- United States

- /

- Semiconductors

- /

- NasdaqCM:CVV

CVD Equipment's (NASDAQ:CVV) Earnings Aren't As Good As They Appear

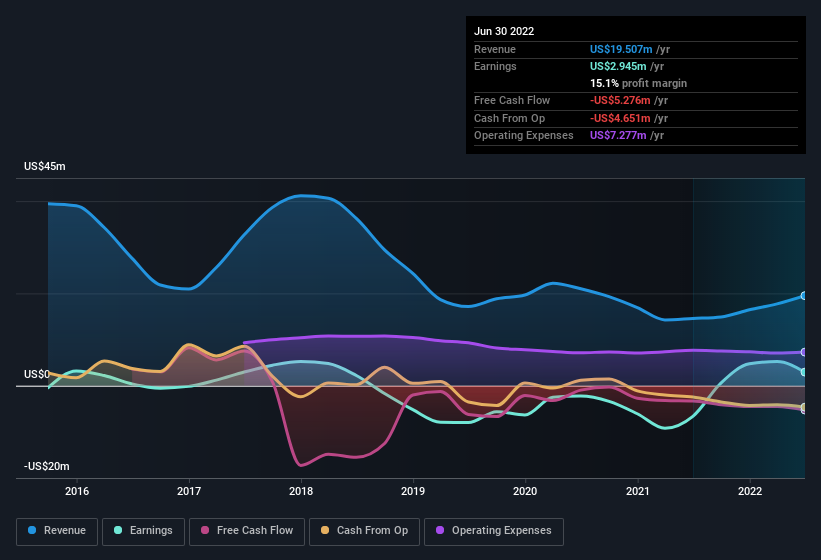

Despite posting strong earnings, CVD Equipment Corporation's (NASDAQ:CVV) stock didn't move much over the last week. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

View our latest analysis for CVD Equipment

Zooming In On CVD Equipment's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

CVD Equipment has an accrual ratio of 0.46 for the year to June 2022. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. In the last twelve months it actually had negative free cash flow, with an outflow of US$5.3m despite its profit of US$2.94m, mentioned above. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of US$5.3m, this year, indicates high risk. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio. One positive for CVD Equipment shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of CVD Equipment.

The Impact Of Unusual Items On Profit

The fact that the company had unusual items boosting profit by US$6.9m, in the last year, probably goes some way to explain why its accrual ratio was so weak. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. CVD Equipment had a rather significant contribution from unusual items relative to its profit to June 2022. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On CVD Equipment's Profit Performance

CVD Equipment had a weak accrual ratio, but its profit did receive a boost from unusual items. For all the reasons mentioned above, we think that, at a glance, CVD Equipment's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, we've found that CVD Equipment has 2 warning signs (1 is potentially serious!) that deserve your attention before going any further with your analysis.

Our examination of CVD Equipment has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you're looking to trade CVD Equipment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CVV

CVD Equipment

Designs, develops, manufactures, and sells equipment to develop and manufacture materials and coatings in the United States, North America, Europe, the Middle East, Europe, Africa, and the Asia Pacific.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives