- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group (CRDO): Evaluating Valuation After $750 Million Equity Offering and Growth-Focused Moves

Reviewed by Kshitija Bhandaru

Credo Technology Group Holding (CRDO) has filed for a $750 million follow-on equity offering and a broad shelf registration. This signals active capital-raising plans to support new growth, recent product launches, and acquisitions.

See our latest analysis for Credo Technology Group Holding.

Credo’s momentum has gathered pace this year thanks to headline moves like its $750 million equity offering, the high-profile acquisition of Hyperlume, and successive launches of next-generation optical and connectivity products. While the 1-year total shareholder return of 3.5% is modest, it reflects a transition period marked by bold investments into future growth markets such as AI and cloud infrastructure.

If you’re interested in where technology leaders find their edge, now is a timely moment to explore See the full list for free..

But with shares up strongly year-to-date and new funding now in play, the question remains: Does Credo Technology Group still have room to run, or has the market already factored in its next chapter of growth?

Most Popular Narrative: 6.1% Undervalued

With Credo's most-followed narrative setting fair value at $157.07 and the last close at $147.42, expectations run high as the market digests ambitious growth projections. The stage is set for future expansion, but the real question is which catalyst will justify the current premium.

The industry-wide transition towards energy-efficient, high-speed interconnects (such as AECs) in data centers and hyperscale infrastructure aligns directly with Credo's product strengths and market leadership. This positions the company to benefit from secular shifts and improving operating leverage and net margins.

Want to know why analysts see so much upside? Hint: explosive growth projections, margin leaps, and a profit multiple that few other chip companies command. Find out which assumptions set this fair value apart and whether they’re truly achievable.

Result: Fair Value of $157.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high expectations and ongoing reliance on large cloud customers mean that any slowdown in hyperscaler spending or delayed product adoption could challenge this bullish outlook.

Find out about the key risks to this Credo Technology Group Holding narrative.

Another View: Is the Price Getting Ahead of Itself?

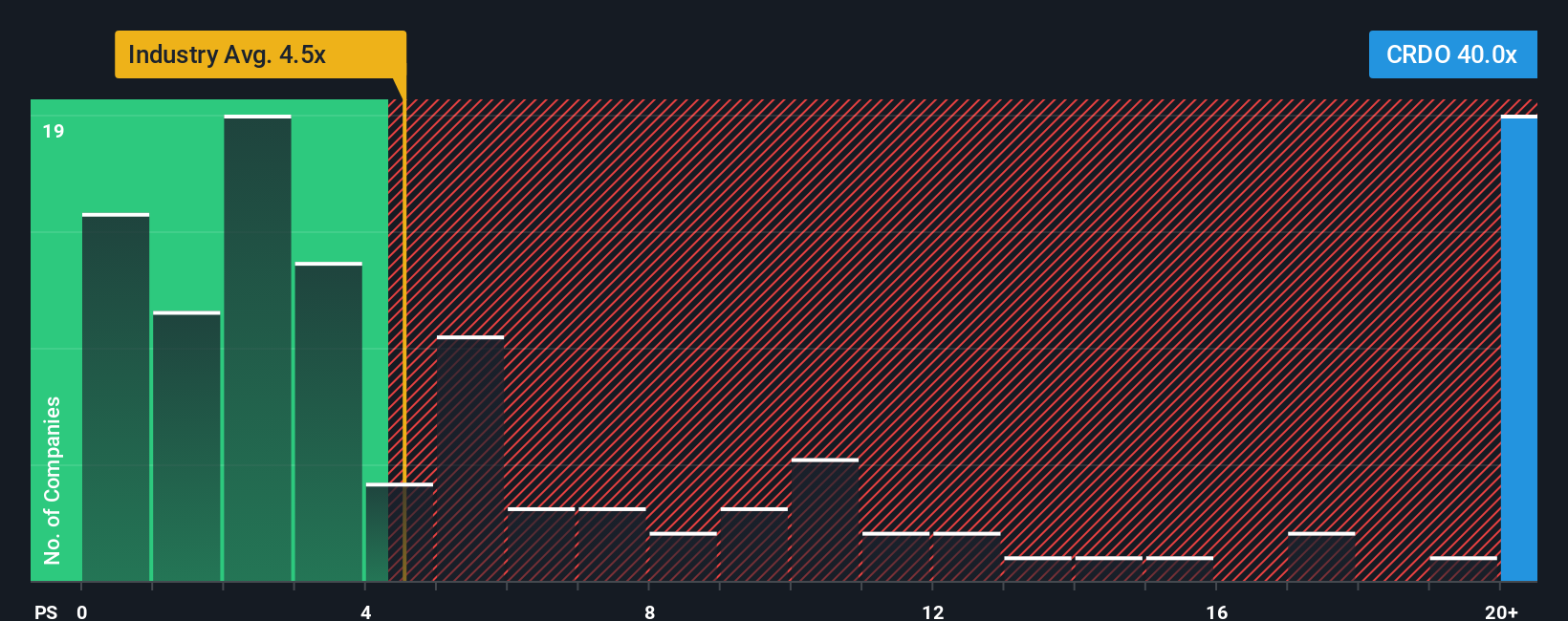

Looking at valuation through the lens of sales multiples tells a more cautious story. Credo’s price-to-sales ratio is 42.5x, which is notably higher than both its peer average (21.9x) and the US Semiconductor industry average (4.9x). The fair ratio is 23.8x, suggesting investors are paying a steep premium for future promise. Could the market be overestimating long-term upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Credo Technology Group Holding Narrative

Feel like you see things differently or want to dig deeper into the data yourself? You can build your own customized view and analysis in just a few minutes, and add your perspective to the mix. Do it your way.

A great starting point for your Credo Technology Group Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Level up your watchlist by targeting unique investment angles. Simply Wall Street’s screeners make it effortless to uncover stocks driving tomorrow's market winners. Don't let these smart opportunities slip past you.

- Capture potential early gains and growth by scanning these 3574 penny stocks with strong financials, where strong financials set select stocks apart from the rest.

- Access income opportunities with attractive yields as you tap into these 19 dividend stocks with yields > 3%, highlighting companies consistently rewarding their shareholders.

- Ride the next wave of innovation by checking out these 25 AI penny stocks, featuring companies spearheading transformative trends in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives