- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Did VMware Cloud Foundation 9.0 and New AI Alliances Just Shift Broadcom’s (AVGO) Investment Narrative?

Reviewed by Simply Wall St

- At VMware Explore 2025 in late August, Broadcom announced major advancements in private cloud with the launch of VMware Cloud Foundation 9.0, native AI services, expanded cybersecurity solutions, and new collaborations with Walmart, Canonical, AMD, and Nvidia, targeting enterprise AI infrastructure and resilience.

- The integration of VMware Private AI Services, advanced compliance features, and alliances with leading technology providers highlights Broadcom's increasing influence in enabling secure, AI-driven cloud solutions across global enterprises.

- We’ll explore how the rollout of AI-native VMware Cloud Foundation may shift Broadcom’s long-term earnings outlook and market position.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Broadcom Investment Narrative Recap

Owning Broadcom is about believing in its ability to scale cutting-edge AI and private cloud infrastructure across global enterprises, while balancing the risks of traditional semiconductor slowdowns and heavy R&D investment. The recent rollout of VMware Cloud Foundation 9.0, enriched with native AI services and cybersecurity solutions, addresses a key short-term catalyst, winning significant enterprise cloud contracts, but does not offset the ongoing vulnerability of Broadcom’s reliance on a handful of large hyperscale customers for substantial revenue. Of the many new announcements, the strategic alliance with Walmart stands out: by naming Broadcom as a primary vendor for modernizing Walmart’s private cloud and edge operations, the partnership directly showcases how Broadcom’s software and private AI expertise are translating into large-scale, real-world deployment, supporting both topline software growth and the push to deepen enterprise relationships. However, despite the momentum, investors should pay close attention to signs of concentration risk, as any disruption in Broadcom’s hyperscale customer relationships could...

Read the full narrative on Broadcom (it's free!)

Broadcom's narrative projects $99.3 billion in revenue and $42.3 billion in earnings by 2028. This requires 20.3% yearly revenue growth and a $29.1 billion increase in earnings from $13.2 billion today.

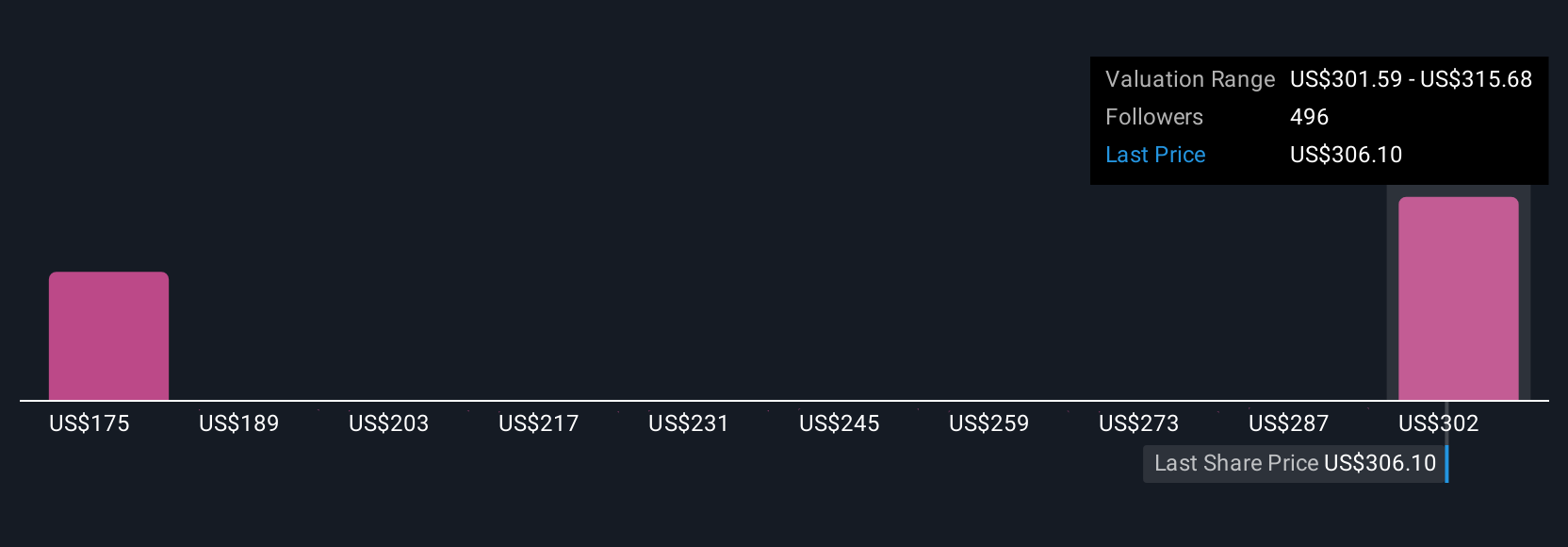

Uncover how Broadcom's forecasts yield a $302.16 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members shared 38 different fair value targets for Broadcom, ranging from US$174 to US$302 per share. Against this breadth of opinion, Broadcom’s continued dependence on a few major hyperscale clients highlights just how much future revenue can hinge on a handful of relationships, encouraging you to weigh all available perspectives before deciding your own view.

Explore 38 other fair value estimates on Broadcom - why the stock might be worth 42% less than the current price!

Build Your Own Broadcom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Broadcom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Broadcom's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives