- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom’s Inc. (NASDAQ:AVGO) Dividends Are Hardly Sustainable

Broadcom Inc. ( NASDAQ:AVGO ) is a semiconductor and infrastructure software producer. Their semiconductors account for 73% of the revenues, while infrastructure software solutions account for the remaining 27%. Most of the revenues (30%) come from their top 5 largest clients.

Aggregate sales to Apple Inc., ( NASDAQ:AAPL ) accounted for approximately 20% and 15% of their net revenue for fiscal years 2019 and 2020, respectively. This might mean that their largest client is slowly decreasing demand, switching vendors or producing their own semiconductors.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Broadcom has grown its earnings per share at 11% per annum over the past five years.

The semiconductor industry in the US is expected to grow 8.1% annually, and revenues for Broadcom are forecasted to follow with a 5.5% yearly growth. This means that besides dividends, investors can expect a stable expansion of this industry and are exposed less to the risk of a declining company or industry.

Dividend paying stocks like Broadcom tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends.

Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations. So let's have a look at Broadcom's dividend characteristics and see what might lie ahead.

Explore this interactive chart for our latest analysis on Broadcom!

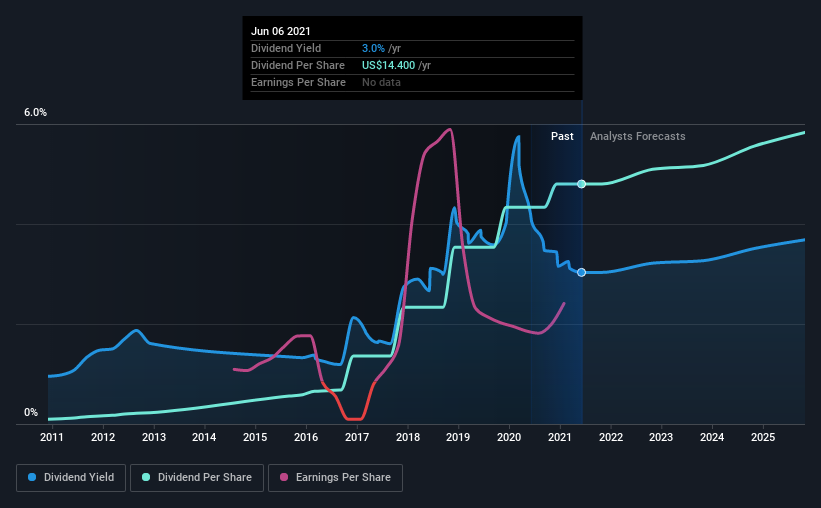

NasdaqGS:AVGO Historic Dividend, June 2021

NasdaqGS:AVGO Historic Dividend, June 2021Payout ratios

Companies (usually) pay dividends out of their net profit. If a company is paying more than it earns, the dividends might need to be cut.

In the last year, Broadcom paid out 151% of its profit as dividends. This effectively means that they had to find cash somewhere other than in profits, to cover their commitment to dividends. A payout ratio of above 100% is usually a concern, unless there are special circumstances.

Problems can sometimes arise when a company has a few bad quarters, but keeps their commitment to dividends because they want to portray the decline as temporary. This can lead to paying out dividends using the cash balance, from sale of hard assets, or in some cases, taking on debt.

Broadcom fortunately did have enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Very few companies are able to sustainably pay dividends larger than their reported earnings.

We update our data on Broadcom every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend History

During the past 10-year period, the first annual payment was US$0.3 in 2011, compared to US$14.4 last year. Dividends per share have grown at approximately 48% per year over this time.

For Broadcom, yearly dividend per share growth is higher than the earnings annual growth rate of 11%. This is concerning because the company has built up an expectation for dividend growth, but earnings haven't been able to follow the growth rate.

Conclusion

To summarize, shareholders should always check that Broadcom's dividends are sustainable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. We like that it has been delivering solid improvement in its earnings per share, and relatively consistent dividend payments.

The concern is that management might not be willing to admit to shareholders that dividends are not sustainable in the long term and may destroy company value in trying to keep up with future dividend payments.

Overall, we think Broadcom is an interesting dividend stock, although it could be better.

At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 4 warning signs for Broadcom you should be aware of, and 1 of them can't be ignored.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide.

High growth potential with adequate balance sheet.