- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Enphase Energy (NasdaqGM:ENPH) Sees 6% Stock Dip Following Disappointing 2024 Earnings Report

Reviewed by Simply Wall St

Enphase Energy (NasdaqGM:ENPH) recently launched its expanded IQ Battery 5P™, enhancing its grid services and expanding into Southeast Asia with IQ8P Microinverters. Despite these advancements, Enphase shares dropped 5.82% last month. This decline could be linked to the company's disappointing 2024 earnings report, revealing sales and net income declines. Furthermore, although Enphase's share buyback program might typically bolster investor confidence, it wasn't enough to offset the weak financial performance. Simultaneously, broader market conditions contributed to the stock's downturn. The tech-heavy Nasdaq Composite, where Enphase trades, lost 4% in February, marking a tough month for tech stocks amid general market volatility and tariff concerns. Despite a positive market reaction to easing inflation towards the month's end, the Nasdaq's overall poor performance underscores broader headwinds impacting tech shares, which likely influenced Enphase's stock movement.

Click to explore a detailed breakdown of our findings on Enphase Energy.

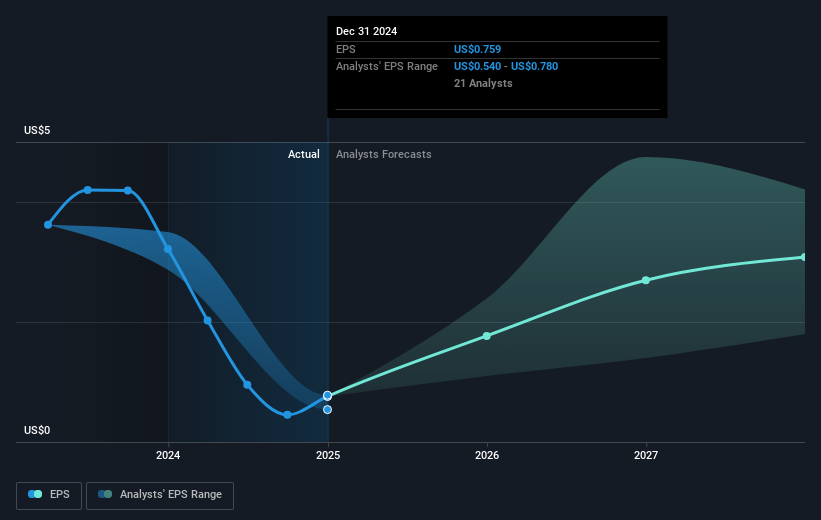

The past five years have seen Enphase Energy deliver a total shareholder return of 8.07%, which was a modest performance compared to broader market dynamics. During this period, the company has experienced fluctuations, notably underperforming the US market by posting significant negative earnings growth in the past year. Enphase's forecasted earnings growth over the next three years stands out, yet the company currently trades at a high price-to-earnings ratio of 74, well above the US Semiconductor industry average of 31. This discrepancy indicates investors' concerns regarding immediate profitability versus long-term potential.

Furthermore, Enphase has been actively expanding its product offerings and geographical reach. Key developments include launching the versatile IQ® Battery 5P™, compliant with California's energy standards, and penetrating the Southeast Asian market with IQ8P™ microinverters. Despite positive product advancements, the negative sentiment from a securities fraud lawsuit filed in December 2024 may have dampened investor enthusiasm, becoming a factor in its total return over the period. These elements collectively highlight the complexities faced by Enphase Energy in the investment landscape.

- Get the full picture of Enphase Energy's valuation metrics and investment prospects—click to explore.

- Uncover the uncertainties that could impact Enphase Energy's future growth—read our risk evaluation here.

- Already own Enphase Energy? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

High growth potential with excellent balance sheet.