- United States

- /

- Semiconductors

- /

- NasdaqGS:ENTG

Entegris (ENTG): Assessing Current Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Entegris (ENTG) shares have been caught in a mixed pattern this year, with recent returns dipping slightly over the past month and year. Investors are watching for signs of momentum or a catalyst that could shift the stock’s direction.

See our latest analysis for Entegris.

Entegris’s share price has edged down 2.1% over the past month and remains 5.9% lower for the year to date, suggesting that recent momentum is cooling after a stretch of growth in prior years. While the one-year total shareholder return sits at -12.5%, long-term holders have still seen a gain of about 24.6% over five years. The bigger picture remains positive despite this near-term dip.

If you’re curious about what else is trending or bouncing back, this is an ideal moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Entegris trading about 10% below analysts’ average price target and its recent pullback, the question for investors now is whether the stock offers hidden value or if all expected growth is already reflected in the price.

Most Popular Narrative: 9.5% Undervalued

According to the most widely followed narrative, Entegris's latest fair value estimate suggests notable upside from its current share price. This fresh perspective puts the stock in a different light compared to where it ended the last session.

Significant ramping of new manufacturing facilities in Taiwan and Colorado, as well as ongoing regionalization of supply chains, positions Entegris to better serve global customers and mitigate trade policy risks. This is expected to shorten lead times, improve supply chain security, and drive future revenue growth as more production is localized.

Want to see what’s driving that premium? There is a bold roadmap for revenue and margin expansion beneath the surface. Find out how analysts connect these dots in their valuation forecast; you might be surprised by the necessary leap of faith.

Result: Fair Value of $101.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade policy uncertainty and persistent industry softness could quickly upend analysts' optimistic outlook for Entegris in the months ahead.

Find out about the key risks to this Entegris narrative.

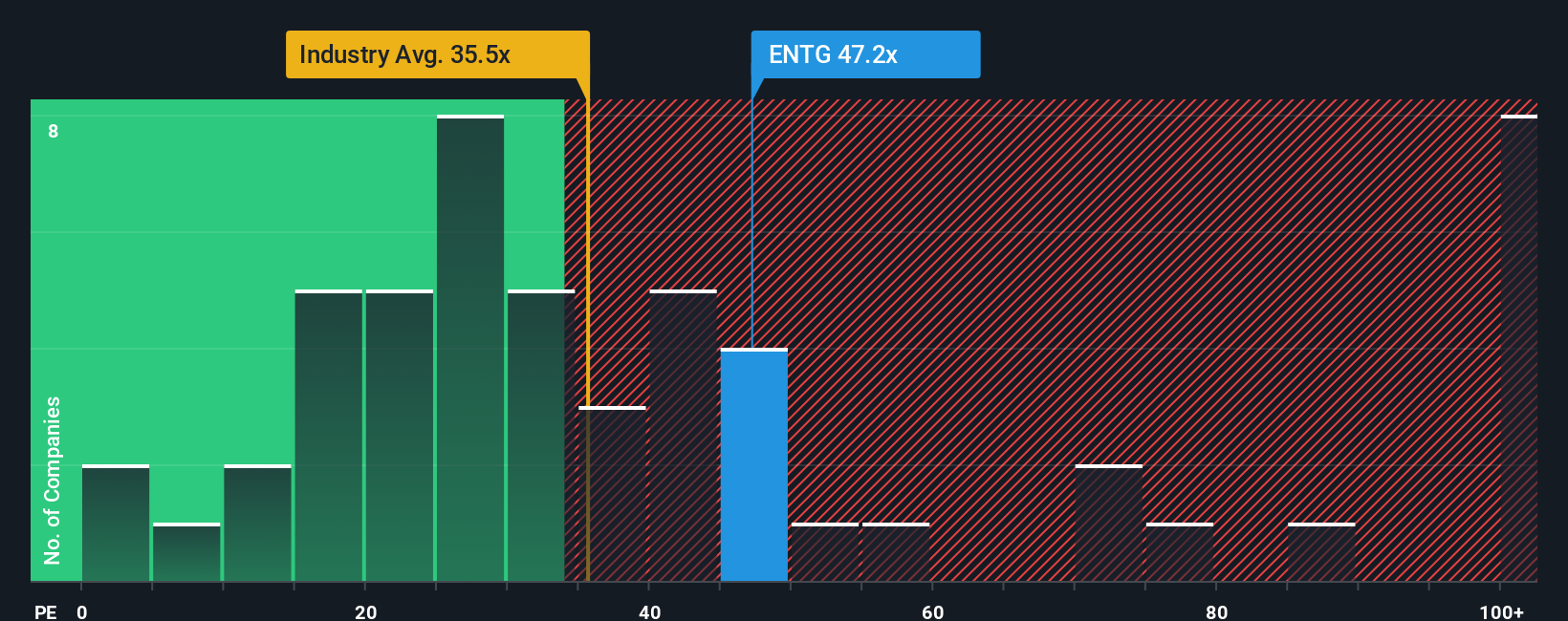

Another View: Market Ratios Point to Hefty Price Tag

Looking through the lens of price-to-earnings, Entegris appears expensive. Its P/E of 47x is noticeably higher than both its peer average of 38.8x and the US semiconductor industry average of 37.6x. Compared to a fair ratio of 32.4x, this pricing elevates the risk if the growth story falters. Could this premium signal investor overconfidence, or is it justified by future gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entegris Narrative

If you see things differently or want to dig into the details yourself, you can craft your own narrative using the data in just a few minutes. Do it your way

A great starting point for your Entegris research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your watchlist now and access new opportunities that set you apart from the crowd. Opportunities are moving quickly, so ensure you're ahead of the curve.

- Supercharge your income potential by checking out these 17 dividend stocks with yields > 3%, which offers impressive dividend yields and stability for long-term growth.

- Capitalize on breakthroughs in artificial intelligence and technology trends by researching these 27 AI penny stocks, which are at the frontlines of innovation.

- Catch undervalued opportunities before the market catches on by reviewing these 878 undervalued stocks based on cash flows, selected for their compelling cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Entegris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENTG

Entegris

Provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)