- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Can the Recent 52% Drop in Enphase Signal a Rebound Opportunity for 2025 Investors?

Reviewed by Bailey Pemberton

If you have Enphase Energy on your watchlist, or if you're already invested and considering your next move, you're not alone in wondering whether now is a good time to buy, hold, or move on. The stock price has been on a wild ride lately. Over the past week alone, the shares slipped by almost 7%, and the losses extend further back: down about 8% over the past month and a staggering 52% so far this year. If you've held on for a year or more, the picture is even more sobering, as Enphase is off by over 66% in the last twelve months. Longer-term investors have experienced even steeper declines.

What is driving this? While industry momentum in renewables is strong, investors have been scrutinizing growth stocks like Enphase more closely in light of shifting market sentiment and concerns about future interest rates. Sentiment appears to be reassessing the risk profile for names in clean energy tech, and that is showing up in the stock's slide.

Despite these dramatic price drops, there are some points for value-oriented investors to consider. Running Enphase through six different valuation checks, the company appears undervalued in four out of six, earning it a solid value score of 4. Whether this represents a hidden opportunity or a classic value trap is the key question going forward.

In the next section, we will break down exactly which valuation approaches point to opportunity and which urge caution before closing with what might be the smartest way to size up Enphase Energy.

Why Enphase Energy is lagging behind its peers

Approach 1: Enphase Energy Discounted Cash Flow (DCF) Analysis

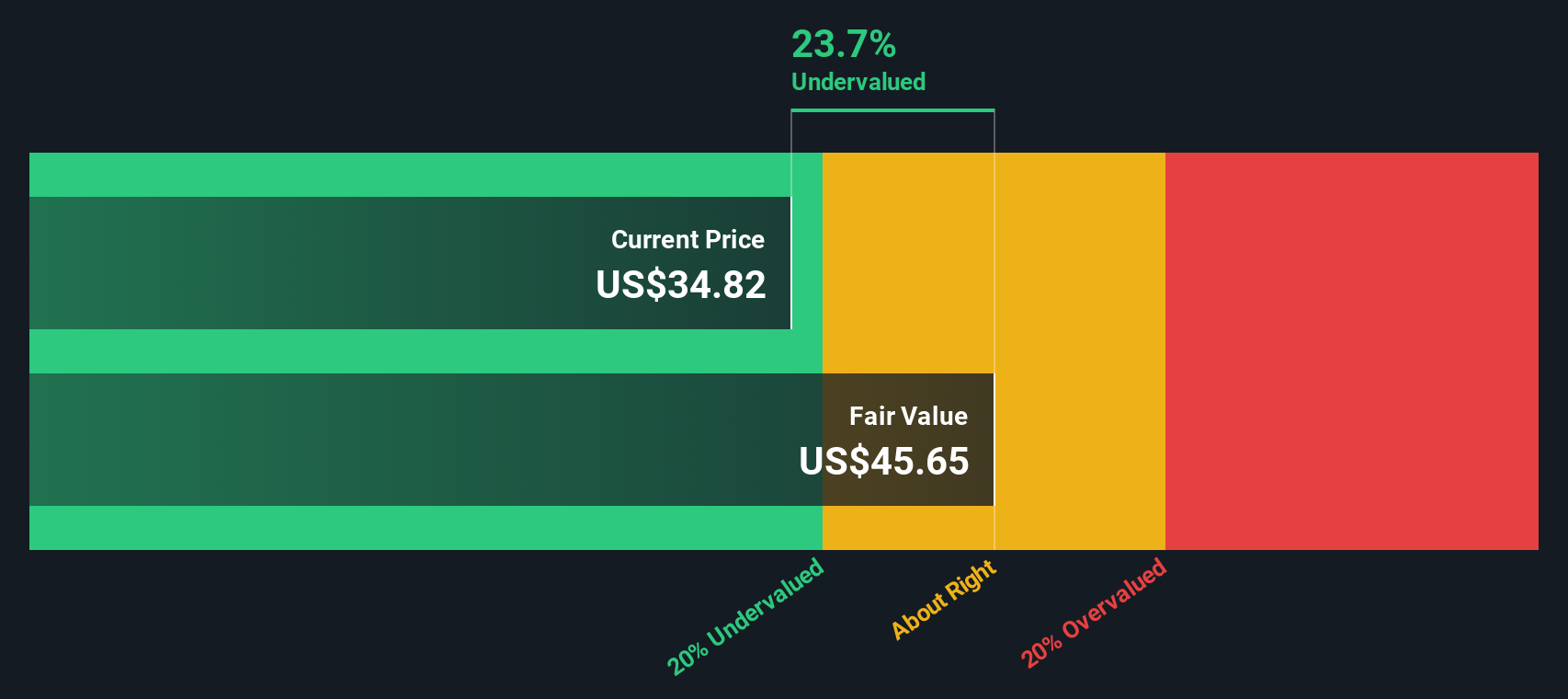

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach aims to determine what Enphase Energy is truly worth based on its ability to generate cash in the years ahead.

Currently, Enphase Energy produces Free Cash Flow (FCF) of $362.46 million. Analyst forecasts extend through 2029, with FCF expected to reach $491.45 million by that year. In the longer term, Simply Wall St extrapolates growth beyond analyst estimates and projects that by 2035, Enphase could generate around $708.26 million in annual FCF. This illustrates a steady growth trajectory for the company in the renewable energy sector, based on current expectations and model extrapolations.

Using the 2 Stage Free Cash Flow to Equity method, the DCF valuation calculates Enphase Energy's intrinsic value at $46.13 per share. This represents a 25.7% discount to the current share price and implies the stock is notably undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Enphase Energy is undervalued by 25.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Enphase Energy Price vs Earnings (PE Ratio)

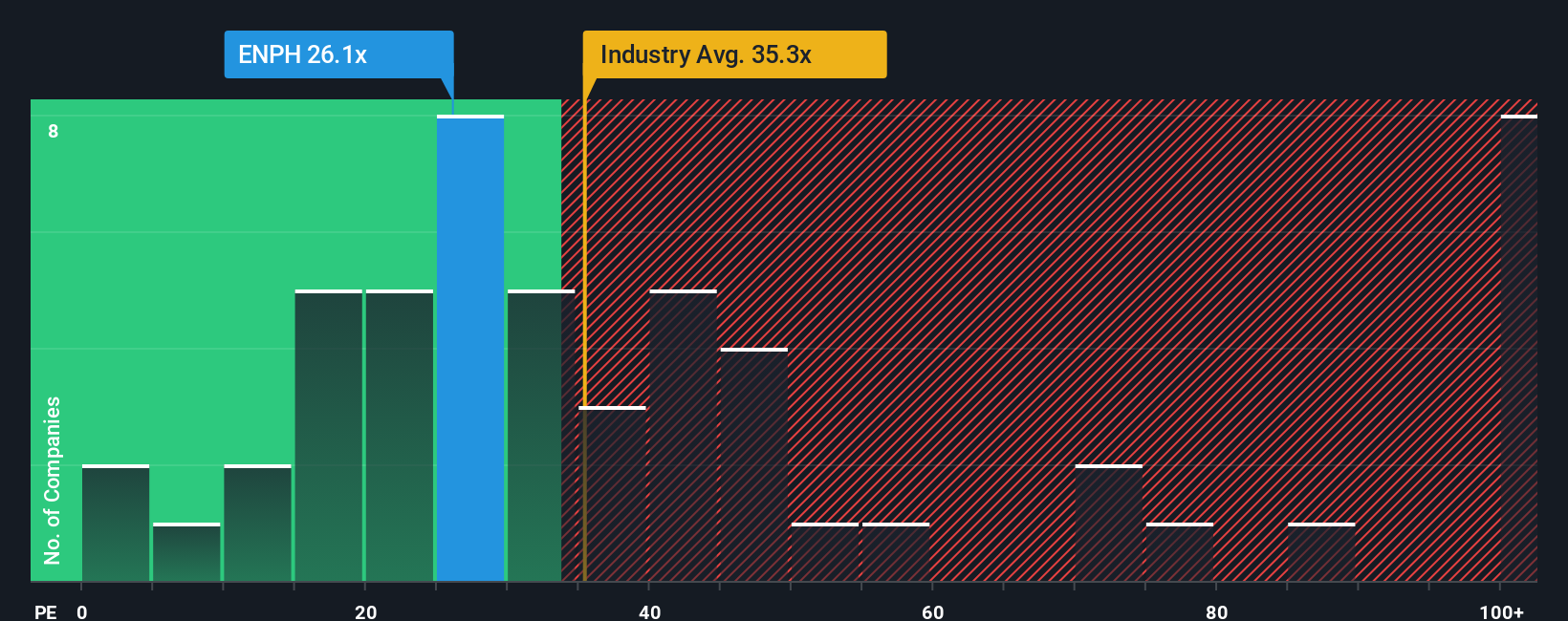

The price-to-earnings (PE) ratio is a go-to valuation metric for profitable companies like Enphase Energy, since it helps investors gauge how much they are paying for each dollar of profit. A PE ratio is most meaningful for businesses with consistent earnings, providing a quick snapshot of market sentiment and expectations for future growth.

Growth prospects and the perceived risk level play a big role in what counts as a “normal” or “fair” PE ratio for any business. High-growth or lower-risk companies often command a higher PE. In contrast, slower-growing or riskier businesses generally trade at a lower multiple.

Enphase Energy currently trades at a PE ratio of 25.6x. This is notably below both the semiconductor industry average of 35.3x and the peer group average of 39.3x. This suggests the market sees Enphase as riskier or with lower growth potential compared to its peers.

However, instead of relying solely on broad averages, Simply Wall St also calculates a Fair Ratio, which is a more dynamic and nuanced assessment. The Fair Ratio for Enphase is 25.0x, which reflects the company’s actual earnings growth, industry position, profit margins, market cap, and overall risk. Comparing to this Fair Ratio gives a more accurate sense of Enphase’s valuation because it accounts for factors unique to the company, rather than relying only on averages that may be skewed by outliers.

With the current PE of 25.6x versus a Fair Ratio of 25.0x, Enphase Energy appears to be valued about right according to this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Enphase Energy Narrative

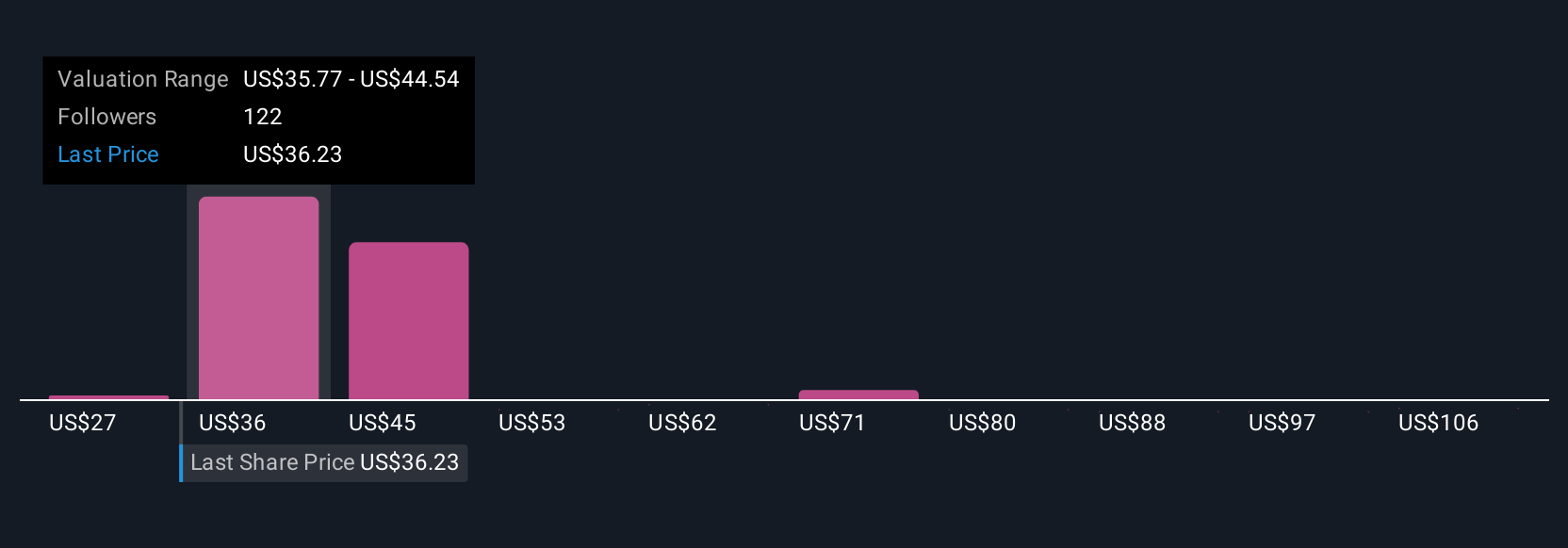

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter and more dynamic approach to making investment decisions. A Narrative is your personalized story and outlook about a company, where you connect the facts and figures (like fair value, revenue or margin forecasts) with your perspective on what drives the business. Narratives link a company’s story directly to a financial forecast and calculate a fair value based on your unique assumptions, helping you see how your beliefs translate into numbers.

This tool is available right now on Simply Wall St’s Community page and is used by millions of investors. It makes it easy to map out your view, compare with others, and see your story update in real-time as fresh news or earnings arrive. Narratives can help you decide when to buy, hold, or sell by continuously comparing your own calculated Fair Value with the current share price.

For example, some investors believe strong product innovation and expanding global demand will push Enphase’s fair value above $120 per share, while others see risks and limited growth, estimating it as low as $27. This highlights how Narratives turn the numbers into actionable insights tailored to your perspective.

Do you think there's more to the story for Enphase Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives