- United States

- /

- Semiconductors

- /

- NasdaqGS:DIOD

Diodes (DIOD): Exploring Valuation Following Launch of Automotive-Focused PI7C9X762Q Chip

Reviewed by Kshitija Bhandaru

Diodes (DIOD) just introduced the PI7C9X762Q, a feature-rich bridge chip targeting electric vehicles. This launch showcases how the company is expanding into next-generation automotive electronics, including smart cockpits and advanced driver-assistance systems.

See our latest analysis for Diodes.

While Diodes is pushing forward in automotive innovation, the market has been cautious; its shares are now at $48.37, following a steep 1-year total shareholder return of -25.19% and ongoing downward momentum in recent months. The latest product launch could mark a shift in perception as the company expands into growth areas, but investors have been factoring in both sector headwinds and near-term uncertainty.

If you’re keeping an eye on EV tech trends, this is a timely chance to discover See the full list for free.

With Diodes shares trading near 21 percent below analyst targets and facing sector headwinds, the big question remains: does this represent an undervalued opportunity, or is the market simply accounting for all the company’s future growth?

Most Popular Narrative: 17.6% Undervalued

With Diodes last closing at $48.37 and the narrative consensus fair value set at $58.67, the outlook is notably optimistic. This sets up high expectations for the company’s earnings trajectory amid fast-changing semiconductor demand.

Rapid electrification in automotive, particularly EVs in China, is leading to growing content per vehicle and an expanding set of design wins for Diodes' automotive-qualified products (such as protection devices, LED controllers, and power management ICs). This supports higher average selling prices and future margin expansion. The strategic focus on new product introductions, especially in high-margin analog, mixed-signal, and power management segments, positions Diodes to benefit from product mix improvement. This could translate into structurally higher gross and operating margins over time.

Want to know what’s fueling that eye-catching valuation? Find out which bold financial forecasts, margin bets, and smart product plays could be the magic behind the narrative’s fair value target. The real drivers are hidden just below the surface.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high inventory levels and Diodes’ heavy exposure to Asia could quickly dampen the current optimism if demand falters or if trade risks emerge.

Find out about the key risks to this Diodes narrative.

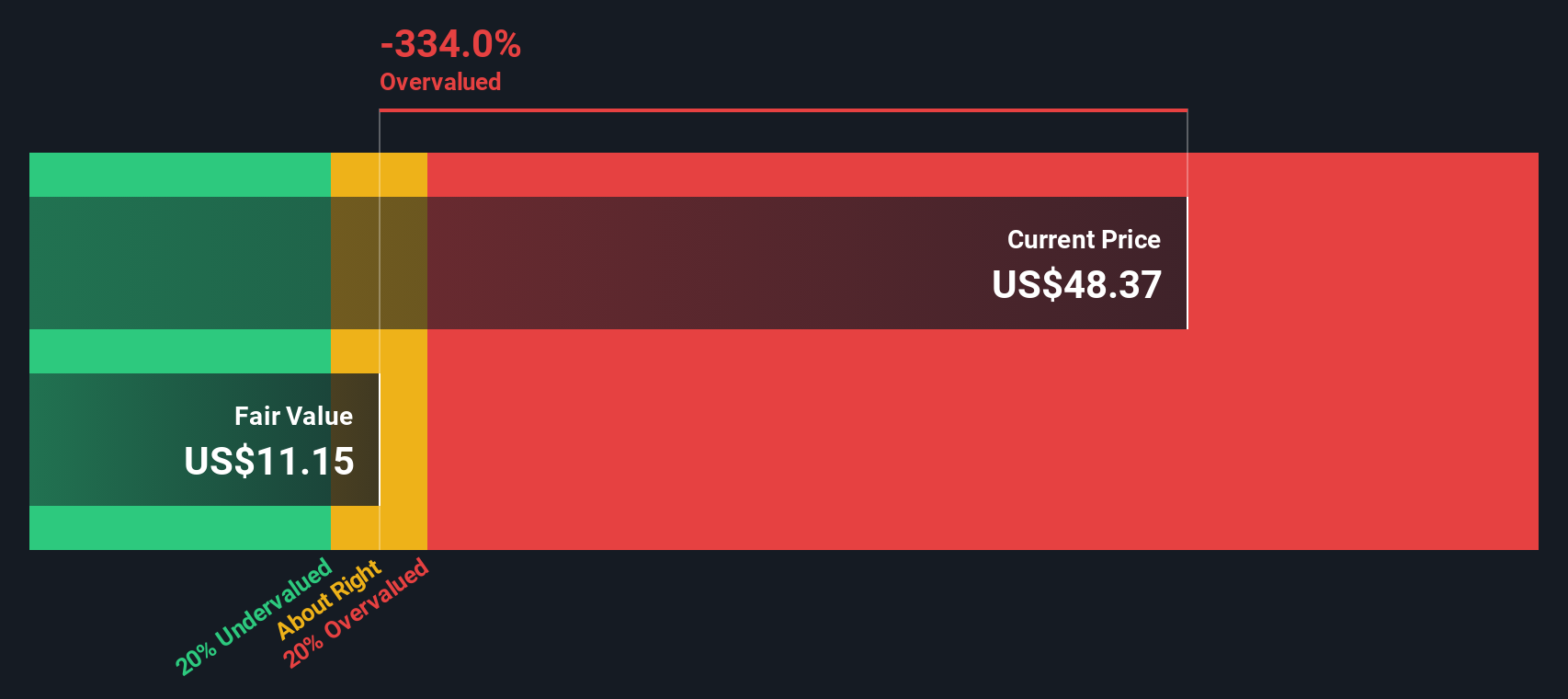

Another View: DCF Model Tells a Different Story

While analysts see Diodes as undervalued using future earnings and peer comparisons, our SWS DCF model paints a more cautious picture. Shares are currently trading well above the model's fair value estimate. This suggests growth expectations may already be built into the price, challenging the optimistic narrative.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diodes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diodes Narrative

If you’d like to put the story to the test or dig into your own insights, you can craft your personal take in just a few minutes with Do it your way.

A great starting point for your Diodes research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity slip past you when new market trends could hold your next big winner. Use these hand-picked screens to step ahead of the crowd:

- Unlock high-potential opportunities by screening for these 3581 penny stocks with strong financials that are making waves with strong financials and remarkable growth stories.

- Supercharge your search for groundbreaking innovation by exploring these 24 AI penny stocks focused on artificial intelligence breakthroughs and digital transformation.

- Target tomorrow’s value leaders by browsing these 898 undervalued stocks based on cash flows with robust fundamentals and prices trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DIOD

Diodes

Manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets in Asia, Europe, and the Americas.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)