- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

How Investors Are Reacting To Broadcom (AVGO) Partnering With OpenAI To Build Custom AI Accelerators

Reviewed by Sasha Jovanovic

- OpenAI and Broadcom announced a collaboration to design, develop, and deploy 10 gigawatts of custom AI accelerators, with solutions leveraging Broadcom’s networking technology and set for global data center rollout.

- This partnership not only deepens Broadcom's presence in the rapidly expanding AI semiconductor space but also reflects surging enterprise and developer adoption of AI infrastructure, underscoring the growing need for custom hardware solutions.

- We'll examine how Broadcom's new partnership with OpenAI advances its AI chip leadership and affects the company’s investment case.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Broadcom Investment Narrative Recap

If you’re considering Broadcom, you have to believe the rapid expansion of AI infrastructure, backed by close partnerships with market leaders like OpenAI, can offset the risks of heavy customer concentration and keep Broadcom at the forefront of high-margin, custom AI hardware. The new OpenAI collaboration could reinforce the AI semiconductor growth story, but it doesn’t immediately reduce the risk of revenue fluctuations tied to a handful of major clients, a central factor for short-term performance and ongoing stability.

The most relevant recent announcement is Broadcom’s roll-out of the Tomahawk 6-Davisson Ethernet switch, which delivers record-breaking bandwidth aimed directly at next-generation AI data center demands. This new product underpins Broadcom’s value as hyperscalers seek more powerful, energy-efficient networking for their exponential AI workloads, keeping the company’s differentiation in focus even as large customer concentration remains a key risk.

By contrast, one thing that could shift the entire outlook for shareholders is if one of Broadcom’s top four XPU customers meaningfully reduced its ...

Read the full narrative on Broadcom (it's free!)

Broadcom's outlook anticipates $119.6 billion in revenue and $50.8 billion in earnings by 2028. This implies a 25.9% annual revenue growth rate and a $32 billion increase in earnings from the current $18.8 billion.

Uncover how Broadcom's forecasts yield a $370.36 fair value, a 14% upside to its current price.

Exploring Other Perspectives

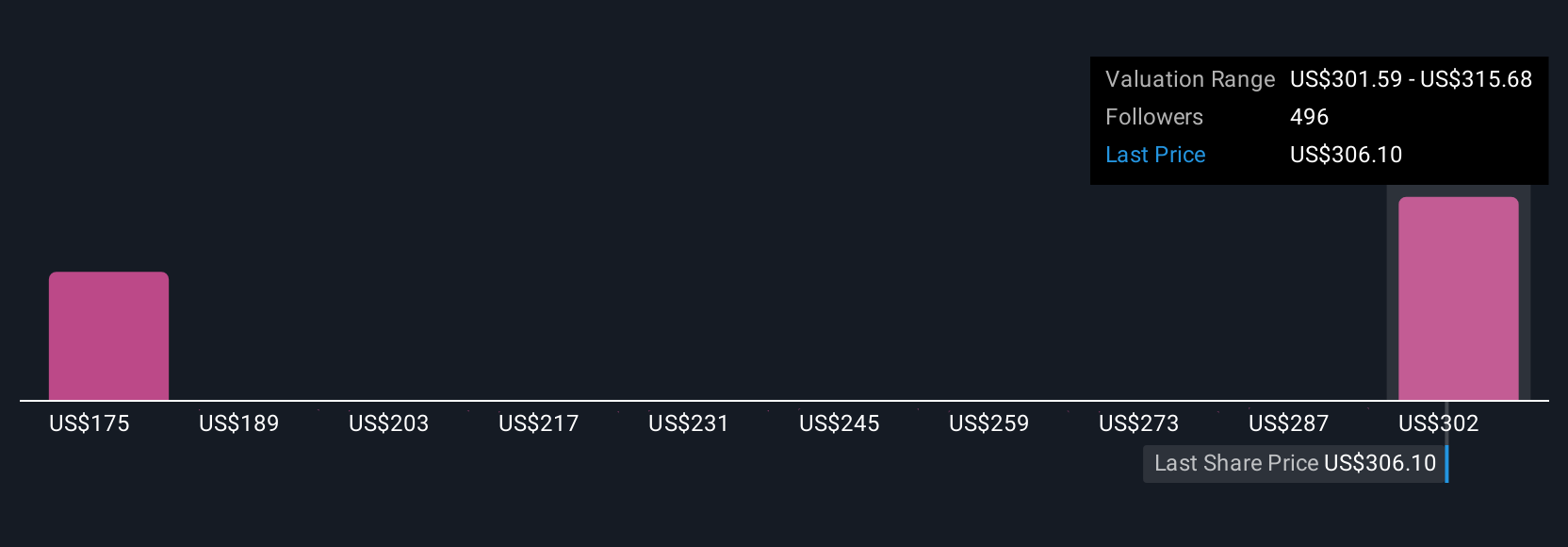

Forty-two members of the Simply Wall St Community estimate Broadcom’s fair value from US$216.95 to US$370.36 per share. This diversity of opinion underscores just how much the company’s AI momentum with new partnerships can mean for future growth, yet staying aware of customer concentration risks is essential.

Explore 42 other fair value estimates on Broadcom - why the stock might be worth as much as 14% more than the current price!

Build Your Own Broadcom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Broadcom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Broadcom's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives