 52% more than the current price!

Build Your Own FormFactor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free FormFactor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FormFactor's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives