- United States

- /

- Semiconductors

- /

- NasdaqGM:CAMT

How Investor Optimism Around Camtek's (CAMT) Hawk Platform May Shape Its Earnings Narrative

Reviewed by Sasha Jovanovic

- In recent weeks, Camtek has attracted significant investor attention ahead of its latest earnings announcement, as market participants respond to expectations of year-over-year growth in both earnings and revenue amidst an optimistic business outlook.

- A key aspect driving this optimism is the anticipated greater contribution from Camtek's Hawk inspection platform, boosted by growing demand for advanced semiconductor applications.

- We'll explore how heightened analyst confidence in Camtek's near-term earnings potential is shaping the company's broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Camtek Investment Narrative Recap

For Camtek shareholders, the core thesis rests on sustained global demand for advanced semiconductor inspection systems, especially as high-performance computing and AI fuels investment in new packaging technologies. The latest news, reflecting upbeat forecasts and strong analyst sentiment, points to the Hawk platform’s momentum as a powerful short-term catalyst. However, the biggest immediate risk remains Camtek's heavy revenue concentration in Asia, where changing geopolitical or regulatory conditions could materially impact key customer relationships, this risk has not been mitigated by recent updates.

Among recent developments, the Hawk inspection platform stands out, with initial orders surpassing US$50 million and customer interest increasing as HBM4 adoption expands. The strong ramp of Hawk is particularly relevant to the current rally, as analyst optimism is closely tied to this product’s performance with advanced semiconductor applications.

But, crucially, investors should be aware that if market access in Asia faces disruption…

Read the full narrative on Camtek (it's free!)

Camtek's narrative projects $679.8 million in revenue and $183.6 million in earnings by 2028. This requires 13.0% yearly revenue growth and a $49.8 million increase in earnings from $133.8 million today.

Uncover how Camtek's forecasts yield a $101.10 fair value, a 8% downside to its current price.

Exploring Other Perspectives

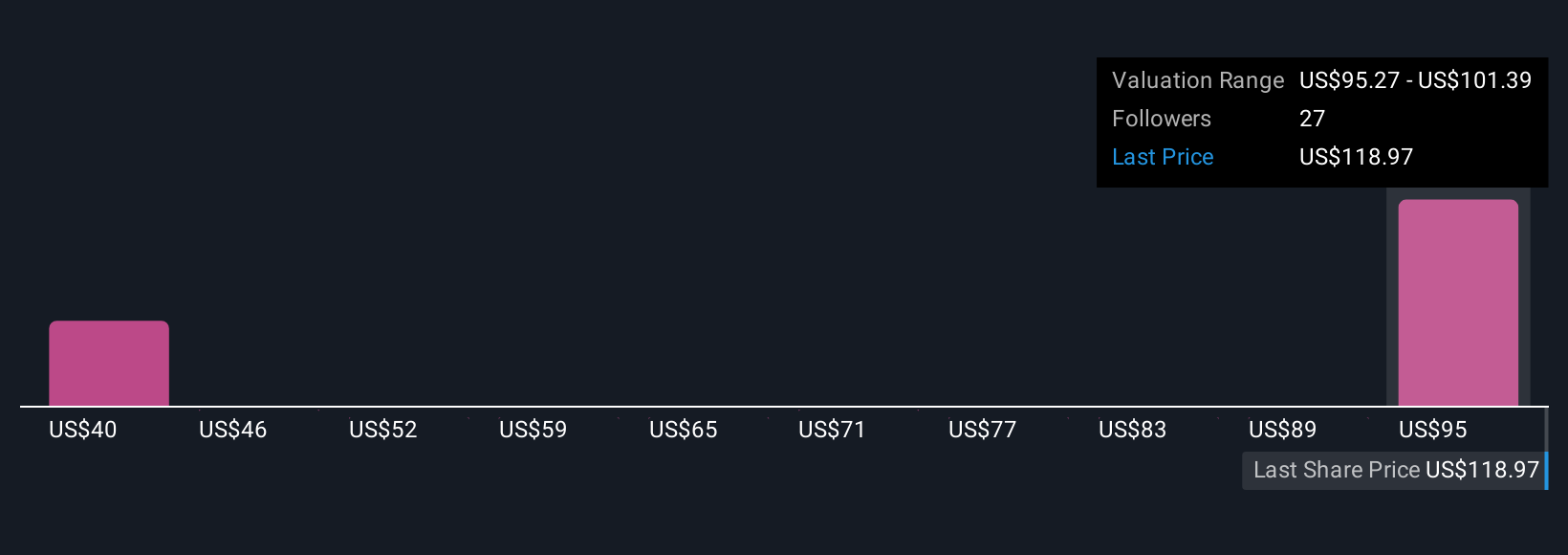

Five fair value estimates from the Simply Wall St Community ranged between US$40.27 and US$101.39 per share, reflecting diverse independent forecasts. With Camtek’s growth hinging on rising HPC and AI semiconductor demand, readers can explore how widely community perspectives diverge on future business performance.

Explore 5 other fair value estimates on Camtek - why the stock might be worth less than half the current price!

Build Your Own Camtek Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Camtek research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Camtek research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Camtek's overall financial health at a glance.

No Opportunity In Camtek?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CAMT

Camtek

Develops, manufactures, and sells inspection and metrology equipment for semiconductor industry in the United States, China, Korea, Europe, and the Asia Pacific.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives