- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Can Enphase (ENPH) Drive Greater Customer Adoption Through Expanded Home Energy Integration?

Reviewed by Sasha Jovanovic

- In October 2025, Enphase Energy expanded its IQ Energy Management platform to integrate electric water heaters within its system in Belgium, the Netherlands, and Switzerland, enabling homeowners to optimize energy use across solar, batteries, electric vehicles, heat pumps, and water heating.

- This upgrade highlights a trend towards fully integrated home energy systems, where AI-driven coordination offers households greater control, efficiency, and flexibility in managing renewable energy consumption.

- We'll explore how Enphase's integration of smart electric water heating could impact its growth outlook and long-term investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Enphase Energy Investment Narrative Recap

To be a convincing Enphase Energy shareholder, you need to believe that global electrification, growing demand for integrated energy systems, and ongoing policy support will propel long-term adoption of solar-plus-storage solutions beyond core U.S. markets. The recent news of Enphase’s IQ Energy Management update, now integrating electric water heaters in Europe, is interesting but does not significantly shift the most important near-term catalyst for the stock, international sales growth and execution on new product launches. The most immediate risk remains the upcoming U.S. residential solar market contraction, which could pressure revenue if rapid overseas expansion fails to scale quickly enough.

Among recent announcements, the launch of the IQ Battery 5P with FlexPhase in India stands out as most relevant in supporting international growth ambitions. While the European water heater integration showcases software-driven system enhancements, the India launch addresses geographic diversification, serving a fast-expanding solar market with a product designed for local grid requirements, an important step as the company seeks new revenue sources amid U.S. headwinds.

By contrast, investors should pay close attention to the looming expiration of the U.S. 25D tax credit for homeowners, since...

Read the full narrative on Enphase Energy (it's free!)

Enphase Energy's outlook projects $1.6 billion in revenue and $232.0 million in earnings by 2028. This requires 3.0% annual revenue growth and a $57.3 million increase in earnings from the current $174.7 million.

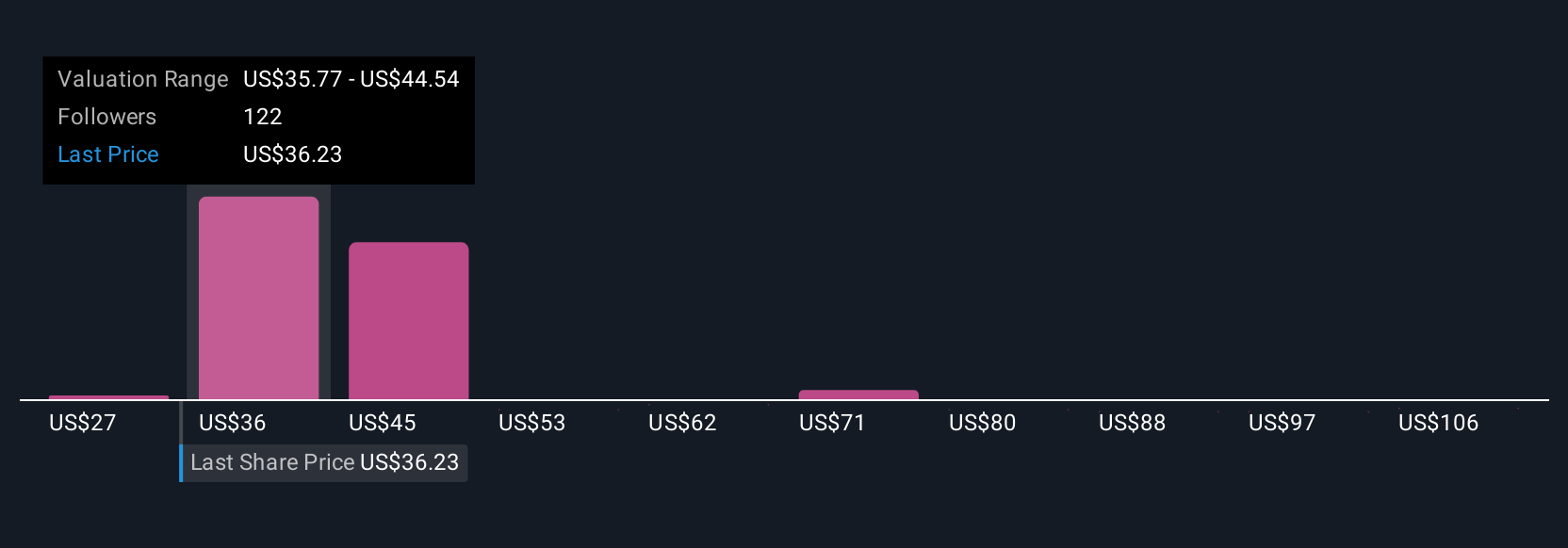

Uncover how Enphase Energy's forecasts yield a $42.79 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Enphase’s fair value between US$28.32 and US$114.69, based on 20 independent analyses. With the U.S. solar market facing a potential 20 percent contraction, these diverse views reflect just how sharply future performance opinions can vary, explore these alternate perspectives for a broader understanding.

Explore 20 other fair value estimates on Enphase Energy - why the stock might be worth 17% less than the current price!

Build Your Own Enphase Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enphase Energy research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Enphase Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enphase Energy's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives