- United States

- /

- Consumer Finance

- /

- NasdaqGM:DAVE

Dave And 2 Other Growth Companies With Significant Insider Stakes

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet over the past 12 months, it has risen by 8.0%, with earnings projected to grow by 14% annually in the coming years. In this context of steady growth and positive outlooks, stocks with significant insider ownership often attract attention as they can indicate strong internal confidence and potential alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 39.6% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 43.4% |

| FTC Solar (NasdaqCM:FTCI) | 32.2% | 61.8% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.5% | 60.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| Clene (NasdaqCM:CLNN) | 19.4% | 67.3% |

| BBB Foods (NYSE:TBBB) | 16.2% | 28.9% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

We'll examine a selection from our screener results.

Dave (NasdaqGM:DAVE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dave Inc. operates a financial services platform in the United States, offering a range of financial products and services, with a market cap of $2.22 billion.

Operations: The company generates revenue of $381.43 million from its service-based and transaction-based operations within the United States.

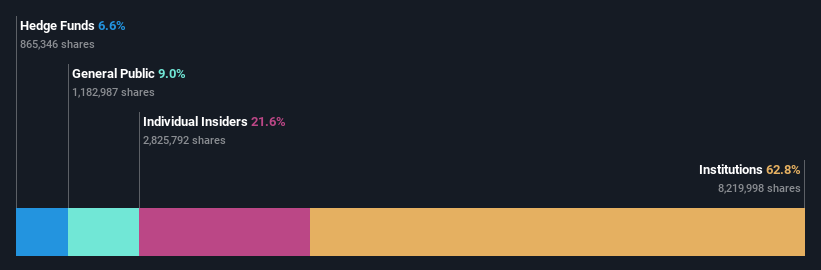

Insider Ownership: 21.3%

Return On Equity Forecast: N/A (2028 estimate)

Dave Inc. demonstrates significant growth potential with its forecasted annual earnings increase of 36.6%, outpacing the US market's 14%. Despite a highly volatile share price, the company has shown profitability and raised its revenue guidance for 2025 to $460-$475 million from an earlier $415-$435 million. Recent earnings revealed a revenue increase to US$107.98 million for Q1 2025, though net income slightly declined compared to the previous year, reflecting mixed performance in profitability.

- Get an in-depth perspective on Dave's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Dave's share price might be on the expensive side.

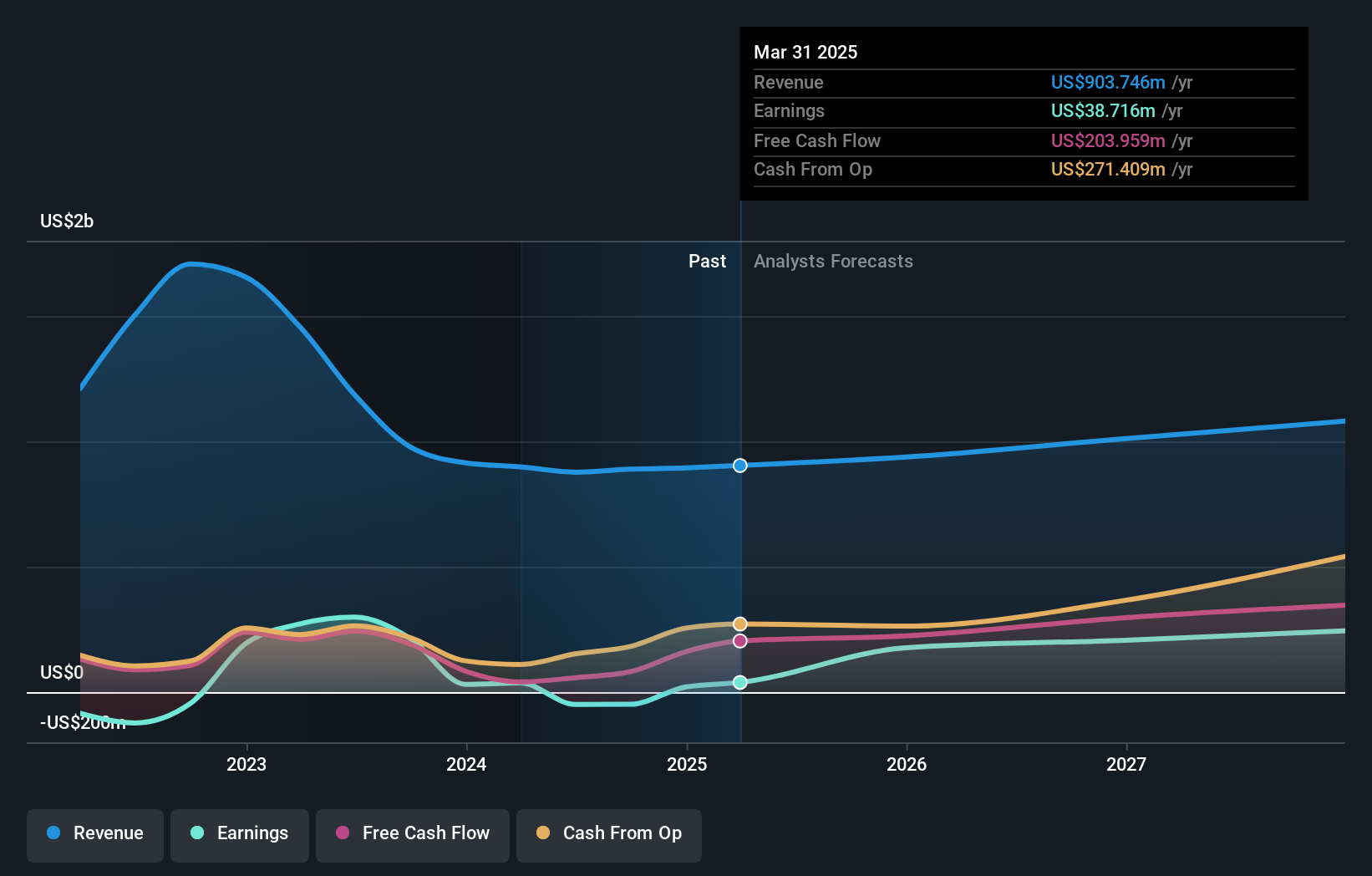

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles both in the United States and internationally, with a market cap of approximately $3.07 billion.

Operations: CarGurus generates revenue primarily from its U.S. Marketplace segment, which accounts for $755.93 million, and its Digital Wholesale segment, contributing $82.13 million.

Insider Ownership: 15.8%

Return On Equity Forecast: 33% (2028 estimate)

CarGurus showcases strong growth potential, with earnings expected to rise 32.5% annually, surpassing the US market's 14.1% growth rate. The company trades significantly below its estimated fair value, suggesting potential upside. Recent Q1 2025 results showed revenue of US$225.16 million and net income of US$39.05 million, indicating improved profitability despite slower revenue growth than the market average and large one-off items impacting financial results.

- Click to explore a detailed breakdown of our findings in CarGurus' earnings growth report.

- Our expertly prepared valuation report CarGurus implies its share price may be lower than expected.

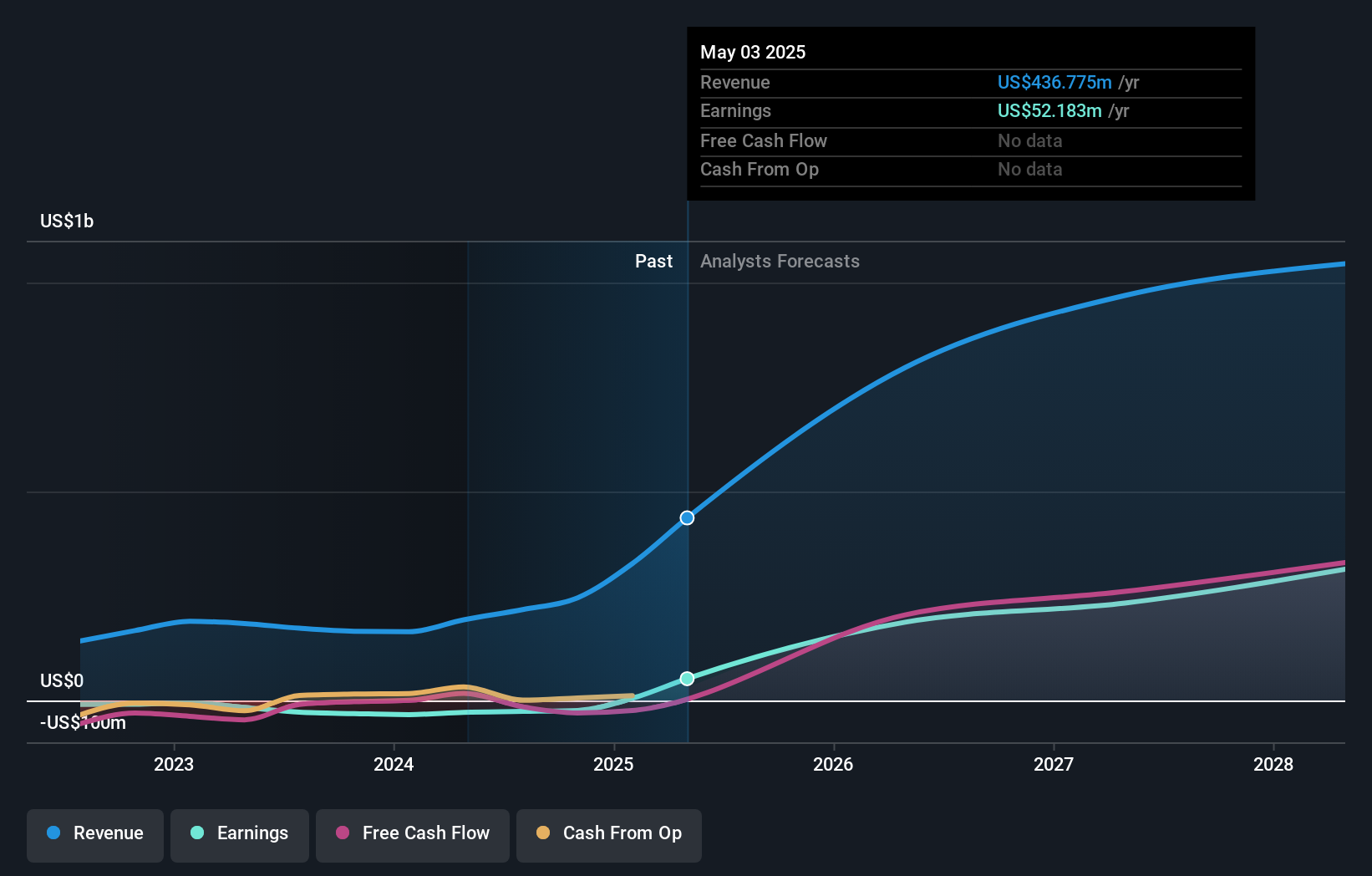

Credo Technology Group Holding (NasdaqGS:CRDO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet applications across the United States, Taiwan, Mainland China, Hong Kong, and other international markets, with a market cap of approximately $8.63 billion.

Operations: The company's revenue is primarily derived from its Semiconductors segment, which generated $327.53 million.

Insider Ownership: 12.1%

Return On Equity Forecast: 31% (2028 estimate)

Credo Technology Group Holding exhibits substantial growth potential, with earnings forecasted to grow 65.1% annually, outpacing the US market's 14% rate. Despite recent insider selling, the company remains profitable and reported Q3 revenue of US$135 million and net income of US$29.36 million, a significant improvement from last year. The launch of its Lark DSP family highlights Credo’s innovation in low-power optical solutions for AI data centers, potentially driving future growth amidst volatile share prices.

- Click here to discover the nuances of Credo Technology Group Holding with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Credo Technology Group Holding's current price could be inflated.

Make It Happen

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 191 more companies for you to explore.Click here to unveil our expertly curated list of 194 Fast Growing US Companies With High Insider Ownership.

- Searching for a Fresh Perspective? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Dave, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DAVE

Dave

Provides various financial products and services through its financial services platform in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives