- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Unveils VMware Cloud Foundation 9.0 Revolutionising Private Cloud Experience

Reviewed by Simply Wall St

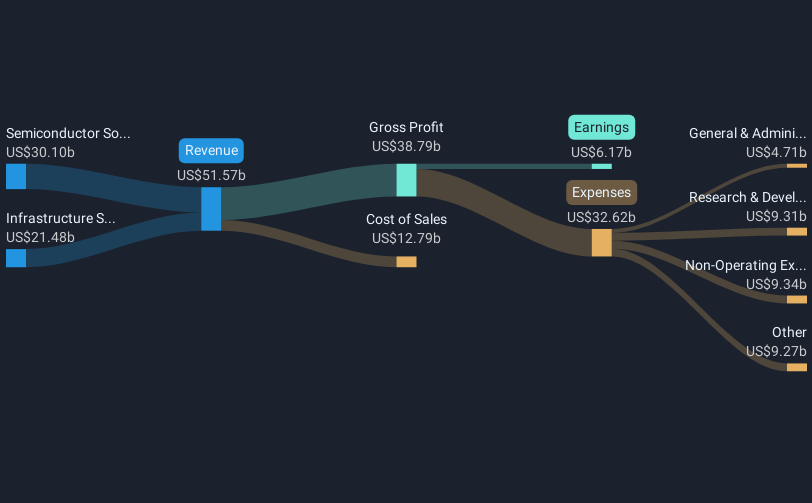

Broadcom (NasdaqGS:AVGO) recently launched the VMware Cloud Foundation 9.0 platform, marking a significant advancement in their cloud infrastructure capabilities. The company's share price increased by 28% over the last quarter, and while the market itself was relatively stable, Broadcom's performance highlights its strong positioning with new product offerings. Financial results were robust, with impressive earnings growth and a strategic collaboration with NVIDIA bolstering AI solutions. These developments, alongside share buyback initiatives and dividend declarations, would have added weight to Broadcom's share price performance amidst broader market trends.

We've spotted 2 warning signs for Broadcom you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Broadcom's recent launch of the VMware Cloud Foundation 9.0 platform underscores its commitment to expanding cloud infrastructure capabilities. This advancement, along with key strategic developments such as the collaboration with NVIDIA and share buyback initiatives, could bolster revenue and earnings forecasts. With ongoing investments in AI and next-generation accelerators, Broadcom is positioning itself to potentially enhance technological leadership and sustained financial growth through increased revenue and margins. However, the reliance on a limited number of hyperscale customers introduces risk that these new ventures aim to mitigate.

Over the past five years, Broadcom's total return, including share price and dividends, was very large, reaching 800.83%. While this represents a significant appreciation over the longer term, it's crucial to contextualize these gains against the market and industry. Over the past year, Broadcom has outperformed both the US Semiconductor industry and the broader US market, which returned 1.4% and 9.8% respectively. This demonstrates Broadcom's robust market presence and effective strategic initiatives that resonate well with investors.

The current market sentiment is partially reflected in the company's share price, which saw a 28% rise last quarter. With an analyst consensus price target at US$280.41 and a current share price at US$200.09, the shares trade at a 16.1% discount to this target. This suggests that there could be potential upside based on analysts’ growth expectations, assuming other risks are effectively managed. As analysts anticipate improved earnings and revenue growth, driven by AI-related initiatives, monitoring Broadcom’s ability to actualize these forecasts will be essential for evaluating future performance.

Examine Broadcom's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)