- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Revenues Tell The Story For Credo Technology Group Holding Ltd (NASDAQ:CRDO) As Its Stock Soars 55%

Credo Technology Group Holding Ltd (NASDAQ:CRDO) shareholders would be excited to see that the share price has had a great month, posting a 55% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 58% in the last year.

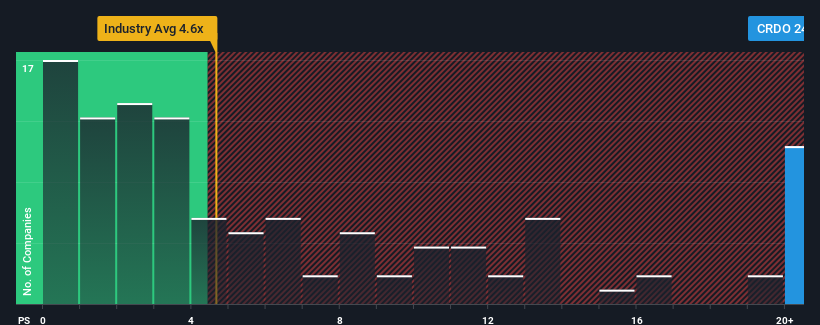

Following the firm bounce in price, Credo Technology Group Holding may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 24.7x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios under 4.6x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Credo Technology Group Holding

How Credo Technology Group Holding Has Been Performing

With revenue growth that's inferior to most other companies of late, Credo Technology Group Holding has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Credo Technology Group Holding.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Credo Technology Group Holding's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 4.7% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 229% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 45% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 27% per annum, which is noticeably less attractive.

In light of this, it's understandable that Credo Technology Group Holding's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Credo Technology Group Holding's P/S Mean For Investors?

The strong share price surge has lead to Credo Technology Group Holding's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Credo Technology Group Holding shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Credo Technology Group Holding you should be aware of.

If these risks are making you reconsider your opinion on Credo Technology Group Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with excellent balance sheet.