- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group Holding Ltd's (NASDAQ:CRDO) 36% Jump Shows Its Popularity With Investors

Credo Technology Group Holding Ltd (NASDAQ:CRDO) shareholders have had their patience rewarded with a 36% share price jump in the last month. The annual gain comes to 114% following the latest surge, making investors sit up and take notice.

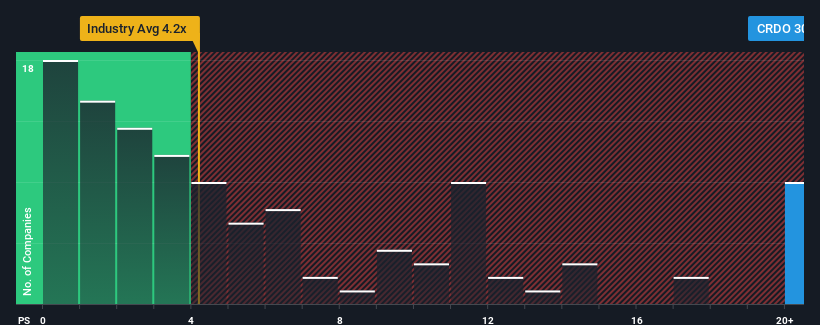

Since its price has surged higher, Credo Technology Group Holding may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 30.3x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios under 4.2x and even P/S lower than 1.7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Credo Technology Group Holding

How Credo Technology Group Holding Has Been Performing

With revenue growth that's inferior to most other companies of late, Credo Technology Group Holding has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Credo Technology Group Holding will help you uncover what's on the horizon.How Is Credo Technology Group Holding's Revenue Growth Trending?

Credo Technology Group Holding's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.7% last year. Pleasingly, revenue has also lifted 229% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 49% each year during the coming three years according to the eleven analysts following the company. That's shaping up to be materially higher than the 25% per year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Credo Technology Group Holding's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has lead to Credo Technology Group Holding's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Credo Technology Group Holding's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Credo Technology Group Holding that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026